Here is the number one thing the SEC should be doing to level the trading field for investors, according to former Citadel trader and Urvin CEO. @dlauer pic.twitter.com/MrUqIW3QQu

— CNBC's Fast Money (@CNBCFastMoney) August 4, 2021

Article: In-Depth: Citadel Connect and Dark Pools Uncovered

Article - MediaIn-Depth: Citadel Connect and Dark Pools Uncovered

MTim Fries, 20 July 2021

Before dark pools, institutional investors had to trade in blocks of shares outside trading hours to avoid upsetting the market. Now, the utility found within dark pools is so high that some market makers have embedded them within their operations. There are certainly some benefits here in terms of increased liquidity, but there’s another side of the coin as well.

Before dark pools, institutional investors had to trade in blocks of shares outside trading hours to avoid upsetting the market. Now, the utility found within dark pools is so high that some market makers have embedded them within their operations. There are certainly some benefits here in terms of increased liquidity, but there’s another side of the coin as well.

Throughout 2021, retail traders have uncovered significant short positions held by hedge funds in a number of stocks. Naked short selling is suspected by many retail traders to be involved. At this point, hedge funds have collectively lost $12 billion—so far. Continue reading “Article: In-Depth: Citadel Connect and Dark Pools Uncovered”

Mo Hormozzadeh: “I went to jail in my country….”

Article - Media

Article: AMC is Now Designated by NYSE as a ‘Threshold Security’

Article - MediaAMC is Now Designated by NYSE as a ‘Threshold Security’

Tim Fries, 29 June 2021

The more one zooms into the stock market’s underpinnings, the more surreal it gets. Today, the NYSE has designated AMC as a ‘threshold security’, shining further light onto the situation with AMC shares that fail to deliver.

The more one zooms into the stock market’s underpinnings, the more surreal it gets. Today, the NYSE has designated AMC as a ‘threshold security’, shining further light onto the situation with AMC shares that fail to deliver.

MOASS Revisited

Yesterday, the Tokenist reported on another tie-in to the great short squeeze saga. Both TD Ameritrade and Schwab brokers announced their increased margin trading requirements to reduce the risk for themselves and for traders who wish to engage in the trading of the two mega-shorted stocks – GME and AMC. As these stocks already drained $12 billion from hedge funds, all market players are fortifying their financial walls. Continue reading “Article: AMC is Now Designated by NYSE as a ‘Threshold Security’”

Article: TLC: THE LONG CON: The markets are frothing with liquidity. PART 1

Article - Media TLC: THE LONG CON: The markets are frothing with liquidity. PART 1

TLC: THE LONG CON: The markets are frothing with liquidity. PART 1

Reddit: u/con101smd, 22 June 2021

TLC: THE LONG CON:

The markets are frothing with liquidity.

How Wall St. conquered the wild west of crypto by laundering funds obtained from illegal naked short selling practices through stock market exchanges worldwide.

Mobile Edition & full PDF: https://docs.google.com/document/d/1fdZV5B6RtyVurxcVsXAOtWNn5NE8BZS1TPu24ZAzLkI/edit?usp=sharing

Article: How the GameStop Hustle Worked

Article - Media How the GameStop Hustle Worked

How the GameStop Hustle Worked

Lucy Komisar, 22 June 2021

I have written previously for the Prospect about the frenzy over GameStop (GME), the video game and electronics company. By now, you know the story. Millions of retail investors made the stock soar by over 1,000 percent in January 2021. This brought disaster upon a handful of hedge funds that had bet on GameStop’s stock to drop. According to Markets Insider, one analyst estimated losses in February of roughly $19 billion. The hedge fund Melvin Capital reportedly closed out its position after taking a drubbing of 51 percent. Another fund, Maplelane, lost 40 percent.

Article: SEC Launches Review Of High-Frequency Traders’ Market Abuses

Article - Media SEC Launches Review Of High-Frequency Traders’ Market Abuses

SEC Launches Review Of High-Frequency Traders’ Market Abuses

Tyler Durden, 09 June 2021

Nearly 8 years have passed since Michael Lewis published “Flash Boys”, raising awareness of the relatively new practice of high-frequency trading and its transformative impact on markets, allowing the most technologically-advanced traders to effectively see a picture of the market that’s nanoseconds ahead of what their non-NFT peers see, giving them a massive advantage.

Now, the SEC is finally considering changing the rules of how stocks are priced and traded to stop exchanges from incentivizing brokers (nowadays, particularly retail trading brokerages that have seen an explosion of activity in the past couple of years).

Tweet by Hitesh Mittal on Twitter

TweetThe PFOF Debate: Interestingly @citsecurities and our paper came out the same day and according to @CuratiaLLC were the top 2 read papers yesterday.

I wrote my take on Citadel's recommendations. Read here https://t.co/2VLUoRJiPS pic.twitter.com/B4uHxSY1Nk

— Hitesh Mittal (@mittalbestex) May 4, 2021

Article: Wall Street Is Donating to This D.A. Candidate. Is That a Problem?

Article - Media, PublicationsWall Street Is Donating to This D.A. Candidate. Is That a Problem?

Jonah E. Bromwich, 13 April 2021

Even had she not raised more money than her rivals, Tali Farhadian Weinstein would be a formidable candidate in the nine-way race to become the Manhattan district attorney, perhaps the most high-profile local prosecutor’s office in the country.

Even had she not raised more money than her rivals, Tali Farhadian Weinstein would be a formidable candidate in the nine-way race to become the Manhattan district attorney, perhaps the most high-profile local prosecutor’s office in the country.

She was a Rhodes scholar, has an elite legal résumé and is the only candidate who has worked for both the Justice Department and a city prosecutor’s office. And while most of the candidates are campaigning as reformers intent on reducing incarceration, Ms. Farhadian Weinstein, 45, has staked out a slightly more conservative position, expressing concerns about guns and gangs. Continue reading “Article: Wall Street Is Donating to This D.A. Candidate. Is That a Problem?”

Tweet by Ben Hunt on Twitter

TweetThey’re not even pretending anymore. https://t.co/rLo2z6i9j7

— Ben Hunt (@EpsilonTheory) April 1, 2021

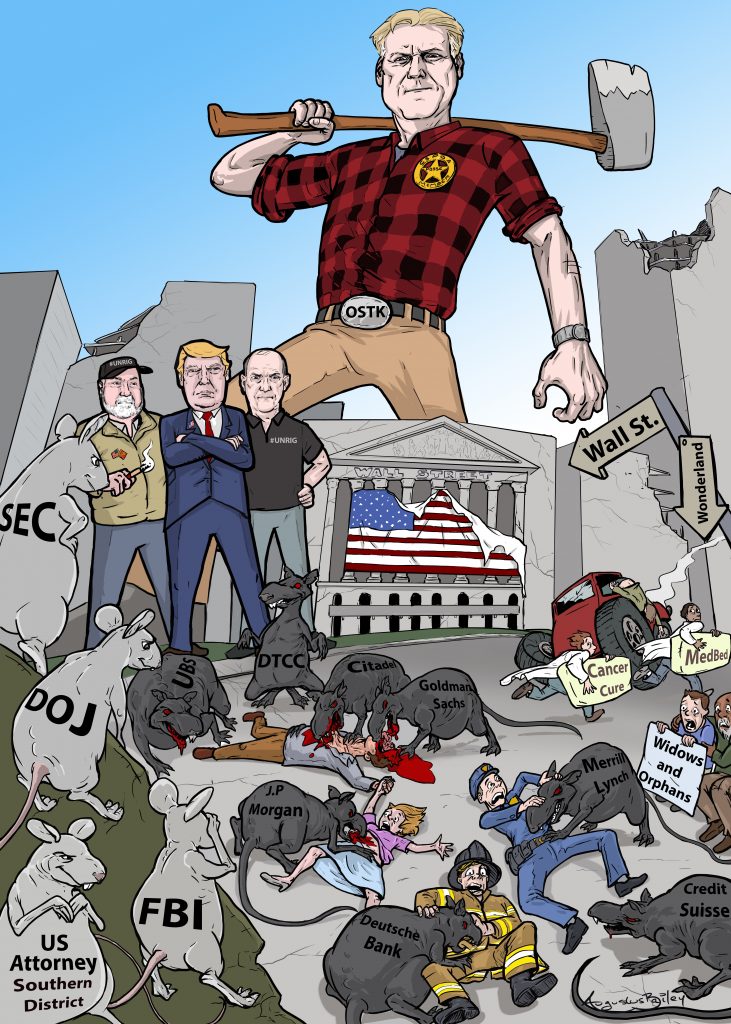

EIN TOON 15: Patrick Byrne Takes on Wall Street

Graphic

Donate to the Cartoonist Directly: http://paypal.me/baileytoons

Tweet: Anders Melin on Congress & Robinhood & Citadel

TweetAnders Melin

@MelinAnders

Robinhood just got asked by two lawmakers to send over its payment-for-order-flow contracts with market makers such as Citadel.

The letter came from @RepCindyAxne and @RepBillFoster

Robert Steele

@OSSRobertSteele

@Jim_Jordan @RepCindyAxne @RepBillFoster all market makers cheat and both Senate and House committees are complicit in http://wall-street-crime.org shall we dance? The tag cloud of names grows daily.

Article: The GameStop Mess Exposes the Naked Short Selling Scam

Article - Media, PublicationsThe GameStop Mess Exposes the Naked Short Selling Scam

LUCY KOMISAR, 25 February 2021

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

Short selling, effectively betting that a stock will go down, involves a trader selling shares he does not own, hoping to buy them back at a lower price to make money on the spread. The trader is supposed to locate (or have a “reasonable belief” he can locate) or borrow the shares in brokerage accounts, and then transfer them to the buyer within two days. This accounts for as much as 50 percent of daily trading. Continue reading “Article: The GameStop Mess Exposes the Naked Short Selling Scam”

Article: Former SEC Chair Jay Clayton Will Become Apollo’s “Lead Independent Director”

WebFormer SEC Chair Jay Clayton Will Become Apollo’s “Lead Independent Director”

As if the establishment ignoring Janet Yellen’s clear ties to Citadel wasn’t enough to help you lose faith in the Wall Street swamp this year, we’ll do you one better. Former SEC Chair Jay Clayton has officially been hired by Apollo Global Management, just weeks after stepping down as SEC chair.

Apollo is, of course, the firm whose CEO, Leon Black, was found to have paid child sex offender Jeffrey Epstein $158 million.

Article: U.S. securities regulator suspends trading in three more ‘meme stocks’

Article - Media, PublicationsU.S. securities regulator suspends trading in three more ‘meme stocks’

Chris Prentice, 19 February 2021

WASHINGTON (Reuters) – The U.S. Securities and Exchange Commission on Friday suspended trading in more securities that have seen jumps in both prices and trading volumes since late January amid social media interest.

The SEC temporarily suspended trading of Marathon Group Corp, Affinity Beverage Group Inc, and Sylios Corp beginning on Friday and ending on March 4, the SEC said in statements published on its website. Continue reading “Article: U.S. securities regulator suspends trading in three more ‘meme stocks’”