Sheelah Kolhatkar, a former hedge fund analyst, is a staff writer at The New Yorker, where she writes about Wall Street, Silicon Valley, and politics, among other things. She has appeared as a speaker and commentator on business and economics issues at conferences and on broadcast outlets including CNBC, Bloomberg Television, Charlie Rose, PBS NewsHour, WNYC and NPR. Her writing has also appeared in Bloomberg Businessweek, New York, The Atlantic, The New York Times and other publications. She lives in New York City.

Sheelah Kolhatkar, a former hedge fund analyst, is a staff writer at The New Yorker, where she writes about Wall Street, Silicon Valley, and politics, among other things. She has appeared as a speaker and commentator on business and economics issues at conferences and on broadcast outlets including CNBC, Bloomberg Television, Charlie Rose, PBS NewsHour, WNYC and NPR. Her writing has also appeared in Bloomberg Businessweek, New York, The Atlantic, The New York Times and other publications. She lives in New York City.

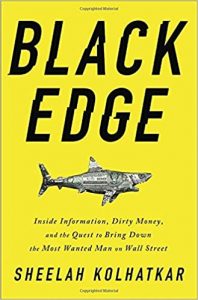

She is the author of Black Edge: Inside Information, Dirty Money, and the Quest to Bring Down the Most Wanted Man on Wall Street.

Before becoming a journalist, she spent several years as a risk arbitrage analyst at two hedge funds in New York City. Sheelah holds an undergraduate degree from New York University and a M.A. from Stanford University. She lives in New York.