Let the Apes Have Wall Street

Let the Apes Have Wall Street

Matt Taibbi, 10 June 2021

The much-publicized war over “meme stocks” drags a longstanding Wall Street ripoff out of the shadows, to hilarious results

On CNBC’s Fast Money last week, anchor Melissa Lee appeared to mention the unmentionable. She was talking with Tim Seymour, CEO of Seymour Asset Management, who made offhand mention of the hedge funds shorting now-infamous stocks like AMC and GameStop. “Look, there are a lot of short sellers out there who have been borrowing stock they didn’t have,” Seymour said.

“Naked shorts, yeah,” said Lee.

During 2007-09 credit crisis the global banking system suffered from a grand-mal seizure. Trillions in their reserves becoming insolvent. The global payment system broke down. There was no way the big Wall Street banks and the financial markets would be spared from his slaughter unless Dr Bernanke and his FOMC began “stabilizing” the financial markets with a brilliant new contrivance; a QE.

During 2007-09 credit crisis the global banking system suffered from a grand-mal seizure. Trillions in their reserves becoming insolvent. The global payment system broke down. There was no way the big Wall Street banks and the financial markets would be spared from his slaughter unless Dr Bernanke and his FOMC began “stabilizing” the financial markets with a brilliant new contrivance; a QE. Billionaire James Packer has been offered a new exit strategy from Crown Resorts after the company received an unsolicited bid from private equity company Blackstone Group.

Billionaire James Packer has been offered a new exit strategy from Crown Resorts after the company received an unsolicited bid from private equity company Blackstone Group. Richard Severin Fuld Jr born April 26, 1946) is an American banker best known as the final Chairman and Chief Executive Officer of major investment Bank Lehman Brothers.

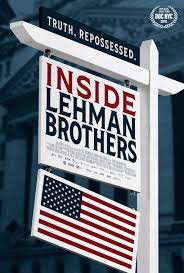

Richard Severin Fuld Jr born April 26, 1946) is an American banker best known as the final Chairman and Chief Executive Officer of major investment Bank Lehman Brothers. Inside Lehman Brothers is the autopsy of a crime by those who tried to prevent it from within. As mortgage brokers for Lehman’s subsidiary BNC, Linda Weekes and her Californian colleagues were at the forefront of the subprime crisis. Matthew Lee, then headquartered in New York, was the first leader to have refused to validate the accounts tainted by fraudulent transactions. At the time nobody listened to these whistleblowers. In 2007 and 2008 other banks lost by the same greed and were saved by the Fed. On Wall Street they say Lehman Brothers was “sacrificed”. It was necessary to make them an example, to promise that this would not happen again. Today banks have recovered their health, and with it, their bad habits. The labels have changed but the mechanisms remain, unlocked by Donald Trump whose cabinet of advisors are the ones who drove the system into bankruptcy back in 2008. Inside Lehman Brothers is the result of an investigative survey conducted by the team for over two years.

Inside Lehman Brothers is the autopsy of a crime by those who tried to prevent it from within. As mortgage brokers for Lehman’s subsidiary BNC, Linda Weekes and her Californian colleagues were at the forefront of the subprime crisis. Matthew Lee, then headquartered in New York, was the first leader to have refused to validate the accounts tainted by fraudulent transactions. At the time nobody listened to these whistleblowers. In 2007 and 2008 other banks lost by the same greed and were saved by the Fed. On Wall Street they say Lehman Brothers was “sacrificed”. It was necessary to make them an example, to promise that this would not happen again. Today banks have recovered their health, and with it, their bad habits. The labels have changed but the mechanisms remain, unlocked by Donald Trump whose cabinet of advisors are the ones who drove the system into bankruptcy back in 2008. Inside Lehman Brothers is the result of an investigative survey conducted by the team for over two years. Timothy Franz Geithner is a former American central banker who served as the 75th United States Secretary of the Treasury under President Barack Obama, from 2009 to 2013. He was the President of the Federal Reserve Bank of New York from 2003 to 2009, following service in the Clinton administration. Since March 2014, he has served as president and managing director of Warburg Pincus, a private equity firm headquartered in New York City. At the New York Fed, Geithner helped manage crises involving Bear Stearns, Lehman Brothers, and the American International Group. Geithner graduated from Dartmouth College (BA) and Johns Hopkins University (MA).

Timothy Franz Geithner is a former American central banker who served as the 75th United States Secretary of the Treasury under President Barack Obama, from 2009 to 2013. He was the President of the Federal Reserve Bank of New York from 2003 to 2009, following service in the Clinton administration. Since March 2014, he has served as president and managing director of Warburg Pincus, a private equity firm headquartered in New York City. At the New York Fed, Geithner helped manage crises involving Bear Stearns, Lehman Brothers, and the American International Group. Geithner graduated from Dartmouth College (BA) and Johns Hopkins University (MA). Pascal Bandelier is the Senior Managing Director, Head of Equities. He joined the Cantor Fitzgerald based in New York.

Pascal Bandelier is the Senior Managing Director, Head of Equities. He joined the Cantor Fitzgerald based in New York.