Hedge Fund CIO: “At Some Point, Through Inflation, War Or Confiscation, The System Will Restart”

TYLER DURDEN, 04 April 2021

Dusted off an anecdote from 2016 that explores the meaning of money. It is worth considering after a quarter in which the US dollar declined by more than 50% versus the dominant digital assets and the S&P 500 closed at an all-time high.

Dusted off an anecdote from 2016 that explores the meaning of money. It is worth considering after a quarter in which the US dollar declined by more than 50% versus the dominant digital assets and the S&P 500 closed at an all-time high.

“People work in order to convert their time into a unit of account,” he said.

“We call that money, and it’s an invention that allows us to store time.” Continue reading “Article: Hedge Fund CIO: “At Some Point, Through Inflation, War Or Confiscation, The System Will Restart””

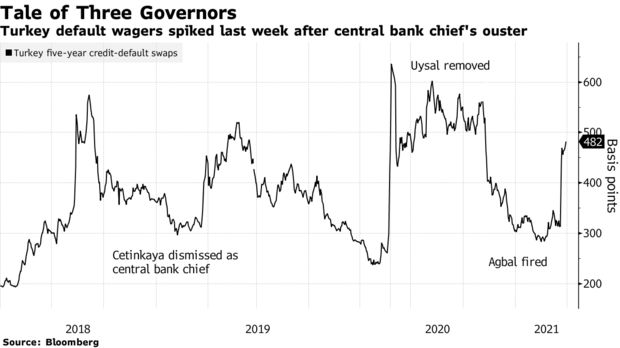

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations. Non-fungible tokens, or NFTs, are changing the way we think about art (and other collectibles), and in 2021, investors have started to take notice. As Decrypt writes, in the last year, NFTs have shot to the forefront of the crypto space. The cryptographically-unique tokens make it possible to create real-world scarcity for digital objects, and artists have seized on the opportunity presented by the technology.

Non-fungible tokens, or NFTs, are changing the way we think about art (and other collectibles), and in 2021, investors have started to take notice. As Decrypt writes, in the last year, NFTs have shot to the forefront of the crypto space. The cryptographically-unique tokens make it possible to create real-world scarcity for digital objects, and artists have seized on the opportunity presented by the technology. It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.”

It’s official: the Financial Times (citing an informal polling of anonymous bankers) has declared Deliveroo’s botched London offering the “worst IPO in London’s history.” Tal Prihar, a 37-year old Israeli living in Brazil, pleaded guilty Wednesday to operating illegal transactions on the darknet, including purchasing firearms, heroin, and other contraband.

Tal Prihar, a 37-year old Israeli living in Brazil, pleaded guilty Wednesday to operating illegal transactions on the darknet, including purchasing firearms, heroin, and other contraband.