AMC is Now Designated by NYSE as a ‘Threshold Security’

Tim Fries, 29 June 2021

The more one zooms into the stock market’s underpinnings, the more surreal it gets. Today, the NYSE has designated AMC as a ‘threshold security’, shining further light onto the situation with AMC shares that fail to deliver.

The more one zooms into the stock market’s underpinnings, the more surreal it gets. Today, the NYSE has designated AMC as a ‘threshold security’, shining further light onto the situation with AMC shares that fail to deliver.

MOASS Revisited

Yesterday, the Tokenist reported on another tie-in to the great short squeeze saga. Both TD Ameritrade and Schwab brokers announced their increased margin trading requirements to reduce the risk for themselves and for traders who wish to engage in the trading of the two mega-shorted stocks – GME and AMC. As these stocks already drained $12 billion from hedge funds, all market players are fortifying their financial walls. Continue reading “Article: AMC is Now Designated by NYSE as a ‘Threshold Security’”

How the GameStop Hustle Worked

How the GameStop Hustle Worked Let the Apes Have Wall Street

Let the Apes Have Wall Street The U.S. Securities and Exchange Commission (SEC) has approved the DTCC Data Repository (U.S.) application to operate as a registered security-based swap data repository (SBSDR).

The U.S. Securities and Exchange Commission (SEC) has approved the DTCC Data Repository (U.S.) application to operate as a registered security-based swap data repository (SBSDR).

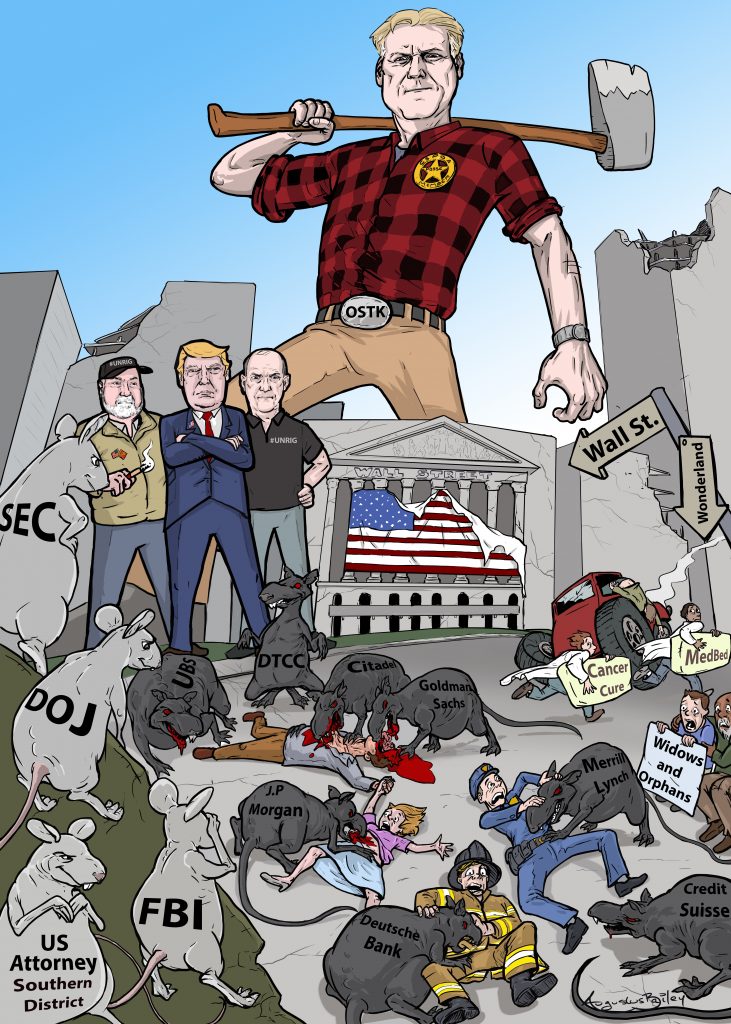

DTCC is a “self-regulating organization” which is code for Licensed to Steal with Impunity. The SEC and DTCC (and the Senate Banking Commission and the US Attorney for the Southern District of New York) are RICO organizations. The fraud continues apace.

DTCC is a “self-regulating organization” which is code for Licensed to Steal with Impunity. The SEC and DTCC (and the Senate Banking Commission and the US Attorney for the Southern District of New York) are RICO organizations. The fraud continues apace. ROBERT STEELE: This article is such crap. As if DTCC had not willfully covered up $100 trillion in naked short counterfeit sales these past 15-20 years. Until DTCC is given a porcupine enema and we sent DOJ, FBI, and US Southern District Attorneys to jail for life for treason — enabling foreign collusion and domestic crime against the US economy — for life, this will not change.

ROBERT STEELE: This article is such crap. As if DTCC had not willfully covered up $100 trillion in naked short counterfeit sales these past 15-20 years. Until DTCC is given a porcupine enema and we sent DOJ, FBI, and US Southern District Attorneys to jail for life for treason — enabling foreign collusion and domestic crime against the US economy — for life, this will not change.