Money laundering gang sentenced to over 100 years, have SR465 million confiscated from them

ARAB NEWS, 10 April 2021

RIYADH: A money laundering gang in Saudi Arabia has been sentenced to a total of 106 years in prison and issued a fine of SR1.08 million ($288,000).

RIYADH: A money laundering gang in Saudi Arabia has been sentenced to a total of 106 years in prison and issued a fine of SR1.08 million ($288,000).

Around SR5 million was seized from the gang and nearly SR2 million was confiscated from their bank accounts, Saudi Press Agency (SPA) reported.

Five citizens obtained seven commercial registers to import foodstuffs, opened bank accounts, and handed them over to 16 residents of Arab nationality with the aim of depositing illegal sums of money and transferring them abroad, the Public Prosecution said. Continue reading “Article: Money laundering gang sentenced to over 100 years, have SR465 million confiscated from them”

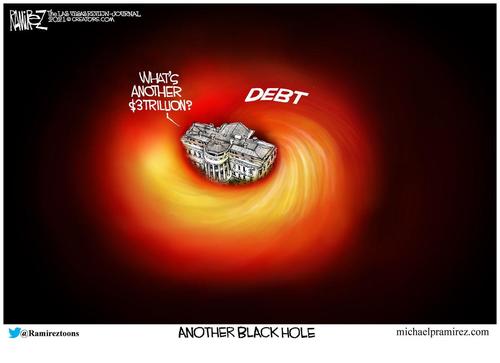

“We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

“We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover RCMP’s failure to earmark adequate resources against financial crime was compounded by government officials downplaying problem, inquiry hears.

RCMP’s failure to earmark adequate resources against financial crime was compounded by government officials downplaying problem, inquiry hears. Earlier, several financial media outlets reported that Credit Suisse was considering dramatically shrinking or selling off its prime brokerage unit, the hedge-fund-focused business that just lost $4.7 billion for the bank, obliterating 18 months of the bank’s average net profits.

Earlier, several financial media outlets reported that Credit Suisse was considering dramatically shrinking or selling off its prime brokerage unit, the hedge-fund-focused business that just lost $4.7 billion for the bank, obliterating 18 months of the bank’s average net profits. Back in December, Bloomberg published a sweeping expose that raised serious questions about the ESG investing craze sweeping the world. In the piece, Bloomberg detailed how the Nature Conservancy, the world’s biggest environmental group and a prominent seller of carbon offsets, had sold “worthless” credits to JPMorgan, Disney and BlackRock as the corporations sought to finance the protection of carbon-absorbing forest land to absolve them of their sins tied to fossil fuel usage.

Back in December, Bloomberg published a sweeping expose that raised serious questions about the ESG investing craze sweeping the world. In the piece, Bloomberg detailed how the Nature Conservancy, the world’s biggest environmental group and a prominent seller of carbon offsets, had sold “worthless” credits to JPMorgan, Disney and BlackRock as the corporations sought to finance the protection of carbon-absorbing forest land to absolve them of their sins tied to fossil fuel usage.

Bitcoin Shows Us That Not All Volatilities Are Created Equal

Bitcoin Shows Us That Not All Volatilities Are Created Equal