TRANSCRIPT Jim Cramer Discusses Subpoena with Herb Greenberg

Mercurity Fintech Holding Inc. Announces Results of 2021 Extraordinary General Meeting

PRNewswire, 09 February 2021

Mercurity Fintech Holding Inc. (the “Company”) (Nasdaq: MFH) today announced the results of its 2021 Extraordinary General Meeting, held on February 5, 2021 in Beijing, where it adopted resolutions, effective immediately, to: (i) increase the authorized share capital of the Company from US$50,000 to US$250,000; and (ii) re-elect following nominees as members of the Company’s Board of Directors: Continue reading “Article: Mercurity Fintech Holding Inc. Announces Results of 2021 Extraordinary General Meeting”

FINRA GameStop Probe May Put Firms’ Compliance In Focus

Al Barbarino, 09 February 2021

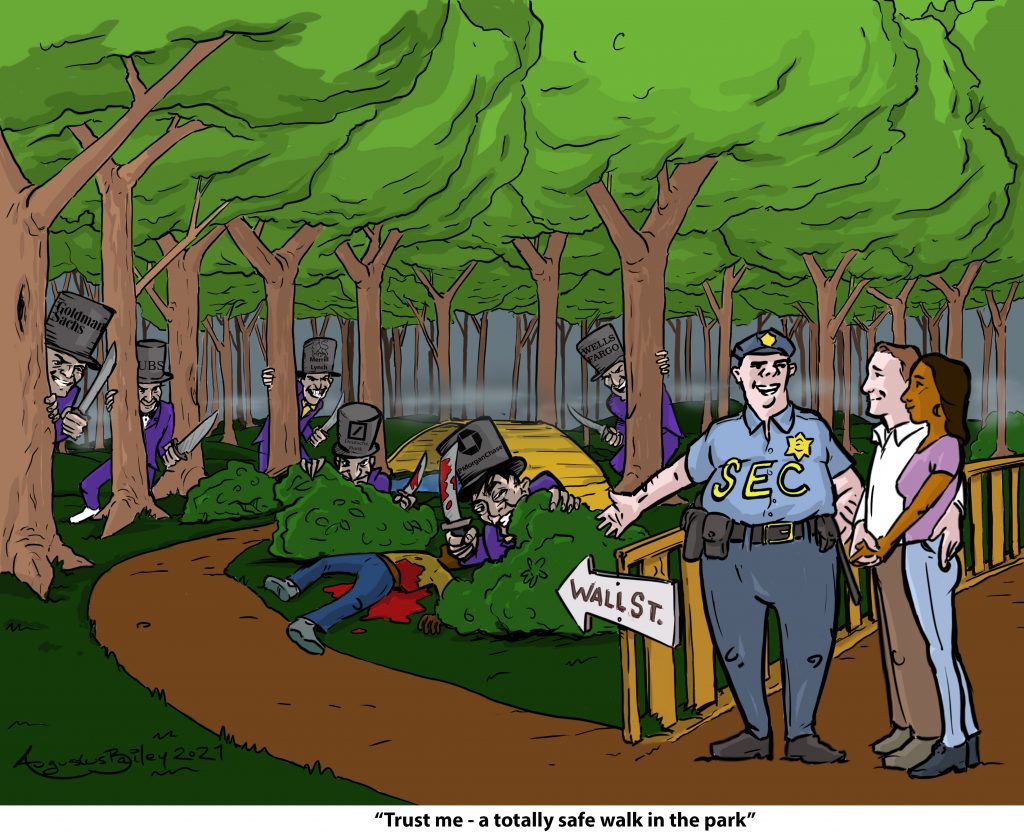

The Financial Industry Regulatory Authority is likely investigating the social media activity of brokers tied to the GameStop stock-trading frenzy, which could ultimately lead to scrutiny of firms’ supervisory procedures and require fine-tuning of their compliance policies.

The erratic trading that sent GameStop’s share price soaring to a high of $483 on Jan. 28 before crashing down was fueled in part by a Reddit board where users promoted the stock to counter Wall Street firms that had bet against it. After weeks of wild fluctuations, the stock closed Tuesday at just over $50. Continue reading “Article: FINRA GameStop Probe May Put Firms’ Compliance In Focus”

Investigations Into GameStop Trading And Reddit: Former SEC Enforcement Chief Provides Insights

Bruce Brumberg, JDN, 9 February 2021

The Reddit/GameStop aftermath continues. Now, it’s been reported, investigators at the US Securities and Exchange Commission (SEC) are allegedly scouring posts on social media and online message boards for evidence of fraud and coordinated stock-price manipulation in the hype that led to recent unlikely surges in the stock prices of GameStop, AMC Entertainment Holdings, and a few other companies.

The Reddit/GameStop aftermath continues. Now, it’s been reported, investigators at the US Securities and Exchange Commission (SEC) are allegedly scouring posts on social media and online message boards for evidence of fraud and coordinated stock-price manipulation in the hype that led to recent unlikely surges in the stock prices of GameStop, AMC Entertainment Holdings, and a few other companies.

What goes on in these types of SEC investigations? Are individual investors who contributed to the online buzz about these companies really at risk of SEC enforcement actions or criminal prosecution? What about the legality of the decision by trading app Robinhood and other online trading platforms to temporarily restrict trading in the stock of GameStop and the other targeted companies? Continue reading “Article: Investigations Into GameStop Trading And Reddit: Former SEC Enforcement Chief Provides Insights”

Posted 2/7/2021

Before you go crying about “What does this company do? Where are the PRs? Fundmentals?”… We all saw what a short squeeze can do to share price.

The GameStop Stock Saga: A Postmortem

Milton Ezrati, 07 February 2021

So much has been written about GameStop stock it seems pointless to offer yet another take on its saga now. It also seems pointless to guess what motivated the Reddit crowd or why the short sellers hung on for as long as they did. All that is water over the dam, as the saying goes.

So much has been written about GameStop stock it seems pointless to offer yet another take on its saga now. It also seems pointless to guess what motivated the Reddit crowd or why the short sellers hung on for as long as they did. All that is water over the dam, as the saying goes.

At this point, the adventure carries two important and age-old investment lessons: One is that taking part in a buying frenzy leads to at least as many losers as winners, usually more, for there are many in the Reddit crowd who enthusiastically bought at highs and have suffered significant losses. The second is that shorting is a very risky business. Both lessons should now be clear, even when seen through the tears of those who lost. What deserves attention here is that, with a few notable exceptions, the media made a hash of covering these events. Continue reading “Article: The GameStop Stock Saga: A Postmortem”

Author: Matt Taibbi / Feb 6, 2021

https://taibbi.substack.com/p/in-response-to-new-york-re-gamestop

Author: Tyler Durden / Feb 6, 2021

While the money flow “buy signal” will likely trigger next week, the market is already trading 2-standard deviations above the 40-dma. Such suggests that the upside may be more limited over the next couple of weeks.

https://www.zerohedge.com/markets/wall-street-wins-again-gamestop-becomes-game-over