Digital art frenzy raises questions for tax, law enforcement

Caitlin Reilly, 13 April 2021

The sale last month of a digital piece of art for a near-record price raises new questions about a technology that the financial sector sees as offering great opportunity.

The sale last month of a digital piece of art for a near-record price raises new questions about a technology that the financial sector sees as offering great opportunity.

Christie’s auctioned the artwork for $69 million and recorded the transaction on a public blockchain as a “non-fungible token,” or NFT. The digital collage incorporating 5,000 separate digital images was created by Beeple, whose real name is Mike Winkelmann, and can be seen on the auction house website. Continue reading “Article: Digital art frenzy raises questions for tax, law enforcement”

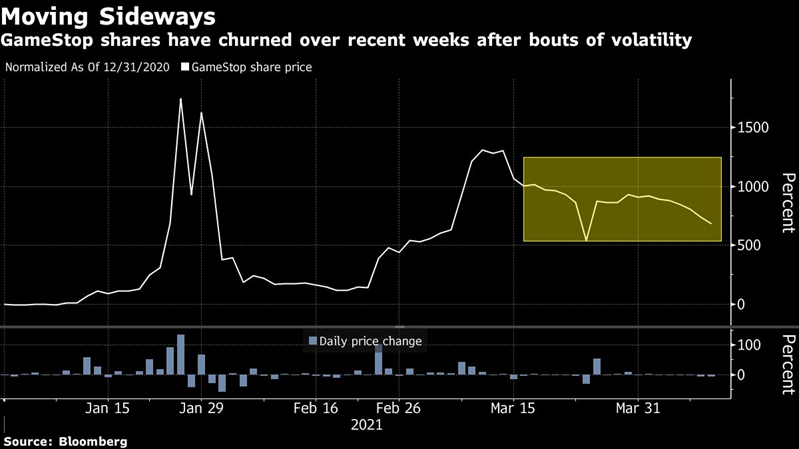

The silver squeeze first started making headlines more than two months ago, but the movement continues today, led by retail investors who continue to snap up physical metal.

The silver squeeze first started making headlines more than two months ago, but the movement continues today, led by retail investors who continue to snap up physical metal. The Reddit revolution in the US has drawn attention to the potential power that a growing force of retail investors can wield in stock markets when equipped by social media.

The Reddit revolution in the US has drawn attention to the potential power that a growing force of retail investors can wield in stock markets when equipped by social media. Even had she not raised more money than her rivals, Tali Farhadian Weinstein would be a formidable candidate in the nine-way race to become the Manhattan district attorney, perhaps the most high-profile local prosecutor’s office in the country.

Even had she not raised more money than her rivals, Tali Farhadian Weinstein would be a formidable candidate in the nine-way race to become the Manhattan district attorney, perhaps the most high-profile local prosecutor’s office in the country. For British PM Boris Johnson, the fallout from the collapse of Greensill has been akin to being gifted a golden saucer filled with excrement. At the time, BoJo apparently didn’t see anything wrong with facilitating the lobbying objectives of one of his predecessors, former PM David Cameron. But now that the British tabloid press has sicced the hounds on the PM, he has apparently realized it’s time for some damage control.

For British PM Boris Johnson, the fallout from the collapse of Greensill has been akin to being gifted a golden saucer filled with excrement. At the time, BoJo apparently didn’t see anything wrong with facilitating the lobbying objectives of one of his predecessors, former PM David Cameron. But now that the British tabloid press has sicced the hounds on the PM, he has apparently realized it’s time for some damage control. Cyberattacks are the greatest threat to the world’s financial system, Federal Reserve Chairman Jerome Powell said in an interview with CBS News this week. Speaking to “60 Minutes” on Sunday (April 11), Powell said the risks posed by cybercriminals are greater than the lending and liquidity troubles that triggered the 2008 financial crisis.

Cyberattacks are the greatest threat to the world’s financial system, Federal Reserve Chairman Jerome Powell said in an interview with CBS News this week. Speaking to “60 Minutes” on Sunday (April 11), Powell said the risks posed by cybercriminals are greater than the lending and liquidity troubles that triggered the 2008 financial crisis. News broke on Tuesday 16 March 2021 that the Financial Conduct Authority (the “FCA”) has started criminal proceedings against NatWest Bank (“NatWest”) for alleged offences relating to the adequacy of procedures in place to prevent money laundering.

News broke on Tuesday 16 March 2021 that the Financial Conduct Authority (the “FCA”) has started criminal proceedings against NatWest Bank (“NatWest”) for alleged offences relating to the adequacy of procedures in place to prevent money laundering.  The recession set to hit Europe after the pandemic will help organised crime penetrate legitimate business and recruit out-of-work specialists, the EU’s joint police agency, Europol, has warned.

The recession set to hit Europe after the pandemic will help organised crime penetrate legitimate business and recruit out-of-work specialists, the EU’s joint police agency, Europol, has warned. It is not often noted that the U.S. Treasury too injects the economy with cash flow, on top of various stimulus packages. With a precarious economic balance such as it is, excess liquidity may yet be another trigger to make inflation worse.

It is not often noted that the U.S. Treasury too injects the economy with cash flow, on top of various stimulus packages. With a precarious economic balance such as it is, excess liquidity may yet be another trigger to make inflation worse. The global system for financial crime is hugely expensive and largely ineffective.

The global system for financial crime is hugely expensive and largely ineffective. Shares in Alibaba surged on Monday after the e-commerce company said that a record $2.8bn (£2bn) fine handed down by Chinese regulators marked the end of an investigation into anti-competitive practices at the company.

Shares in Alibaba surged on Monday after the e-commerce company said that a record $2.8bn (£2bn) fine handed down by Chinese regulators marked the end of an investigation into anti-competitive practices at the company. No 10 is to a launch an independent investigation into former prime minister David Cameron’s lobbying for the now-collapsed Greensill and the role of the scandal-hit financier Lex Greensill in government.

No 10 is to a launch an independent investigation into former prime minister David Cameron’s lobbying for the now-collapsed Greensill and the role of the scandal-hit financier Lex Greensill in government. (Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst.

(Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst. As cases of fraud and money laundering rose during the pandemic last year, banks in the UK faced unforeseen challenges. In a new study by global analytics software provider FICO and independent research firm OMDIA, 79 per cent of respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention.

As cases of fraud and money laundering rose during the pandemic last year, banks in the UK faced unforeseen challenges. In a new study by global analytics software provider FICO and independent research firm OMDIA, 79 per cent of respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention.