China reiterates warning against cryptocurrency use in transactions

Eileen Yu, 19 May 2021

Three state-backed financial groups in China have issued a joint statement warning against the use of cryptocurrencies as payment, citing their volatility as a high risk. They further remind industry players that digital currencies cannot be used in any financial activities in the country.

National Internet Finance Association of China, China Banking Association, and Payment and Clearing Association of China said Tuesday that its members should not be involved in transactions dealing with cryptocurrencies. These included activities encompassing intermediary services that facilitate trading as well as the exchange of fiat money. Continue reading “Article: China reiterates warning against cryptocurrency use in transactions”

A Lahore sessions court extended Wednesday the bail of PTI leader Jahangir Tareen and his son Ali Tareen until May 31, in three money laundering and fraud cases.

A Lahore sessions court extended Wednesday the bail of PTI leader Jahangir Tareen and his son Ali Tareen until May 31, in three money laundering and fraud cases. The Western Australia gambling watchdog’s board “regularly discussed” the threat of money laundering in Crown’s Perth casino but did not feel it had “the resources or authority” to investigate it itself, a royal commission heard on Wednesday.

The Western Australia gambling watchdog’s board “regularly discussed” the threat of money laundering in Crown’s Perth casino but did not feel it had “the resources or authority” to investigate it itself, a royal commission heard on Wednesday. It was tax season 1999. I was a federal economic-crimes prosecutor in Miami, and this was the time of year my colleagues and I brought cases to deter would-be tax cheats. My target was a tax-return preparer operating out of Liberty City’s “Pork & Beans” projects, made famous in the movie Moonlight. This tax preparer had been manufacturing false W-2s and Social Security numbers so that her clients would receive an earned-income tax credit to which they weren’t entitled—amounting to more than $100,000 in bogus refunds. She eventually pleaded guilty and spent nearly three years in prison, which at the time I considered a broadly just result. She had committed a real crime against the United States.

It was tax season 1999. I was a federal economic-crimes prosecutor in Miami, and this was the time of year my colleagues and I brought cases to deter would-be tax cheats. My target was a tax-return preparer operating out of Liberty City’s “Pork & Beans” projects, made famous in the movie Moonlight. This tax preparer had been manufacturing false W-2s and Social Security numbers so that her clients would receive an earned-income tax credit to which they weren’t entitled—amounting to more than $100,000 in bogus refunds. She eventually pleaded guilty and spent nearly three years in prison, which at the time I considered a broadly just result. She had committed a real crime against the United States.  The claim: Pfizer was sued for $2.3 billion for “bribing doctors and suppressing adverse trial results” A viral social media post suggests that Americans shouldn’t trust Pfizer — one of the primary producers of coronavirus vaccines — because of a 2009 lawsuit against the pharmaceutical company.

The claim: Pfizer was sued for $2.3 billion for “bribing doctors and suppressing adverse trial results” A viral social media post suggests that Americans shouldn’t trust Pfizer — one of the primary producers of coronavirus vaccines — because of a 2009 lawsuit against the pharmaceutical company. The Federal Government yesterday appealed to countries that are the main destination for illicit financial flows (IFFs) to freeze, seize and repatriate such funds. Minister of Finance, Budget and National Planning Mrs. Zainab Ahmed made the appeal during a virtual International Conference on Illicit Financial Flows (IFFs) and Asset Recovery.

The Federal Government yesterday appealed to countries that are the main destination for illicit financial flows (IFFs) to freeze, seize and repatriate such funds. Minister of Finance, Budget and National Planning Mrs. Zainab Ahmed made the appeal during a virtual International Conference on Illicit Financial Flows (IFFs) and Asset Recovery. The Minnesota Court of Appeals Monday, May 17, dismissed 29 of 31 claims made by Crosby Mayor James Hunter against Crosby city officials — sending the remaining two back to district court for review.

The Minnesota Court of Appeals Monday, May 17, dismissed 29 of 31 claims made by Crosby Mayor James Hunter against Crosby city officials — sending the remaining two back to district court for review. In March, the government published its review of all the threats facing this country, and how it would respond to them, from hostile autocracies and cybercrime to terrorism and trade. Running through the pages of this huge and complex document, like lead through a pencil, is one consistent vulnerability: dark money.

In March, the government published its review of all the threats facing this country, and how it would respond to them, from hostile autocracies and cybercrime to terrorism and trade. Running through the pages of this huge and complex document, like lead through a pencil, is one consistent vulnerability: dark money. Authorities in Europe have dismantled several investment fraud schemes across the continent and recovered some of the money victims lost. Confiscation of proceeds from crimes is a strategic priority of the European Union, Europol said.

Authorities in Europe have dismantled several investment fraud schemes across the continent and recovered some of the money victims lost. Confiscation of proceeds from crimes is a strategic priority of the European Union, Europol said. Zoy Home Furnishing, an exporter of sofas and furniture in Zhejiang province spurned by most securities analysts, has become the public face of China’s crackdown on financial malfeasance, offering the nation’s 186 million investors a peek into the underbelly of Asia’s largest capital market. The 1.4 billion yuan (US$218 million) company, based in Anji county, was named on May 16 by the China Securities Regulatory Commission (CSRC) as the subject of an investigation into pump-and-dump price manipulation based on a whistle-blower’s report.

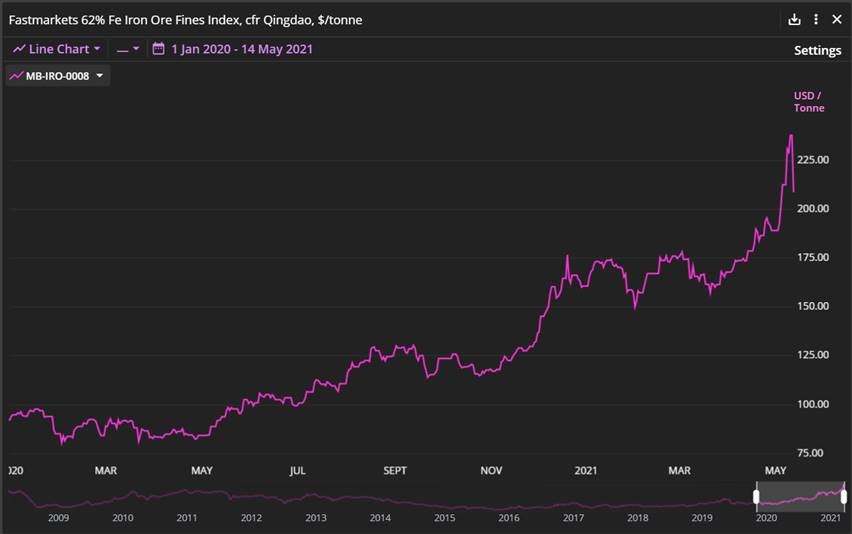

Zoy Home Furnishing, an exporter of sofas and furniture in Zhejiang province spurned by most securities analysts, has become the public face of China’s crackdown on financial malfeasance, offering the nation’s 186 million investors a peek into the underbelly of Asia’s largest capital market. The 1.4 billion yuan (US$218 million) company, based in Anji county, was named on May 16 by the China Securities Regulatory Commission (CSRC) as the subject of an investigation into pump-and-dump price manipulation based on a whistle-blower’s report. How did we get here? Of course, steel demand and iron ore supply do not change by multiple percentages over these daily timeframes. Mature markets trade as much on expectation as on current fundamentals, and changes in sentiment triggered by news and gossip can drive jarring session-to-session swings. However, panning out to a noise-reducing resolution, the explanations for iron ore’s current high price levels are very apparent.

How did we get here? Of course, steel demand and iron ore supply do not change by multiple percentages over these daily timeframes. Mature markets trade as much on expectation as on current fundamentals, and changes in sentiment triggered by news and gossip can drive jarring session-to-session swings. However, panning out to a noise-reducing resolution, the explanations for iron ore’s current high price levels are very apparent. The UK’s Serious Fraud Office (SFO) has gone public investigating charges that Sanjeev Gupta’s GFG Alliance (Gupta Family Group Alliance) holding company and subsidiaries, such as Liberty Steel, has been involved in fraud, fraudulent trading and money laundering.

The UK’s Serious Fraud Office (SFO) has gone public investigating charges that Sanjeev Gupta’s GFG Alliance (Gupta Family Group Alliance) holding company and subsidiaries, such as Liberty Steel, has been involved in fraud, fraudulent trading and money laundering.