BILL BINNEY WITH MICHELLE HOLIDAY: WE HAVE IT ALL

Continue reading “Bill Binney & Robert Steele: We Have It All – Make The Deal Or Else . . .”

BILL BINNEY WITH MICHELLE HOLIDAY: WE HAVE IT ALL

Continue reading “Bill Binney & Robert Steele: We Have It All – Make The Deal Or Else . . .”

Last week was a crazy week for the markets, to say the least. The retail bros were back to troll Wall Street. But this time, their victims were some of the biggest names on Wall Street. Hedge Funders like Ken Griffin, Steve Cohen, and Point72 (Steven Cohen’s fund) alumnus Gabe Plotkin.

Then Chamath Palihapitiya joined the GameStop parade and promised to donate all of his profits to David Portnoy’s Barstool Small Business Fund created to support America’s small businesses affected by the Pandemic.

LaSalle Vaughn is the Head of Global Communications Compliance at Robinhood.

LaSalle Vaughn is the Head of Global Communications Compliance at Robinhood.

Kevin Wyatt is an Insurance & Business Risk Head at Robinhood based in Menlo Park, California.

Kevin Wyatt is an Insurance & Business Risk Head at Robinhood based in Menlo Park, California.

https://theorg.com/org/robinhood/org-chart/kevin-wyatt

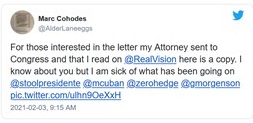

Comment: Mr. Cohodes, who is very much present in the tag cloud, seems to think that we have all forgotten his years of engagement in the ecology of naked short selling. His offering to brief Congress, which G. Robert Blakey considers a RICO organization enabling naked short selling, is laughable. We have it all, Mr. Cohodes. There is no place to run. Can you spell “discovery?”

Robert J. Shapiro | 21.02.03

The investors’ struggle over the video game retailer GameStop has been cast as a David versus Goliath story. Allegedly, this is the tale of scrappy, small online day traders buying shares of a beleaguered company to thwart a hedge fund scheme to take it down. Like GameStop’s stock, this narrative is mostly speculation because the facts about the buyers and sellers and their trades are hidden in the records of Robinhood, the new online trading platform, as well as Charles Schwab and other traditional broker-dealers. Only the SEC could demand to inspect those records.

Continue reading “Article: GameStop Isn’t a Popular Uprising”

Shah Husain Imam, 03 February 2021

GameStop Corp shares more than halved in value on Tuesday and silver prices retreated as the Reddit-driven trading frenzy that roiled stock and commodity markets appeared to fizzle, at least for now.

The videogame retailer’s shares, whose wild gyrations have made or lost billions of dollars for hedge funds and other investors in recent weeks, closed down 60 per cent at $90. They are now worth less than a fifth of their high of $483 last week, reports Reuters. Continue reading “Article: GameStop shares halve”

Heather Breslow is the Head of Research at Robinhood. As the Head of Research, Heather is responsible for building research as a strategic capability of Robinhood. Before joining Robinhood in 2017, Heather was a Senior User Experience Researcher at YouTube.

Heather Breslow is the Head of Research at Robinhood. As the Head of Research, Heather is responsible for building research as a strategic capability of Robinhood. Before joining Robinhood in 2017, Heather was a Senior User Experience Researcher at YouTube.

Baiju Bhatt is the co-founder of Robinhood, the fastest-growing brokerage in the world. In 2013, Bhatt co-founded Robinhood with Vlad Tenev, aiming to democratize the financial system. The company has millions of users across the country and is currently valued at $8.6 billion. Bhatt earned his B.S. in Physics and M.S. in Mathematics at Stanford University.

Baiju Bhatt is the co-founder of Robinhood, the fastest-growing brokerage in the world. In 2013, Bhatt co-founded Robinhood with Vlad Tenev, aiming to democratize the financial system. The company has millions of users across the country and is currently valued at $8.6 billion. Bhatt earned his B.S. in Physics and M.S. in Mathematics at Stanford University.

Vlad Tenev is the co-founder and CEO of Robinhood. A first-generation immigrant from Bulgaria, Tenev earned his B.S. in Mathematics at Stanford University before starting two finance companies in New York City, selling trading software to hedge funds. In 2013, Tenev and longtime friend Baiju Bhatt co-founded Robinhood, a zero-commission brokerage dedicated to democratizing the finance system. The company has millions of users across the country and is currently valued at $8.6 billion.

Vlad Tenev is the co-founder and CEO of Robinhood. A first-generation immigrant from Bulgaria, Tenev earned his B.S. in Mathematics at Stanford University before starting two finance companies in New York City, selling trading software to hedge funds. In 2013, Tenev and longtime friend Baiju Bhatt co-founded Robinhood, a zero-commission brokerage dedicated to democratizing the finance system. The company has millions of users across the country and is currently valued at $8.6 billion.

Robinhood | 21.02.03

Alert Reader:

Go figure… Robinhood buys superbowl ads after Gamestop fiasco in order to try to gain its reputation back. Naturally professional sports would be their next marketing scam. Seems like in the past few years when there is a major exposure, everyone goes crying to professional sports. People need to boycott these giants to.

Continue reading “Video: Robinhood is Buying a Super Bowl Ad after its GameStop Fiasco”

Ian Sherr | 21.02.03

What makes this roller coaster unusual is why the Reddit community is buying up GameStop shares. While some of them say they believe in GameStop’s future, others are attracted to the idea that the higher GameStop’s shares go, the more Wall Street’s bad bets will cost institutional investors money.

Bix Weir | 21.02.02

Simply Wall St, 03 February 2021

In this article we are going to estimate the intrinsic value of Americas Gold and Silver Corporation (TSE:USA) by projecting its future cash flows and then discounting them to today’s value. This will be done using the Discounted Cash Flow (DCF) model. Before you think you won’t be able to understand it, just read on! It’s actually much less complex than you’d imagine.

Remember though, that there are many ways to estimate a company’s value, and a DCF is just one method. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.

Continue reading “Article: Americas Gold and Silver Corporation (TSE:USA) Shares Could Be 33% Below Their Intrinsic Value Estimate”

The Lesson Of GameStop: Investing Is Not A Game

Taylor Tepper, 03 February 2021

In a matter of days, GameStop has gone from being a dying retail chain to the latest obsession of media and markets. Along the way, the GameStop saga has morphed into a lesson in American populism, an allegory of Main Street taking a pound of flesh from Wall Street.

In a matter of days, GameStop has gone from being a dying retail chain to the latest obsession of media and markets. Along the way, the GameStop saga has morphed into a lesson in American populism, an allegory of Main Street taking a pound of flesh from Wall Street.

To recap: Video game retailer GameStop was struggling to survive even before the pandemic struck, and Covid-19 only worsened its ailing condition. Hedge funds on Wall Street smelled blood and took out massive bets that the company’s shares would drop, maybe even to zero—so-called short trades or short positions. Continue reading “Article: The Lesson Of GameStop: Investing Is Not A Game”