This is stunning. Leon Black leaving Apollo entirely.

Just two months ago, this plan was to remain as chairman. Now that job goes to Jay Clayton.

Don't think there has ever been a bigger private equity "retirement."

— Dan Primack (@danprimack) March 22, 2021

Article: Meme stocks loom large in the CSA’s short-selling review

Article - Media, PublicationsMeme stocks loom large in the CSA’s short-selling review

James Langton, 22 March 2021

When a group of retail traders used Reddit to gleefully gang up on a handful of hedge funds in January, giving birth to the concept of “meme” stocks, they cranked up an already simmering debate about proper public discourse related to trading. In Canada, a consultation regarding activist short-sellers is the focus of that debate.

Late last year, the Canadian Securities Administrators (CSA) published a consultation paper on the role and regulation of activist short-sellers — traders who publicly air their negative views on the stocks they’re shorting.

Defenders of the practice maintain that vocal short-sellers are the only thing standing between unrelenting upside hype and ordinary investors — i.e., their skepticism and scrutiny help expose corporate fraud and misconduct, aiding naive regulators and investors alike. Continue reading “Article: Meme stocks loom large in the CSA’s short-selling review”

Article: Credit Suisse Faces Additional Charges over FX Market Rigging

Article - Media, PublicationsCredit Suisse Faces Additional Charges over FX Market Rigging

Arnab Shome, 22 March 2021

The European Commission has slapped an extra antitrust charge sheet against Credit Suisse for its involvement in the manipulation of foreign exchange (forex) markets, according to a Bloomberg report.

The Swiss lender confirmed the fresh charges in addition to the earlier charges, which were introduced in July 2018 for sharing crucial market-related information in chatrooms. However, the bank denied all allegations against it.

Looking Forward to Meeting You at iFX EXPO Dubai May 2021 – Making It Happen!

“Credit Suisse continues to believe that it did not engage in any systemic conduct in the FX markets which violated the European Union’s competition rules, and is contesting the EC’s case,” the bank said in a statement.

The EU regulator’s original allegations named several major banks for their part in manipulating the currency benchmarks. Though most of the lenders settled with the regulator, Credit Suisse remains adamant pushing its innocence.

Article: Hargreaves Lansdown faces legal action over Woodford fund

Article - Media, PublicationsHargreaves Lansdown faces legal action over Woodford fund

Pedro Gonçalves, 22 March 2021

RGL Management has formally launched legal action against Hargreaves Lansdown, which continued to recommend Woodford Equity Income to its clients right up until its suspension in June 2019, even though its analysts raised concerns in 2017.

RGL Management has formally launched legal action against Hargreaves Lansdown, which continued to recommend Woodford Equity Income to its clients right up until its suspension in June 2019, even though its analysts raised concerns in 2017.

RGL Management has taken legal action against both Hargreaves Lansdown Asset Management and Link Fund Solutions, the fund’s authorised corporate director, as it was first reported by This Is Money and The Times.

The claims will centre around losses sustained directly as a result of the collapse of WEIF and also for “loss of opportunity” losses, suffered through missing out on alternative investments that, in contrast to WEIF, would have generated positive returns. Continue reading “Article: Hargreaves Lansdown faces legal action over Woodford fund”

Article: Farmmi Prices $7.4 Million Underwritten Public Offering of Ordinary Shares

Article - Media, PublicationsFarmmi Prices $7.4 Million Underwritten Public Offering of Ordinary Shares

PRNewswire, 22 March 2021

Farmmi, Inc. (“Farmmi” or the “Company”) (NASDAQ: FAMI), an agriculture products supplier in China, today announced the pricing of an underwritten public offering of 6,469,467 ordinary shares of the Company, at a price to the public of $1.15 per share. The closing of the offering is expected to occur on March 24, 2021, subject to customary closing conditions. In addition, the Company has granted the underwriter an option to purchase an additional 15 percent of the ordinary shares offered in the public offering solely to cover over-allotments, if any, exercisable for 25 days, after the closing of this offering, which would bring total gross proceeds to approximately $8.6 million. The Company intends to use the net proceeds from this offering for general corporate and working capital needs.

Article: COMEXposed: How The Hateful-8 Kill Free Market Price Discovery

Article - Media, PublicationsCOMEXposed: How The Hateful-8 Kill Free Market Price Discovery

TYLER DURDEN, 22 March 2021

We certainly live in interesting times. Yet be you bear or bull, left or right, optimist, cynic or pessimist, one would be hard pressed to pretend that anything is, well, normal.

Many are questioning why a virus with a death rate of less than .4% has shut down the global economy for a year and counting.

Despite extremely legitimate moments of silence for those who died with (or of) COVID, others are questioning policy makers who ignored protecting the most at risk profiles while remaining largely silent for the self-inflicted death for the rest of Main Street economies shut-down across the world. Continue reading “Article: COMEXposed: How The Hateful-8 Kill Free Market Price Discovery”

Article: Form 424B4 American Acquisition Opportunity Inc.

Article - Media, PublicationsForm 424B4 American Acquisition Opportunity Inc.

EDGAR AGENTS LLC, 22 March 2021

American Acquisition Opportunity Inc. is a newly organized blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, which we refer to as our initial business combination throughout this prospectus. We have not selected any specific business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target. While we may pursue an initial business combination target in any business or industry or geographic location, we intend to focus our search on land and resource holding companies. Continue reading “Article: Form 424B4 American Acquisition Opportunity Inc.”

Article: Crown Resorts: US private equity group Blackstone offers James Packer exit strategy

Article - Media, PublicationsCrown Resorts: US private equity group Blackstone offers James Packer exit strategy

Anne Davies, 22 March 2021

Billionaire James Packer has been offered a new exit strategy from Crown Resorts after the company received an unsolicited bid from private equity company Blackstone Group.

Billionaire James Packer has been offered a new exit strategy from Crown Resorts after the company received an unsolicited bid from private equity company Blackstone Group.

Blackstone, which already has a 10% holding in the casino giant, has offered to acquire all of the shares in Crown through a scheme of arrangement.

It is offering $11.85 a share, representing a 19% premium to the volume-weighted average price of Crown shares since the release of its first half results for the financial year 2021. Continue reading “Article: Crown Resorts: US private equity group Blackstone offers James Packer exit strategy”

Article: Blackstone rolls the dice with $6.2 billion move on Australia’s Crown Resorts

Article - Media, PublicationsBlackstone rolls the dice with $6.2 billion move on Australia’s Crown Resorts

Byron Kaye, Rashmi Ashok, 22 March 2021

Crown shares leapt more than 20% after it disclosed the informal offer on Monday, passing Blackstone’s indicative price of A$11.85 as investors wagered a bigger payment could be in the offing from the world’s No. 1 private equity firm or another suitor.

“It’s nice to get a bid, and now it’s about price discovery,” said John Ayoub, a portfolio manager at Wilson Asset Management, which has Crown shares.

“These stocks are trading at trough earnings and I wouldn’t be surprised to see further activity in the sector.” Continue reading “Article: Blackstone rolls the dice with $6.2 billion move on Australia’s Crown Resorts”

Article: Credit Suisse Gets Extra EU Charge Sheet in FX Rigging Probe

Article - Media, PublicationsCredit Suisse Gets Extra EU Charge Sheet in FX Rigging Probe

Aoife White and Hugo Miller, 22 March 2021

The EU and the Zurich-based bank confirmed the so-called supplementary statement of objections, which adds to earlier charges sent in July 2018 based on information swapped in currency traders’ chatrooms. Credit Suisse denies wrongdoing and is fighting allegations that other banks have agreed to settle.

“Credit Suisse continues to believe that it did not engage in any systemic conduct in the FX markets which violated the European Union’s competition rules,” the bank said in a statement.

The commission said it sent the objections as it “continues investigating past conduct in the forex spot trading market.” It declined to provide further details while the case is ongoing.

EU regulators are still investigating Credit Suisse and potential collusion with other banks, years after other authorities meted out billions of dollars in fines in similar probes. The EU’s probe dates back to 2013 and follows a Bloomberg report that uncovered traders’ manipulation of benchmark foreign-exchange rates. A first set of banks, including Citigroup Inc. and JPMorgan Chase & Co., agreed to pay EU penalties of more than $1 billion in 2019.

Regulators pushed on with a parallel probe into similar allegations involving Credit Suisse and other banks that aren’t challenging the EU. Such a “hybrid cartel” means officials need to make legal findings against all participants in a cartel at the same time — even if some are prepared to settle in return for a lower fine and shorter process.

Credit Suisse also challenged a 2018 information request in a probe by Switzerland’s Competition Commission into possible currency manipulation, the only bank to do so. The lender was ordered to hand over data that year after it lost a court ruling in which it had argued that doing so would violate a rule preventing self-incrimination.

Article: Bay Area oil company executive charged with market manipulation

Article - Media, PublicationsBay Area oil company executive charged with market manipulation

NATE GARTRELL, 22 March 2021

SAN FRANCISCO — Federal prosecutors in the Bay Area have charged a local resident with conspiracy to manipulate the oil market, a crime that prosecutors say was committed while he was a vice president at an oil company.

Emilio Collado, aka Emilio Heredia, was charged earlier this month with a single count of conspiracy. The charging records allege that since 1998, Collado worked at two oil companies, one of which bought out the other one in 2014. The companies are referred to in court records not by their names but as “Company A” and “Company B.”

The charging records allege that Collado and unnamed co-conspirators deliberately misled price assessors toward oil prices “that did not reflect legitimate forces of supply and demand.” Collado allegedly manipulated the prices depending on his company’s needs; when they were selling, the manipulated price went high, and when they were buying, it went low, prosecutors allege.

For instance, on Aug. 24, 2016, Collado allegedly shifted the price per metric ton of oil down by roughly $40, “resulting in an unlawful gain of hundreds of thousands of dollars to Company B” on that day alone, the charging records say.

Collado is set to appear in court Wednesday afternoon before U.S. District Judge Charles Breyer for a change of plea hearing. Generally, change of plea hearings are set when a defendant has agreed to plead guilty or no contest to a charge, though no plea deals have been announced in Collado’s case.

If he’s convicted, Collado faces a maximum of five years in federal prison and a $250,000 fine, court records show

Article: Creepy Former DOJ Prosecutor, Glenn Kirschner, Connected to the Seth Rich Case, Now Wants “Every Business In America” to Pledge that the 2020 Election Was “Accurate”

Article - Media, PublicationsJoe Hoft, Gateway Pundit, 22 March 2021

A former federal prosecutor, Glenn Kirschner, has launched a campaign to force “every business in America” to take a pledge that states, in part, that “The 2020 presidential election was free and fair, and produced accurate, reliable results.”

A former federal prosecutor, Glenn Kirschner, has launched a campaign to force “every business in America” to take a pledge that states, in part, that “The 2020 presidential election was free and fair, and produced accurate, reliable results.”

Any American business refusing to take this pledge, regardless of their own personal beliefs, will presumably be subjected to the cancel mob.

Article: SNB Threw $118 Billion at FX Campaign as U.S. Alarm Bells Rang

Article - Media, PublicationsSNB Threw $118 Billion at FX Campaign as U.S. Alarm Bells Rang

Catherine Bosley, 22 March 2021

The Swiss National Bank spent 110 billion francs ($118 billion) on interventions in 2020, evidence of heightened market activism that risks fueling more tension with the U.S.

The tally is the highest since 2012 and indicates officials purchased currency worth 9 billion francs in the fourth quarter, when the U.S. Treasury branded Switzerland a currency manipulator. Such eye-watering sums won’t escape the attention of President Joe Biden’s new administration in Washington, which doesn’t appear to be breaking with the stance of its predecessor.n Continue reading “Article: SNB Threw $118 Billion at FX Campaign as U.S. Alarm Bells Rang”

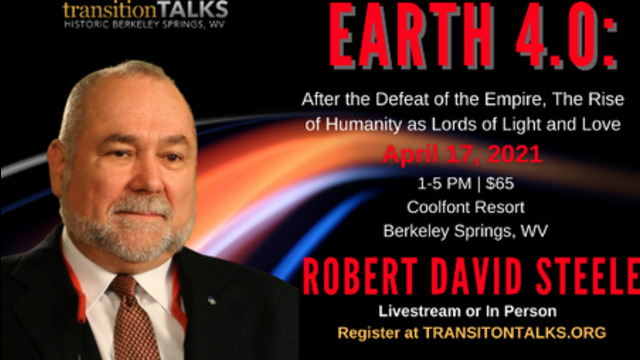

PROMO for 17 APR Earth 4.0 Manifesto and ARISE USA Resurrection Tour 17 May – 15 August 2021

VideoArticle: Ex-top aide to former Maltese PM charged with corruption

Article - Media, PublicationsEx-top aide to former Maltese PM charged with corruption

FRANCES D’EMILIO, Associated Press, 21 March 2021

ROME (AP) — A former top government aide in Malta who was investigated by a journalist later killed by a car bomb has been arraigned in a Maltese court on charges of money-laundering, fraud and corruption.

Keith Schembri, who was chief of staff to Prime Minister Joseph Muscat, entered a not-guilty plea to the charges, which stem from an investigation of alleged financial crimes going back years. Continue reading “Article: Ex-top aide to former Maltese PM charged with corruption”