Interview 8.8.21 #darkpools @CNBC erase clip. 8.10.21 @andrewrsorkin “conspiracy theories” “Don’t make much sense” Please restore clip @CNBC & let @GaryGensler words speak for himself. Silence is the same as complicit @MelissaLeeCNBC @jimcramer @cvpayne https://t.co/SU5Sg3LGW8 pic.twitter.com/GXj39RS6Z7

— Dragon Breath (@elon55447676) August 11, 2021

Article: Morgan Stanley gives Nasdaq bullish rating on tailwinds strategy shift

Article - MediaMorgan Stanley gives Nasdaq bullish rating on tailwinds strategy shift/strong>

Liz Kiesche, 11 June 2021

Morgan Stanley analyst Michael Cyprys, favoring U.S. exchange operators that are shifting toward recurring revenue and benefiting from secular tailwinds, initiates coverage of Nasdaq (NDAQ +2.3%) at Overweight, Intercontinental Exchange (ICE +0.5%) and CME Global (CME +0.5%) at Equal-Weight, and Cboe Global (CBOE -0.2%) at Underweight.

Sees upside from NDAQ’s move to catch tailwinds from data and analytics, ESG and anti-financial crime, and index segments. Continue reading “Article: Morgan Stanley gives Nasdaq bullish rating on tailwinds strategy shift”

Article: Wall Street languid as “meme stock” frenzy hogs spotlight

Article - MediaWall Street languid as “meme stock” frenzy hogs spotlight

Stephen Culp, 08 June 2021

Wall Street stocks wavered near the starting line on Tuesday as a lack of clear market catalysts kept institutional investors on the sidelines, while retail traders kept the rally of so-called meme stocks alive. All three major U.S. stock indexes were little changed, with the S&P (.SPX) and the Dow (.DJI) hovering within 1% of their record closing highs.

The tech-laded Nasdaq (.IXIC) fared best, with Amazon.com Inc (AMZN.O) and Apple Inc (AAPL.O) providing the biggest boost. The CBOE volatility index (.VIX), a measure of investor anxiety, touched its lowest level in over a year. Continue reading “Article: Wall Street languid as “meme stock” frenzy hogs spotlight”

Article: Stocks Pop in After-Hours as Traders Eye Oil and Inflation

Article - MediaStocks Pop in After-Hours as Traders Eye Oil and Inflation

Gerelyn Terzo, 07 June 2021

Stocks finished mixed on Monday with the S&P 500 failing to make a run for a new record and closing slightly in the red. The index is already up about 12% year-to-date, but investors are feeling a bit skittish about inflation.

Stocks finished mixed on Monday with the S&P 500 failing to make a run for a new record and closing slightly in the red. The index is already up about 12% year-to-date, but investors are feeling a bit skittish about inflation.

The Nasdaq and the Dow Jones Industrial Average both finished the day up fractionally, while oil is back on investors’ radar to reclaim the USD 100 level in the medium-term. Meme stocks continue to rule the roost. Let’s take a look at some of today’s market action. Continue reading “Article: Stocks Pop in After-Hours as Traders Eye Oil and Inflation”

Article: What is market manipulation?

Article - Media, PublicationsThomas Dixon, 25 May 2021

“The market is manipulated by big sharks.”

“The price isn’t moving when it should be.”

And a lot more. That’s how people on the internet speak about stock manipulation or market manipulation. But, what is it, really?

What is manipulation?

Psychologically speaking, manipulation is a form of social control that uses indirect, misleading, or underhanded techniques to alter the behavior or opinion of others. Such tactics could be called exploitative and devious since they further the manipulator’s objectives at the cost of others. Continue reading “Article: What is market manipulation?”

Article: Swedbank Fined $5.5 million by Nasdaq Stockholm

Article - Media, PublicationsSwedbank Fined $5.5 million by Nasdaq Stockholm

Dominic Chopping, 05 May 2021

STOCKHOLM–Swedbank AB said Wednesday that it has been ordered to pay 46.6 million Swedish kronor ($5.5 million) by Nasdaq Stockholm’s disciplinary committee for anti-money laundering shortcomings.

“The disciplinary committee states that Swedbank over a long period of time had shortcomings in its AML processes and routines and that the shortcomings were known to the bank’s former top management for a long period of time,” the bank said.

The fine, for breaching Nasdaq rules on disclosure of information, relates to the period between December 2016 and February 2019. Continue reading “Article: Swedbank Fined $5.5 million by Nasdaq Stockholm”

Article: Bernard Madoff, criminal financier, 1938-2021

Article - Media, PublicationsBernard Madoff, criminal financier, 1938-2021

Brooke Masters , 16 April 2021

When Bernard Madoff’s Ponzi scheme collapsed in December 2008, $65bn vanished overnight, devastating tens of thousands of small investors, charities and religious groups who continue to struggle to this day.

When Bernard Madoff’s Ponzi scheme collapsed in December 2008, $65bn vanished overnight, devastating tens of thousands of small investors, charities and religious groups who continue to struggle to this day.

The former chair of the Nasdaq stock market’s confession that his fabled investment company was “one big lie” came at the depths of the financial crisis and riveted global attention. Amid an alphabet soup of opaque financial products that had crashed the world economy, people could understand this crime.

Continue reading “Article: Bernard Madoff, criminal financier, 1938-2021”

Article: About Credit Suisse X-Links Silver CovCall ETN

Article - Media, PublicationsAbout Credit Suisse X-Links Silver CovCall ETN

U.S. News, 16 April 2021

The investment seeks a return linked to the performance of the Credit Suisse NASDAQ Silver FLOWSTM 106 Index. The index measures the return of a “covered call” strategy on the shares of the iShares® Silver Trust (the “SLV Shares”) by reflecting changes in the price of the SLV Shares and the notional option premiums received from the notional sale of monthly call options on the SLV Shares less notional transaction costs incurred in connection with the covered call strategy.

Article: NANO-X IMAGING LTD Files 2020 Annual Report on Form 20-F

Article - Media, PublicationsNANO-X IMAGING LTD Files 2020 Annual Report on Form 20-F

GLOBE NEWSWIRE, 06 April 2021

NANO-X IMAGING LTD (NASDAQ: NNOX) (www.nanox.vision) (“Nanox” or the “Company”), the innovative medical imaging technology company democratizing healthcare, today announced that it has filed its annual report on Form 20-F for the fiscal year ended December 31, 2020 with the U.S. Securities and Exchange Commission (“SEC”) on April 6, 2021. The annual report on Form 20-F, which contains the Company’s audited consolidated financial statements, can be accessed on the SEC’s website at www.sec.gov and on the Company’s website at www.nanox.vision under “Financials” in the Investors section. Continue reading “Article: NANO-X IMAGING LTD Files 2020 Annual Report on Form 20-F”

Article: American Acquisition Opportunity Inc. Announces Partial Exercise of Over-Allotment Option in Connection With Its Initial Public Offering

Article - Media, PublicationsACCESSWIRE, 02 April 2021

American Acquisition Opportunity Inc. (NASDAQ:AMAOU)(the “Company”) announced today that it has closed the issuance of an additional 506,002 units pursuant to the partial exercise of the underwriter’s over-allotment option in connection with the company’s initial public offering. The units are listed on the Nasdaq Capital Market (“Nasdaq”) under the ticker symbol “AMAOU”. Each unit consists of one share of the Company’s Class A common stock and one-half of one redeemable warrant. Each whole warrant entitles the holder thereof to purchase one share of Class A common stock at a price of $11.50 per share. Only whole warrants are exercisable and will trade. Once the securities comprising the units begin separate trading, shares of the Class A common stock and warrants are expected to be listed on Nasdaq under the symbols “AMAO” and “AMAOW,” respectively Continue reading “Article: American Acquisition Opportunity Inc. Announces Partial Exercise of Over-Allotment Option in Connection With Its Initial Public Offering”

Article: Bitcoin’s Price Is Not the Only Risk to Riot Blockchain

Article - Media, PublicationsBitcoin’s Price Is Not the Only Risk to Riot Blockchain

Vince Martin, 31 March 2021

Less than four years ago, Riot Blockchain (NASDAQ:RIOT) was a failed animal health company named Bioptix. What is now RIOT stock was then BIOP stock — and it traded for less than $4 per share.

That wasn’t because investors put much value on the business: Bioptix in fact had more than $2 per share in cash at the end of 2017’s second quarter. BIOP was basically just another penny stock in the biotech space.

But in October of that year, Bioptix rebranded to Riot Blockchain. It was a move that invited a huge rally — and quite a bit of skepticism.

Blockchain and other cryptocurrencies were hot then, with Bitcoin (CCC:BTC-USD) at one point rising from $900 to $20,000 during 2017. Riot was not alone in moving into crypto and blockchain: Eastman Kodak (NYSE:KODK) infamously was involved in a “KodakCoin” project which never came to fruition. That didn’t stop KODK stock from soaring. Continue reading “Article: Bitcoin’s Price Is Not the Only Risk to Riot Blockchain”

Article: No Surprise Here: Institutions Could Run Bitcoin’s Price Higher

Article - Media, PublicationsNo Surprise Here: Institutions Could Run Bitcoin’s Price Higher

ETF Trends, 31 March 2021

Institutions are slowly warming to Bitcoin, which many market observers believe will lead to substantial long-term price appreciation.

Institutions are slowly warming to Bitcoin, which many market observers believe will lead to substantial long-term price appreciation.

Institutional investors are playing an increasingly prominent role in the Bitcoin market, and that role is likely to continue growing. For smaller investors, there are tangible benefits to this scenario. Continue reading “Article: No Surprise Here: Institutions Could Run Bitcoin’s Price Higher”

Article: Fraudsters Siphon $100 Million In COVID Relief Through Online Investment Platforms

Article - Media, PublicationsFraudsters Siphon $100 Million In COVID Relief Through Online Investment Platforms

PYMNTS, 30 March 2021

Scammers stealing from government-funded pandemic relief programs have found a new trick — opening accounts with at least four online investment platforms, CNBC reported Monday (March 29).

Law enforcement officials say digital platforms are an easy way to dump money into stolen identity accounts.

Authorities say over $100 million in fraudulent funds reportedly passed through investment accounts in the time since Congress passed the CARES Act last March.

Among the platforms allegedly used by thieves are Robinhood, TD Ameritrade, E-Trade and Fidelity, according to law enforcement.

“The thieves are loving this stuff. This has been the financial crime bonanza act of 2021,” said Charles Intriago, a money-laundering expert and former federal prosecutor, according to CNBC. Continue reading “Article: Fraudsters Siphon $100 Million In COVID Relief Through Online Investment Platforms”

Article: Glass Houses Acquisition Corp. – EX-1.1 – – UNDERWRITING AGREEMENT BETWEEN THE COMPANY AND JEFFERIES LLC – March 26, 2021

Article - Media, PublicationsFintel, 26 March 2021

Introductory. Glass Houses Acquisition Corp., a Delaware corporation (the ?Company?), proposes, upon the terms and subject to the conditions set forth in this agreement (this ?Agreement?), to issue and sell to the several underwriters listed on Schedule A hereto (the ?Underwriters?) an aggregate of 20,000,000 units of the Company (the ?Units?). The 20,000,000 Units to be sold by the Company are called the ?Firm Securities.? In addition, the Company has granted to the Underwriters an option to purchase up to an additional 3,000,000 Units as provided in Section 2. The additional 3,000,000 Units to be sold by the Company pursuant to such option are collectively called the ?Optional Securities.? The Firm Securities and, if and to the extent such option is exercised, the Optional Securities are collectively called the ?Offered Securities.? Jefferies LLC (?Jefferies?) has agreed to act as the representative of the several Underwriters (in such capacity, the ?Representative?) in connection with the offering of the Offered Securities for sale to the public as contemplated in the Prospectus (as defined below) (the ?Offering?).

Article: A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price

Article - Media, PublicationsPam Martens and Russ Martens, 26 March 2021

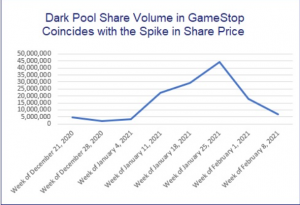

If the Securities and Exchange Commission is not taking a hard look at the involvement of Dark Pools owned by the biggest banks on Wall Street during the meteoric spike in the price of GameStop shares in late January, then we have to conclude that it doesn’t want to actually get at the truth.

Wall Street On Parade spent one hour combing through the Dark Pool trading data available through Wall Street’s self-regulator, FINRA, and the evidence of Dark Pools’ involvement in the dodgy trading in GameStop is striking. (GameStop is a New York Stock Exchange listed company and it has been trading like a penny stock operated out of a boiler room – raising questions about the integrity of U.S. markets.

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price