Pam Martens and Russ Martens, 23 July 2021

The unthinkable is happening with alarming regularity at the Frankenbank JPMorgan Chase. Over the last seven years, with Chairman and CEO Jamie Dimon at the helm, JPMorgan Chase has managed to do what no other federally-insured American bank has managed to do in the history of banking in the United States. The bank has admitted to five separate felony countsbrought by the U.S. Department of Justice, while regulators took no action to remove the Board of Directors or Jamie Dimon.

The unthinkable is happening with alarming regularity at the Frankenbank JPMorgan Chase. Over the last seven years, with Chairman and CEO Jamie Dimon at the helm, JPMorgan Chase has managed to do what no other federally-insured American bank has managed to do in the history of banking in the United States. The bank has admitted to five separate felony countsbrought by the U.S. Department of Justice, while regulators took no action to remove the Board of Directors or Jamie Dimon.

Now, once again, the outrageous hubris of this Board is on display. Just last fall the bank forked over $920 million of shareholders moneyto settle its fourth and fifth felony counts brought by the Department of Justice, this time for rigging the precious metals and U.S. Treasury market. Now, in the dog days of summer, rarely a time for bonuses on Wall Street, the Jrgan Chase board announced on July 20 that it is giving Dimon 1.5 million stock options which, according to a specialist cited at Bloomberg News, have a total value of $50 million on paper.

Affirm CEO Max Levchin discusses Apple’s announcement that they will collaborate with Goldman Sachs and start allowing customers to buy products using Apple Pay and pay off the purchases in installments, which will be in direct competition with his company. He speaks with Emily Chang on “Bloomberg Technology.”

Affirm CEO Max Levchin discusses Apple’s announcement that they will collaborate with Goldman Sachs and start allowing customers to buy products using Apple Pay and pay off the purchases in installments, which will be in direct competition with his company. He speaks with Emily Chang on “Bloomberg Technology.” The Texas Freeze was one of those unprecedented events that have the potential to upend the way things are done, in this case, in power utilities. The crisis, which saw natural gas prices rise from two-figure to four-figure numbers, prompted an in-depth look at Texas’s grid and electricity market, and measures to ensure it never happened again. Now, gas prices are on the rise again, and many of the February bills have not been paid yet. Disgruntlement is building up across the swathe of states affected by the freezing cold spell in February. In California, people are being warned their bills are going to rise higher.

The Texas Freeze was one of those unprecedented events that have the potential to upend the way things are done, in this case, in power utilities. The crisis, which saw natural gas prices rise from two-figure to four-figure numbers, prompted an in-depth look at Texas’s grid and electricity market, and measures to ensure it never happened again. Now, gas prices are on the rise again, and many of the February bills have not been paid yet. Disgruntlement is building up across the swathe of states affected by the freezing cold spell in February. In California, people are being warned their bills are going to rise higher. How the GameStop Hustle Worked

How the GameStop Hustle Worked China’s government has suffered a setback in its campaign against inflation as consumer prices accelerated last month despite pressure on producers to keep commodity costs down.

China’s government has suffered a setback in its campaign against inflation as consumer prices accelerated last month despite pressure on producers to keep commodity costs down. Let the Apes Have Wall Street

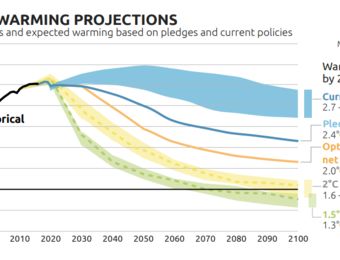

Let the Apes Have Wall Street The Group of Seven nations targeted environmental crimes with a move to push companies into disclosing the impact they have on the climate.

The Group of Seven nations targeted environmental crimes with a move to push companies into disclosing the impact they have on the climate. In a letter to his investors this April, David Einhorn, founder of the hedge fund Greenlight Capital and a well-known short-seller, complained that the stock market was in a state of “quasi anarchy.” As one piece of evidence, he pointed to Elon Musk, whose commentary on Twitter, Einhorn said, amounted to market manipulation. “The laws don’t apply to him, and he can do whatever he wants,” Einhorn noted. As another example, he cited a restaurant in rural New Jersey called Your Hometown Deli, which despite making $13,976 in revenue last year had somehow attained a value of $113 million on the stock market.

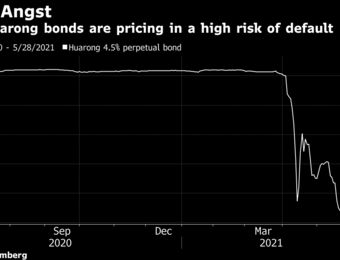

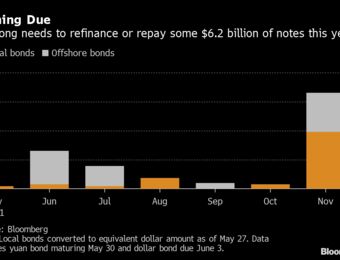

In a letter to his investors this April, David Einhorn, founder of the hedge fund Greenlight Capital and a well-known short-seller, complained that the stock market was in a state of “quasi anarchy.” As one piece of evidence, he pointed to Elon Musk, whose commentary on Twitter, Einhorn said, amounted to market manipulation. “The laws don’t apply to him, and he can do whatever he wants,” Einhorn noted. As another example, he cited a restaurant in rural New Jersey called Your Hometown Deli, which despite making $13,976 in revenue last year had somehow attained a value of $113 million on the stock market.  China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter.

China’s finance ministry is considering a proposal to transfer its shares in China Huarong Asset Management Co. and three other bad-debt managers to a new holding company modeled after the one that owns the government’s stakes in state-run banks, according to a person familiar with the matter. China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity.

China Huarong Asset Management Co. made the biggest bond payment since confidence in its financial health began plunging two months ago, adding to signs that the company still has access to near-term liquidity. Elon Musk is taking his Boring Company circus on the road to Adelanto, California.

Elon Musk is taking his Boring Company circus on the road to Adelanto, California.  Apparently, firing half a dozen executives including its head of risk management (Lara Warner, also one of the most high-ranking women in the global financial services industry) hasn’t done enough to quiet shareholders’ demands for change atop Credit Suisse, the Swiss banking giant that reported a $4.7 billion loss from the collapse of Archegos Capital Management, with billions of losses likely to follow from the collapse for Greensill.

Apparently, firing half a dozen executives including its head of risk management (Lara Warner, also one of the most high-ranking women in the global financial services industry) hasn’t done enough to quiet shareholders’ demands for change atop Credit Suisse, the Swiss banking giant that reported a $4.7 billion loss from the collapse of Archegos Capital Management, with billions of losses likely to follow from the collapse for Greensill.