John Serubo was a stock promoter & investor who introduced “EagleTech” to his wall street firm and partners, Salomon Smith Barney. According to the SEC complaint, Serubo was one of the primary perpetrators in the EagleTech criminal case. Serubo, Tonino Labella, and others manipulated EagleTech’s stock and solicited investors to buy shares before EagleTech went public. According to the book, Naked, Short, and Greedy: Wall Street’s Failure to Deliver, “they pretended to sell shares to investors for a total of $1.4 million – before they had the actual shares to sell.” He explained how to take down a company through infiltrated management in The Wall Street Conspiracy Documentary.

John Serubo was a stock promoter & investor who introduced “EagleTech” to his wall street firm and partners, Salomon Smith Barney. According to the SEC complaint, Serubo was one of the primary perpetrators in the EagleTech criminal case. Serubo, Tonino Labella, and others manipulated EagleTech’s stock and solicited investors to buy shares before EagleTech went public. According to the book, Naked, Short, and Greedy: Wall Street’s Failure to Deliver, “they pretended to sell shares to investors for a total of $1.4 million – before they had the actual shares to sell.” He explained how to take down a company through infiltrated management in The Wall Street Conspiracy Documentary.

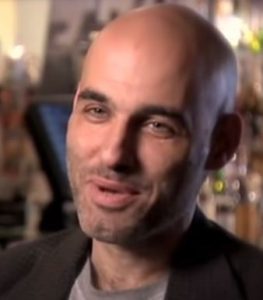

Media: Jim Cramer

Media James J. Cramer is an American television personality, and host of Mad Money on CNBC. He is a former hedge fund manager, author, and a co-founder of TheStreet.com. In 1984, Cramer became a stockbroker at Goldman Sachs, where he worked on sales and trading. In 1987, Cramer left Goldman Sachs and started a hedge fund, Cramer & Co. (later Cramer, Berkowitz & Co.). From 2002 to 2005, Cramer co-hosted Kudlow & Cramer (first called America Now) with Larry Kudlow. Cramer received a Juris Doctor degree from Harvard Law School.

James J. Cramer is an American television personality, and host of Mad Money on CNBC. He is a former hedge fund manager, author, and a co-founder of TheStreet.com. In 1984, Cramer became a stockbroker at Goldman Sachs, where he worked on sales and trading. In 1987, Cramer left Goldman Sachs and started a hedge fund, Cramer & Co. (later Cramer, Berkowitz & Co.). From 2002 to 2005, Cramer co-hosted Kudlow & Cramer (first called America Now) with Larry Kudlow. Cramer received a Juris Doctor degree from Harvard Law School.

Web: Jim Cramer Called Onto The Carpet By Jon Stewart

Video: Cramer on Market Manipulation

Article: Jim Cramer fires entire staff after soundboard calls him a stock pumper

Web: As The Country Burns, Citadel’s Founder Spends $100 Million On A Painting

WebAs The Country Burns, Citadel’s Founder Spends $100 Million On A Painting

ZeroHedge, 4 June 2020

While the country burns and millions of Americans scramble to figure out how they’re going to survive once supplemental unemployment benefits expire, Citadel founder Ken Griffin has just dropped a $100 million nut – nearly half the amount he dropped on a Central Park penthouse, and roughly equivalent to the cost of his wintertime Palm Beach Mansion – on a contemporary painting by American artist Jean Michel Basquiat, who died of a drug overdose in 1988.

Victim: David Patch

Victim - Individual David Patch is an engineer and Wall Street investor. He became an activist after becoming a victim of naked short selling. He is one of the stars in The Wall Street Conspiracy (2012) documentary. Patch filed Freedom of information requests on various companies to research “fails to deliver” only to discover these crimes were happening every day on Wall Street and nothing was being done about it. He began an online petition against naked short selling and started a website called InvestigateTheSEC.com directed at congress and to raise awareness of the $1 Billion investor fraud orchestrated by SEC. He was also known as one of the “dirty dozen” that took to the streets to raise awareness of these financial crimes.

David Patch is an engineer and Wall Street investor. He became an activist after becoming a victim of naked short selling. He is one of the stars in The Wall Street Conspiracy (2012) documentary. Patch filed Freedom of information requests on various companies to research “fails to deliver” only to discover these crimes were happening every day on Wall Street and nothing was being done about it. He began an online petition against naked short selling and started a website called InvestigateTheSEC.com directed at congress and to raise awareness of the $1 Billion investor fraud orchestrated by SEC. He was also known as one of the “dirty dozen” that took to the streets to raise awareness of these financial crimes.

Victim: Darren Saunders

Victim - Individual Darren Saunders was an investor, activist, and one of the stars in The Wall Street Conspiracy (2012) documentary. He was a victim of Naked Short Selling and spent the remainder of his life exposing and protested daily to raise awareness about the financial crime of naked short selling He eventually hooked up with David Patch, another victim and activist and was known as one of the “dirty dozen.” Saunders passed away from cancer in 2010.

Darren Saunders was an investor, activist, and one of the stars in The Wall Street Conspiracy (2012) documentary. He was a victim of Naked Short Selling and spent the remainder of his life exposing and protested daily to raise awareness about the financial crime of naked short selling He eventually hooked up with David Patch, another victim and activist and was known as one of the “dirty dozen.” Saunders passed away from cancer in 2010.

Media: Helen Avery

Media Helen Avery is a journalist for Euromoney Magazine heading up global coverage of social and environmental finance. She is the managing editor of their sustainable finance podcast series. Avery also runs Euromoney’s coverage of global wealth management and philanthropy (since 2004). Throughout the years, Avery has written several articles and exposed how naked shorts and “fails to deliver” in the US equity market have been exacerbated and the sharp declines in share prices of financials.

Helen Avery is a journalist for Euromoney Magazine heading up global coverage of social and environmental finance. She is the managing editor of their sustainable finance podcast series. Avery also runs Euromoney’s coverage of global wealth management and philanthropy (since 2004). Throughout the years, Avery has written several articles and exposed how naked shorts and “fails to deliver” in the US equity market have been exacerbated and the sharp declines in share prices of financials.

Lawyer: John O’Quinn

Lawyer John Maurice O’Quinn (September 4, 1941 – October 29, 2009) was a Texas trial lawyer and founding partner of The O’Quinn Law Firm (formerly known as O’Quinn & Laminack). His firm made its business handling plaintiff’s litigation, including representing clients suing breast implant manufacturers, medical facilities, and tobacco companies. In 2009, O’Quinn, along with his passenger, died in a single car crash in Houston, Texas. There were three class-action law firms, headed by John O’Quinn, pushing back against naked short selling. O’Quinn ‘s firm was one also representing Overstock.com in the Internet retailer’s suit against short seller Rocker Partners LP and research firm Gradient Analytics.

John Maurice O’Quinn (September 4, 1941 – October 29, 2009) was a Texas trial lawyer and founding partner of The O’Quinn Law Firm (formerly known as O’Quinn & Laminack). His firm made its business handling plaintiff’s litigation, including representing clients suing breast implant manufacturers, medical facilities, and tobacco companies. In 2009, O’Quinn, along with his passenger, died in a single car crash in Houston, Texas. There were three class-action law firms, headed by John O’Quinn, pushing back against naked short selling. O’Quinn ‘s firm was one also representing Overstock.com in the Internet retailer’s suit against short seller Rocker Partners LP and research firm Gradient Analytics.

#UNRIG Video (29:32) Lucy Komisar on Wall Street Offshore Money Laundering

Video

Continue reading “#UNRIG Video (29:32) Lucy Komisar on Wall Street Offshore Money Laundering”

Article: What To Know About Short-Seller Risks During Pandemic

Article - AcademicWhat To Know About Short-Seller Risks During Pandemic

Avi Weitzman, Barry Goldsmith and Jonathan Seibald

Law360, 3 June 2020

As the world struggles to cope with the COVID-19 pandemic, and volatile markets are rattled by the latest virus and economic news, publicly traded companies are increasingly susceptible to fraudulent short-seller attacks. While legitimate short selling plays an important and well-recognized role in the public markets, there are a few who have abused and misused short selling to manipulate the price of public company stock.

Graphic: The MAGA Squeeze – $200 Trillion for MAGA via Civil & Criminal Forfeiture from Wall Street Financial Criminal Gangs?

GraphicText for Cartoon Below the Fold Along with Links.

Article: Goldman Sachs starts shorting the dollar as economic reopenings boost foreign currencies

Article - Media, PublicationsGoldman Sachs starts shorting the dollar as economic reopenings boost foreign currencies

Ben Winck, 01 June 2020

Economic reopenings outside the US are lifting foreign currencies and creating a strong opportunity for some bets against the dollar, Goldman Sachs strategists said in a Sunday note.

Cash assets served as an initial safe haven for investors as the coronavirus spread throughout the US in March and fueled new recession fears. With economic reopenings taking effect around the world and new stimulus measures further lifting sentiments, the firm highlighted the Norwegian krone as best suited for a bet against the dollar.

“We have maintained for some time that it was too early to look for outright and sustained dollar downside given the balance of cyclical risks,” the team led by Zach Pandl wrote. Yet “the steady reopening process, limited evidence of a pickup in COVID infection rates” and new relief policy like the EU Recovery Fund make Norway appear “well-positioned to outperform through the coronavirus shock,” they added.

#UNRIG Video (8:41) Riots as Sedition, NSA and OSA as Solution, Restoring Made in America & America the Beautiful

VideoArticle: 9 FINANCIAL GURUS WHO’VE GIVEN TERRIBLE ADVICE

Article - Media, Publications9 FINANCIAL GURUS WHO’VE GIVEN TERRIBLE ADVICE

Accounting Degree, 01 June 2020

Many Americans turn to financial gurus for personal finance advice. Twenty-four-hour news stations, online media, and a wealth of financial books have made it easy to tune into your financial wizard of choice. And while there’s a lot of good advice being shared by financial gurus, even the best are bound to slip up at some point. Here, we’ll take a look at financial gurus, some good and some bad, that have at one point given terrible advice to their fans and clients.

Continue reading “Article: 9 FINANCIAL GURUS WHO’VE GIVEN TERRIBLE ADVICE”

Subject: Geraldine Buckingham

Subject of Interest Geraldine Buckingham is a member of BlackRock’s Global Executive Committee. She is a Senior Managing Director and is BlackRock’s Chair for the Asia Pacific region. She is responsible for all business activities in the region, which includes Greater China, Japan, Australia, Singapore, India and Korea. Buckingham previously served as Global Head of Corporate Strategy at BlackRock. Prior to joining BlackRock in 2014, Dr. Buckingham was a partner with McKinsey & Company’s financial services practice based in New York. Buckingham received the Rhodes scholarship to study at Oxford University, where she earned a Master of Philosophy degree in Comparative Social Policy. She earned her Bachelor of Medicine and Bachelor of Surgery (MBBS) degrees from Monash University.

Geraldine Buckingham is a member of BlackRock’s Global Executive Committee. She is a Senior Managing Director and is BlackRock’s Chair for the Asia Pacific region. She is responsible for all business activities in the region, which includes Greater China, Japan, Australia, Singapore, India and Korea. Buckingham previously served as Global Head of Corporate Strategy at BlackRock. Prior to joining BlackRock in 2014, Dr. Buckingham was a partner with McKinsey & Company’s financial services practice based in New York. Buckingham received the Rhodes scholarship to study at Oxford University, where she earned a Master of Philosophy degree in Comparative Social Policy. She earned her Bachelor of Medicine and Bachelor of Surgery (MBBS) degrees from Monash University.

.

Subject: Edwin N. Conway

Subject of Interest Edwin N. Conway is a member of BlackRock’s Global Executive Committee. He is a Senior Managing Director and is Global Head of BlackRock Alternative Investors (BAI). Prior to this, Conway was Global Head of BlackRock’s Institutional Client Business (ICB). Prior to joining BlackRock in 2011, Mr. Conway was a Senior Managing Director at The Blackstone Group where he headed the Global Investor Relations & Business Development Group. Before joining Blackstone in 2005, Mr. Conway was an Executive Director at Arden Asset Management, Inc. and prior to that he was a Director at Credit Suisse Asset Management located both in London and New York. Conway earned a BComm degree from University College Dublin (UCD).

Edwin N. Conway is a member of BlackRock’s Global Executive Committee. He is a Senior Managing Director and is Global Head of BlackRock Alternative Investors (BAI). Prior to this, Conway was Global Head of BlackRock’s Institutional Client Business (ICB). Prior to joining BlackRock in 2011, Mr. Conway was a Senior Managing Director at The Blackstone Group where he headed the Global Investor Relations & Business Development Group. Before joining Blackstone in 2005, Mr. Conway was an Executive Director at Arden Asset Management, Inc. and prior to that he was a Director at Credit Suisse Asset Management located both in London and New York. Conway earned a BComm degree from University College Dublin (UCD).