ADMIN: New Tiny URL For This Site

UncategorizedSubject: Fahmi Quadir

Subject of Interest Founder & Chief Investment Officer at Safkhet Capital

Founder & Chief Investment Officer at Safkhet Capital

Born in the USA to Bangladeshi parents. Left PhD track to do research at Deallus Consulting. Recruited by Michael Krensavage to be a short seller.

Central to the short selling of both Valeant and Wirecard. Has enjoyed a massive media elevation with no inquries into her connections to naked short sellers who destroyed both Valeant and Wirecard.

Website: https://safkhetcapital.com/

Comment: There is a new layer of naked short sellers and bashers on Wall Street that is connected to India, Pakistan, and Bangldesh. They are the new gang in town.

Article: The woman shaking up Wall Street

Article - MediaThe woman shaking up Wall Street

Safi Thind, SquareMile, 7 February 2020

“Valeant had a certain reputation within the industry,” she says. “I knew it was already engaged in unethical, potentially fraudulent practice. Pharmaceuticals are a very established industry, when someone tries to disrupt it and post unusual numbers, there’s probably something wrong.”

Article: Short-sellers need more transparency, says former SEC commissioner

UncategorizedShort-sellers need more transparency, says former SEC commissioner

Ben Ashwell, Corporate Secretary, 26 June 2020

Former SEC commissioner Robert Jackson says he is troubled by the ‘increasing evidence of manipulation through short-selling’, and calls on his former colleagues at the SEC to consider a proposal for greater transparency for short-sellers.

Graphic: JPMorgan and Illegal Manipulation of Silver

GraphicCartoon sponsored by Robert David Steele https://robertdavidsteele.com

#UNRIG VIDEO (10:21) Former Spy & Strategist Suggests 6 Initiatives for POTUS to Win Mother of All Landslides

VideoRobert Steele: Decision Memorandum for the President – Achieving the Mother of All Landslides with Six Initiatives

MemorandumSHORT URL THIS POST:

https://tinyurl.com/POTUS-DMX4

25 June 2020

DECISION MEMORANDUM FOR THE PRESIDENT

From: Robert David Steele

Subject: Eradicating Crime on Wall Street, Recovering $100 Trillion, Passing Election Reform Legislation, Winning the Mother of All Landslides

#UNRIG Video (43:11) Wall Street Financial Crime — $100 Trillion Stolen from Main Street — Appeal to President Trump

VideoArticle: In Friday Night Drama, US Attorney Geoffrey Berman Refuses To ‘Step Down’ After Barr Asks For Resignation

UncategorizedGraphic: Deep State Court (Everything Is Connected) by Ben Garrison

Graphic

Credits, Text, and Links Below the Fold

Continue reading “Graphic: Deep State Court (Everything Is Connected) by Ben Garrison”

Article: Wirecard Shares Plunge 60% As Auditors ‘Unable To Verify’ $2 Billion In Cash On Its Books

Article - MediaWirecard Shares Plunge 60% As Auditors ‘Unable To Verify’ $2 Billion In Cash On Its Books

As we’ve previously noted, German regulators have bent over backwards to accommodate Wirecard, even going so far as to discourage short sellers from targeting the stock, and launching an investigation into an FT reporter who published the first allegations about fraud within the fast-growing digital payments company.

Comment: Insiders always have deep broad advance knowledge. Wirecard appears to have some combination of internal issues AND be under attack. The plunging prices are covering the shorts. NSA has all the data but is not doing “trade intelligence” or white collar crime counterintelligence.

Article: Robinhood Selling Order Flow to Enable Illegal Front Running by Wall Street

Article - MediaFrank Chaparro

TheBlockCrypto.com, 15 June 2020

- The new 606 filed at the end of May shows net payments made to Robinhood increased from $19.4 million in January to $45.4 million in March

- Payments for options orders made up the lion’s share of total payments

Graphic: The Real Looters – 1%, Congress, Wall Street

Graphic

Re-Published with Permission. Visit Ben at https://grrrgraphics.com/.

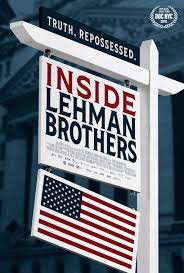

Video: Inside Lehman Brothers

Video Inside Lehman Brothers is the autopsy of a crime by those who tried to prevent it from within. As mortgage brokers for Lehman’s subsidiary BNC, Linda Weekes and her Californian colleagues were at the forefront of the subprime crisis. Matthew Lee, then headquartered in New York, was the first leader to have refused to validate the accounts tainted by fraudulent transactions. At the time nobody listened to these whistleblowers. In 2007 and 2008 other banks lost by the same greed and were saved by the Fed. On Wall Street they say Lehman Brothers was “sacrificed”. It was necessary to make them an example, to promise that this would not happen again. Today banks have recovered their health, and with it, their bad habits. The labels have changed but the mechanisms remain, unlocked by Donald Trump whose cabinet of advisors are the ones who drove the system into bankruptcy back in 2008. Inside Lehman Brothers is the result of an investigative survey conducted by the team for over two years.

Inside Lehman Brothers is the autopsy of a crime by those who tried to prevent it from within. As mortgage brokers for Lehman’s subsidiary BNC, Linda Weekes and her Californian colleagues were at the forefront of the subprime crisis. Matthew Lee, then headquartered in New York, was the first leader to have refused to validate the accounts tainted by fraudulent transactions. At the time nobody listened to these whistleblowers. In 2007 and 2008 other banks lost by the same greed and were saved by the Fed. On Wall Street they say Lehman Brothers was “sacrificed”. It was necessary to make them an example, to promise that this would not happen again. Today banks have recovered their health, and with it, their bad habits. The labels have changed but the mechanisms remain, unlocked by Donald Trump whose cabinet of advisors are the ones who drove the system into bankruptcy back in 2008. Inside Lehman Brothers is the result of an investigative survey conducted by the team for over two years.

https://www.watchonline.guide//movies/inside-lehman-brothers