Hedge Fund Manager: Daniel S. Loeb

People Daniel Seth Loeb born December 18, 1961) is an American investor, hedge fund manager, and philanthropist. He is the founder and chief executive of Third Point, a New York-based hedge fund focused on event-driven, value-oriented investing with $10.8 billion in assets under management, as of March 2016.

Daniel Seth Loeb born December 18, 1961) is an American investor, hedge fund manager, and philanthropist. He is the founder and chief executive of Third Point, a New York-based hedge fund focused on event-driven, value-oriented investing with $10.8 billion in assets under management, as of March 2016.

New York magazine noted that Loeb’s “preferred strategy” is to buy into troubled companies, replace inefficient management, and return the companies to profitability, which “is the key to his success.” Loeb was described as “one of the most successful activists” in 2014. Continue reading “Hedge Fund Manager: Daniel S. Loeb”

Author: Michael Lewis

Uncategorized Michael Monroe Lewis (born October 15, 1960) is an American author and financial journalist. He has also been a contributing editor to Vanity Fair since 2009, writing mostly on business, finance, and economics. He is known for his non-fiction work, particularly his coverage of financial crises and behavioral finance.

Michael Monroe Lewis (born October 15, 1960) is an American author and financial journalist. He has also been a contributing editor to Vanity Fair since 2009, writing mostly on business, finance, and economics. He is known for his non-fiction work, particularly his coverage of financial crises and behavioral finance.

Lewis was born in New Orleans and attended Princeton University where he graduated with a degree in art history. After attending the London School of Economics, he began a career on Wall Street during the 1980s as a bond salesman at Salomon Brothers. The experience prompted him to write his first book, Liar’s Poker (1989). Continue reading “Author: Michael Lewis”

Journalist: Matt Levine

Journalist, People Matt Levine is a columnist for Bloomberg News covering finance and business. Levine has previously been a lawyer, investment banker, law clerk, and has written for a number of newspapers and financial sites. His newsletter, Money Stuff, is one of the most popular on Wall Street with over 150k subscribers.

Matt Levine is a columnist for Bloomberg News covering finance and business. Levine has previously been a lawyer, investment banker, law clerk, and has written for a number of newspapers and financial sites. His newsletter, Money Stuff, is one of the most popular on Wall Street with over 150k subscribers.

After graduating Levine was a mergers and acquisitions lawyer for the law firm Wachtell, Lipton, Rosen & Katz. He later went on to become an investment banker for Goldman Sachs, where he structured and marketed corporate equity derivatives for four years. Levine was also a high school Latin teacher and a law clerk for the U.S. Court of Appeals for the 3rd Circuit.[ Continue reading “Journalist: Matt Levine”

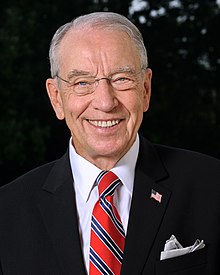

Senator: Chuck Grassley

People, Senator Charles Ernest Grassley (born September 17, 1933) is an American politician serving as the president pro tempore emeritus of the United States Senate, and the senior United States senator from Iowa. He is in his seventh term in the Senate, having first been elected in 1980.

Charles Ernest Grassley (born September 17, 1933) is an American politician serving as the president pro tempore emeritus of the United States Senate, and the senior United States senator from Iowa. He is in his seventh term in the Senate, having first been elected in 1980.

A member of the Republican Party, Grassley served eight terms in the Iowa House of Representatives (1959–1975) and three terms in the United States House of Representatives (1975–1981). He has served three stints as Senate Finance Committee chairman during periods of Republican Senate majority.[ Continue reading “Senator: Chuck Grassley”

Advisor: Michael Flynn

Advisor, People Michael Thomas Flynn (born December 24, 1958) is a retired United States Army lieutenant general and conspiracy theorist who was the 25th United States National Security Advisor for the first 22 days of the Trump administration until his resignation. Flynn’s military career included a key role in shaping U.S. counterterrorism strategy and dismantling insurgent networks in the Afghanistan and Iraq Wars, and he was given numerous combat arms, conventional, and special operations senior intelligence assignments.

Michael Thomas Flynn (born December 24, 1958) is a retired United States Army lieutenant general and conspiracy theorist who was the 25th United States National Security Advisor for the first 22 days of the Trump administration until his resignation. Flynn’s military career included a key role in shaping U.S. counterterrorism strategy and dismantling insurgent networks in the Afghanistan and Iraq Wars, and he was given numerous combat arms, conventional, and special operations senior intelligence assignments.

e became the 18th Director of the Defense Intelligence Agency in July 2012 until his forced retirement from the military in August 2014. During his tenure he gave a lecture on leadership at the Moscow headquarters of the Russian military intelligence directorate GRU, the first American official to be admitted entry to the headquarters. Continue reading “Advisor: Michael Flynn”

Director’s Cut: Michelle Holiday with Harley Schlanger

VideoDirector’s Cut: Michelle Holiday with Charles Hugh Smith

VideoDirector’s cut: Michelle Holiday with Dave Kranzler

VideoArticle: Robinhood Is In Talks With FINRA To Settle March 2020 Probe Into Options And Outages

Article - Media, PublicationsRobinhood Is In Talks With FINRA To Settle March 2020 Probe Into Options And Outages

Tyler Durden, Zero Hedge, 26 February 2021

At the center of the investigation was how Robinhood displays cash balances and buying power to its customers and the process that it undertakes to vet and approve traders for options trading. Continue reading “Article: Robinhood Is In Talks With FINRA To Settle March 2020 Probe Into Options And Outages”

Article: Rule of Law Collapsed in USA – Martin Armstrong

Article - Media, Publications Rule of Law Collapsed in USA – Martin Armstrong

Rule of Law Collapsed in USA – Martin Armstrong

Greg Hunter, 26 February 2021

Legendary financial and geopolitical cycle analyst Martin Armstrong says now that the stolen election is over, get ready for lawlessness to reign. We start with the Supreme Court that refused to hear the Trump case on Pennsylvania voting fraud. There are three more 2020 Election voter fraud cases pending at the nation’s highest court. Armstrong says, “I don’t think they are going to take any of them. Look, the rule of law has absolutely collapsed in the United States. It’s just a joke at this point. . . . You swear an oath to uphold the Constitution. It’s not whenever you feel like it. . . . This is not only a denial of due process but the civil rights of everybody in the country. They effectively said Pennsylvania changed the rules against the (state) legislature in the middle of an election, and we are not going to hear the case. So, they are effectively saying politicians can change the rules of an election at any time, and it doesn’t have to be constitutional. Refusing to take this case is a disaster because next election they can choose to do the same thing at any time.” Continue reading “Article: Rule of Law Collapsed in USA – Martin Armstrong”

Article: SEC Suspends Trading In 15 Companies Due To “Questionable Trading And Social Media Activity”

Article - Media, PublicationsSEC Suspends Trading In 15 Companies Due To “Questionable Trading And Social Media Activity”

TYLER DURDEN, 26 February 2021

Two weeks ago we said that the regulatory crackdown against WallStreetBets had begun when the SEC suspended trading in pennystock Spectra Science (SCIE). Well, today we got the clearest confirmation yet that the SEC will do everything in its power to make sure that are no more Melvin Capitals and will seek to put a resolute end to the reddit bull raids when it announced that it “suspended trading in the securities of 15 companies because of questionable trading and social media activity.”

Today’s order states that trading is being suspended because of “questions about recent increased activity and volatility in the trading of these issuers, as well as the influence of certain social media accounts on that trading activity.” In enforcing the suspension, the SEC referred to federal securities laws, according to which “the SEC can suspend trading in a stock for 10 days and generally prohibit a broker-dealer from soliciting investors to buy or sell the stock again until certain reporting requirements are met.”

Continue reading “Article: SEC Suspends Trading In 15 Companies Due To “Questionable Trading And Social Media Activity””

Article: War Of Words: Robinhood Responds To “Disappointing, Elitist” Charlie Munger Bemoaning “Speculative Orgies”

Article - Media, PublicationsTYLER DURDEN, 26 February 2021

Investing legend Charlie Munger didn’t pull any punches when talking about Robinhood and the gamification that is driving new investments in the stock market over the last few years. In an exclusive interview with the Wall Street Journal, the 97 year old Vice Chairman of Berkshire Hathaway sounded off about the “wild speculation” created by the budding brokerage.

“I hate this luring of people into engaging in speculative orgies. [Robinhood] may call it investing, but that’s all bullshit,” Munger said on Thursday.

“It’s really just wild speculation, like casino gambling or racetrack betting. There’s a long history of destructive capitalism, these trading orgies whooped up by the people who profit from them.”

Continue reading “Article: War Of Words: Robinhood Responds To “Disappointing, Elitist” Charlie Munger Bemoaning “Speculative Orgies””

Entrepreneur: Mark Cuban

entrepreneur, People Gary J. Aguirre (born July 31, 1958)[3] is an American billionaire entrepreneur, television personality, media proprietor, and investor, whose net worth is an estimated $4.3 billion, according to Forbes and ranked #177 on the 2020 Forbes 400 list..

Gary J. Aguirre (born July 31, 1958)[3] is an American billionaire entrepreneur, television personality, media proprietor, and investor, whose net worth is an estimated $4.3 billion, according to Forbes and ranked #177 on the 2020 Forbes 400 list..

He is a named inventor of two utility patents and two ornamental designs associated with two failed ventures. He is the owner of the National Basketball Association’s (NBA) Dallas Mavericks, co-owner of 2929 Entertainment, and chairman of AXS TV. Continue reading “Entrepreneur: Mark Cuban”

Investor: Bill Ackman

Investor, People William Albert Ackman (born May 11, 1966) is an American investor and hedge fund manager. He is the founder and CEO of Pershing Square Capital Management, a hedge fund management company. Ackman has been considered an engaged activist investor, which is long-term in nature..

William Albert Ackman (born May 11, 1966) is an American investor and hedge fund manager. He is the founder and CEO of Pershing Square Capital Management, a hedge fund management company. Ackman has been considered an engaged activist investor, which is long-term in nature..

Ackman was raised in Chappaqua, New York, the son of Ronnie I. (née Posner) and Lawrence David Ackman, the chairman of a New York real estate financing firm, Ackman-Ziff Real Estate Group. Continue reading “Investor: Bill Ackman”