Fraud allegations put Wirecard’s shy billionaire CEO Markus Braun in the spotlight

Straits Times (Singapore), 7 February 2019

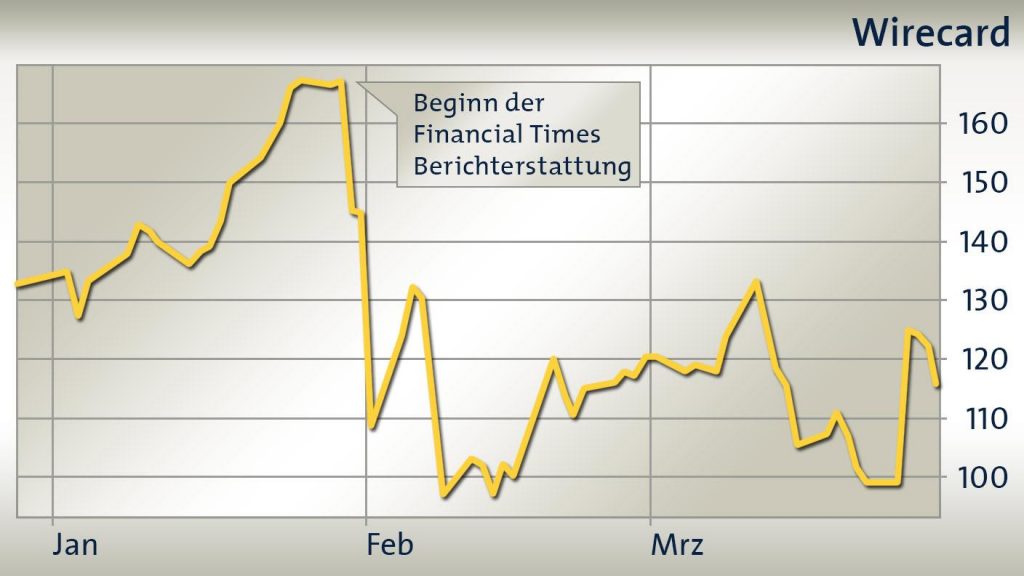

The 49-year-old Austrian computer scientist has spent more than a decade fighting off critics whose whispering campaign burst into the headlines again last week. A Financial Times report of suspect transactions in Asia sent the company’s shares plummeting.

Read full article.

Comment: WireCard appears to be under attack by naked short sellers aided by corrupt journalists who, if properly iinvestigated, would in all likehood be found to have received substantial financial incentives for trashing the company. Dan McCrum at Financial Times is the “journalist” under investigation by German authorities. The bad guys most times have a [hired] whistleblower that alerts police and regulatory authorities. Once they have information sometimes legit, other times not or the naked short sellers then blow the investigation all out of proportion. They set outto destroy the stock price with their band of criminal syndicates which includes the banks. They are often joined by law firms that maliciously file shareholder class lawsuit announcements to inspire fear in the marketplace — this is outright tortious interference and market manipulation.

Joshua Mitts writes and teaches on securities law and financial contracting. His recent projects study

Joshua Mitts writes and teaches on securities law and financial contracting. His recent projects study