Investment fraud reports 32% leap as criminals exploit covid-19

Mark Battersby, 26 March 2021

Investment scam reports surged by almost a third (32%) during 2020, with losses to these scams increasing 42% to £135.1m, according to a report by trade body UK Finance.

Investment scam reports surged by almost a third (32%) during 2020, with losses to these scams increasing 42% to £135.1m, according to a report by trade body UK Finance.

So called ‘authorised’ fraud losses increased 5% in 2020 to £479m as scammers ramped up online activity during the pandemic, its latest Fraud the Facts report stated. Unauthorised fraud losses dropped 5% as lockdown restrictions forced criminals to switch tactics, but were still very high at £784m, the latest Fraud the Facts report also revealed.

It cannot be right that online firms are effectively profiting from fraud, while society as a whole pays the price.”

Impersonation scam cases almost doubled to nearly 40,000 cases during the year.

The shocking figures show why tackling scam activity, particularly online, needs to be prioritised across Government, UK Finance argued in the report.

UK Finance is specifically calling for fraud to be included in the scope of the government’s Online Safety Bill to better protect consumers from these scams.

This would ensure that online platforms such as social media firms, search engines and dating websites take action to address vulnerabilities in their systems that are being exploited by criminals to commit fraud.

Katy Worobec, managing director of economic crime at UK Finance, said: “The banking industry has worked hard throughout the pandemic to protect customers from fraud and to go after the criminals behind it, with over £1.6 billion of fraud stopped in 2020.

Read Full Article

GameStop Takes $6 Billion Round Trip as Results Shrugged Off

GameStop Takes $6 Billion Round Trip as Results Shrugged Off Investment scam reports surged by almost a third (32%) during 2020, with losses to these scams increasing 42% to £135.1m, according to a report by trade body UK Finance.

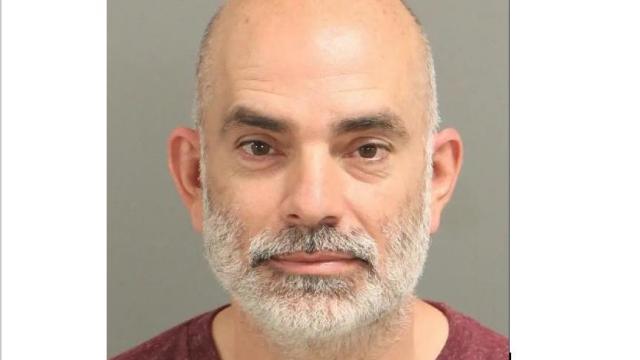

Investment scam reports surged by almost a third (32%) during 2020, with losses to these scams increasing 42% to £135.1m, according to a report by trade body UK Finance. Former Central Prison employee charged with embezzlement

Former Central Prison employee charged with embezzlement Tense YMCA board scrambles to replace CEO amid scandal

Tense YMCA board scrambles to replace CEO amid scandal

Triads, shopping bags full of cash, money laundering – if you’ve been following the inquiry into Crown Resorts run by New South Wales authorities, you might think there aren’t many allegations left to be hurled at the casino operator.

Triads, shopping bags full of cash, money laundering – if you’ve been following the inquiry into Crown Resorts run by New South Wales authorities, you might think there aren’t many allegations left to be hurled at the casino operator. A former governor of Tamaulipas, Mexico on Thursday pleaded guilty in a Texas court for taking over $3.5 million in bribes for government contracts, which he then laundered in the United States.

A former governor of Tamaulipas, Mexico on Thursday pleaded guilty in a Texas court for taking over $3.5 million in bribes for government contracts, which he then laundered in the United States.