In other news, Gary fails to see the 800 lb elephant dancing in his office… pic.twitter.com/xYqorSmoS5

— Jim (@Jim54288169) August 17, 2021

Article: SEC Charges Investment Adviser and Associated Individuals with Causing Violations of Regulation SHO

Article - MediaSEC Charges Investment Adviser and Associated Individuals with Causing Violations of Regulation SHO

Washington D.C., Aug. 17, 2021

The Securities and Exchange Commission today announced settled charges against Murchinson Ltd.; its principal, Marc Bistricer; and its trader, Paul Zogala (the respondents), for providing erroneous order-marking information that caused executing brokers to violate Regulation SHO. In addition, Murchinson and Bistricer settled charges for causing a dealer to fail to register with the SEC.

The Securities and Exchange Commission today announced settled charges against Murchinson Ltd.; its principal, Marc Bistricer; and its trader, Paul Zogala (the respondents), for providing erroneous order-marking information that caused executing brokers to violate Regulation SHO. In addition, Murchinson and Bistricer settled charges for causing a dealer to fail to register with the SEC.

According to the SEC’s order, from June 2016 through October 2017, the respondents provided erroneous order-marking information on hundreds of sale orders of their hedge fund client to the hedge fund’s brokers, causing those brokers to mismark the hedge funds’ sales as “long.” The order finds that in providing the inaccurate information, the respondents also caused the hedge fund’s brokers to fail to borrow or locate shares prior to executing the sales.

Tweet by NateTheApe on Twitter IV

TweetHopefully we can develop quantum programming language that can help the SEC be an effective and ethical regulatory agency in the interest of a truly free market.

— NateTheApe (@NateSte48031981) July 30, 2021

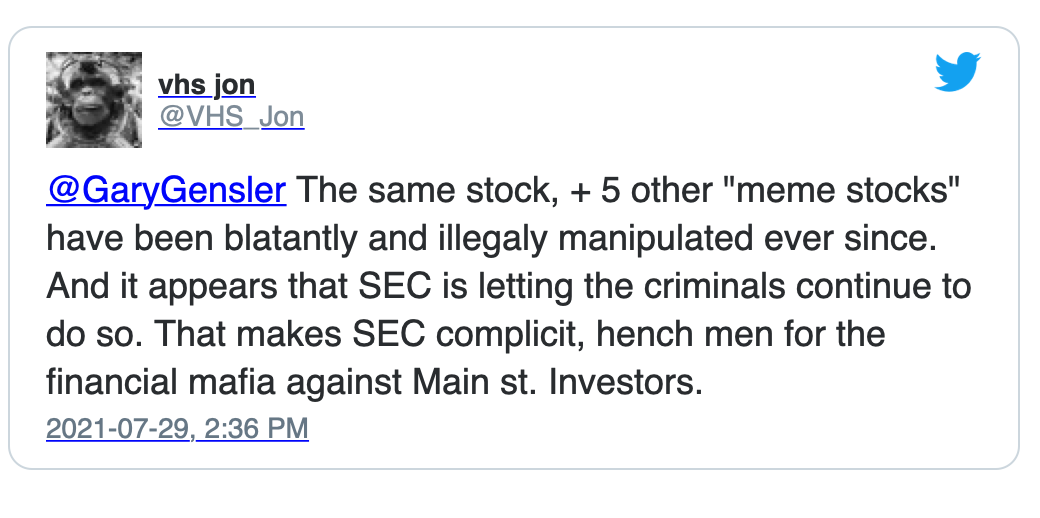

Tweet by vhs jon on Twitter

Tweet

Article: Want to Make $1 Million? Market Manipulation Is Back! (Thanks to Social Media)

Article - MediaWant to Make $1 Million? Market Manipulation Is Back! (Thanks to Social Media)

Thomas Yeung, 16 July 2021

When Keith “Roaring Kitty” Gill announced he was buying GameStop (NYSE:GME) shares and options on Reddit’s r/WallStreetBets, regulators might have considered his outrageous claims as parody — speech protected by First Amendment rights. Who could take $20 calls on GME seriously when the stock was trading at $5?

When Keith “Roaring Kitty” Gill announced he was buying GameStop (NYSE:GME) shares and options on Reddit’s r/WallStreetBets, regulators might have considered his outrageous claims as parody — speech protected by First Amendment rights. Who could take $20 calls on GME seriously when the stock was trading at $5?

Since then, other social media forums have blurred the lines between satire and intentional deception. This week, shares in SCWorks (NASDAQ:WORX) doubled after traders on Discord and Twitter banded together to push prices higher. MINM, DTSS and an alphabet soup of other small-cap stocks have followed the same path Continue reading “Article: Want to Make $1 Million? Market Manipulation Is Back! (Thanks to Social Media)”

Article: Three Sued Over Blockchain Firm Trading

Article - MediaThree Sued Over Blockchain Firm Trading

Matthew Heller, 12 July 2021

The controlling shareholder of Long Blockchain has been charged with tipping off his broker about the company’s pivot to blockchain technology before it was publicly announced.

The U.S. Securities and Exchange Commission said Eric Watson, a New Zealand national, engaged in an insider trading scheme with Oliver Barret-Lindsay, his friend and broker, and stock promoter Gannon Giguiere, that allegedly resulted in Giguiere making a profit of $162,500 on Long Blockchain shares.

According to the SEC, Watson tipped off Lindsay in December 2017 that the company formerly known as Long Island Tea would be switching from making iced tea and lemonade to providing blockchain technology and Lindsay passed the tip on Giguiere. Continue reading “Article: Three Sued Over Blockchain Firm Trading”

Article: Feds indict ‘The Bull’ for selling insider trading info on the dark web

Article - MediaFeds indict ‘The Bull’ for selling insider trading info on the dark web

Richard Lawler, 10 July 2021

Nearly four years after the lights went out at AlphaBay, the feds are still charging people with criminal activities linked to the dark web marketplace. On Friday the SEC and the Department of Justice announced charges against Apostolos Trovias, a Greek national who they allege posted on dark web marketplaces using the nickname “The Bull.”

Nearly four years after the lights went out at AlphaBay, the feds are still charging people with criminal activities linked to the dark web marketplace. On Friday the SEC and the Department of Justice announced charges against Apostolos Trovias, a Greek national who they allege posted on dark web marketplaces using the nickname “The Bull.”

However, unlike drug dealers targeted in previous actions, the authorities allege Trovias used dark web forums as a way to troll for people willing to buy or sell insider trading information while hiding behind “anonymizing software, screen names, and bitcoin payments.” Continue reading “Article: Feds indict ‘The Bull’ for selling insider trading info on the dark web”

GTII and FNGR disgusting trading from yesterday

CommentaryAlert Reader writes in:

GTII.. The stock was trading like a normal stock even with all the naked shorting going on Then they sold 55,000 at the market down from $1.55 ot

$1.37 Just to try and get longs to panic. Who takes a $10K just to do that? A naked short in Huge trouble, Anyway they changed the price for a few and buyers

Stepped back in to close it back to $1.47 instead of a day ion the Black we closed in the Red down a penny To longs a nonevent day BUT the short is 1000%

In a panic They sold 166,000 more our of 233,000 that traded. another BIG short day. 72,000,000 is my final # why change it. I haven’t in weeks

Thats Big enough to make everyone happy when they fold

Working on a conference call with a former SEC enforcement Lawyer. Who I was told has spread our story to many People who Like to know fraud. ( GTII story is 100% is being told in DC)

I want him to tell all of you NOT from me. Working on it. Will keep you up

NOW if you thought GTII was manipulated yesterday this is even better

FNGR I knew buyers who were paying up to $6.50 like 15K. The naked short sold it to them and then the NEXT

OFFER in the stock was $5.33 on 13,000 down over $1.10 Think about that That The offer was taken and even

I had enough money To buy 84 shares at $5.33 to join in the fun. Then the stock moved back up

and closed at $6.25

THE NAKED SOLD 52,000 out of 61,000 that traded or 85.5%. Watching it was insane

I do believe. The naked short in Both GTII and FNGR have a margin problem from the new SEC rules

The TRADING tells the story and Its wild for sure When they Fold Both may go at the same time

Lets hope so. Good luck today

Tweet by real aloy on Twitter

TweetAll reporting agencies have been fooled by Hedge funds, trading platforms, MMs etc etc…. nothing new… fines are in the millions when they make $Billions with fake reporting and fraudulent trades….@SEC_Enforcement still waking up….$AMC $GME @ORTEX

— real aloy (@rimisback) June 30, 2021

Article: Moez Kassam & Anson Funds Part II: Rotten To The Core

Article - MediaMoez Kassam & Anson Funds Part II: Rotten To The Core

Market Frauds, 28 June 2021

Note to all readers: The Canadian regulators (OSC and IIROC) are asking people for information on illegal trading strategies. If you or a company or investor have been hurt by Anson Funds please do not remain silent. Get in touch with the OSC and file a formal complaint. This really is your only chance to be heard. Make it count! You can also send information to the SEC here: https://www.sec.gov/whistleblower Continue reading “Article: Moez Kassam & Anson Funds Part II: Rotten To The Core”

Article: How the GameStop Hustle Worked

Article - Media How the GameStop Hustle Worked

How the GameStop Hustle Worked

Lucy Komisar, 22 June 2021

I have written previously for the Prospect about the frenzy over GameStop (GME), the video game and electronics company. By now, you know the story. Millions of retail investors made the stock soar by over 1,000 percent in January 2021. This brought disaster upon a handful of hedge funds that had bet on GameStop’s stock to drop. According to Markets Insider, one analyst estimated losses in February of roughly $19 billion. The hedge fund Melvin Capital reportedly closed out its position after taking a drubbing of 51 percent. Another fund, Maplelane, lost 40 percent.

Article: Former SEC chair on the market risks even meme stock traders can’t afford to ignore

Article - MediaFormer SEC chair on the market risks even meme stock traders can’t afford to ignore

Eric Rosenbaum, 20 June 2021

The Wall Street establishment and the Reddit, Robinhood-fueled meme stock traders don’t see eye to eye, on just about anything. In fact, rolling eyes at the stock market’s traditional ways is inherent in trades like GameStop and AMC Entertainment.

The Wall Street establishment and the Reddit, Robinhood-fueled meme stock traders don’t see eye to eye, on just about anything. In fact, rolling eyes at the stock market’s traditional ways is inherent in trades like GameStop and AMC Entertainment.

Warnings from the market greats, like Warren Buffett, may as well be a badge of honor among the new traders. But one thing Buffett hasn’t noted in his criticisms of the “casino” atmosphere of this bull market and companies like Robinhood, which he has thoroughly beat on, is that when he was a young investor himself he had a fondness for “cigar butt” stocks — the dregs of the market, companies with a few puffs left in them — before he graduated to a more refined kind of investing that made him a billionaire. And that Buffett footnote raises an important point about the market’s newest investors. Continue reading “Article: Former SEC chair on the market risks even meme stock traders can’t afford to ignore”

Article: Shell company hijack: Men used SEC filings, fake press releases for stock pump-and-dump scam, feds say

UncategorizedDan Mangan, 18 June 2021

Three men engaged in a brazen scheme to “surreptitiously hijack” and take over dormant shell companies, whose stock they then fraudulently inflated to dump to unwitting investors, according to charges in an indictment that was unsealed Friday.

Three men engaged in a brazen scheme to “surreptitiously hijack” and take over dormant shell companies, whose stock they then fraudulently inflated to dump to unwitting investors, according to charges in an indictment that was unsealed Friday.

The men from 2017 through 2019 allegedly used fake resignation letters to seize control of four shell companies and then used the Securities and Exchange Commission’s EDGAR public filing system and bogus press releases to fraudulently “pump up” their share prices by claiming new business opportunities, the indictment says. Continue reading “Article: Shell company hijack: Men used SEC filings, fake press releases for stock pump-and-dump scam, feds say”

Article: 2 Indian-Americans among six charged in Silicon Valley insider trading ring

Article - Media2 Indian-Americans among six charged in Silicon Valley insider trading ring

The Tribune, 16 June 2021

Two Indian-Americans were among six members of a Silicon Valley trading ring against which the US’ Securities and Exchange Commission has slapped charges for generating nearly USD 1.7 million in illegal profits by trading on the confidential earnings information of two local technology companies.

Two Indian-Americans were among six members of a Silicon Valley trading ring against which the US’ Securities and Exchange Commission has slapped charges for generating nearly USD 1.7 million in illegal profits by trading on the confidential earnings information of two local technology companies.

According to the SEC complaint on Tuesday, Nathaniel Brown, 49, who served as the revenue recognition manager for Infinera Corporation, repeatedly tipped Infinera’s unannounced quarterly earnings and financial performance to his best friend, Benjamin Wylam, 42, from April 2016 until Brown left the company in November 2017. Continue reading “Article: 2 Indian-Americans among six charged in Silicon Valley insider trading ring”