Private sector ‘key in fighting illegal wildlife trade’

Hellen Nachilongo, 29 April 2021

Dar es Salaam. Involving private sector and financial institutions is the best tactic that could be used to help investigate and prosecute syndicate leaders (Kingpins) involved in illegal Wildlife Trade (IWT) and money laundering.

Dar es Salaam. Involving private sector and financial institutions is the best tactic that could be used to help investigate and prosecute syndicate leaders (Kingpins) involved in illegal Wildlife Trade (IWT) and money laundering.

African Wildlife Foundation senior manager and wildlife law enforcement species Didi Wamukoya said most of the culprits associate themselves with shell, front companies and banks to operate their business thus making it difficult to investigate and prosecute them.

“Normally the syndicate leader operates in such institutions, to access loans from financial institutions, mix funds for different purposes, pay taxes and sometimes they get witnesses, “she said. Continue reading “Article: Private sector ‘key in fighting illegal wildlife trade’”

Britain’s NatWest would move its headquarters out of Scotland in the event of a vote in favour of independence, its CEO Alison Rose said, only days before parliamentary elections there.

Britain’s NatWest would move its headquarters out of Scotland in the event of a vote in favour of independence, its CEO Alison Rose said, only days before parliamentary elections there. After the collapse of Lehman Brothers Holdings Inc., the Big Three rating companies were blamed for their enabling roles in the subprime mortgage crisis. Troubled securitized products would not have been marketed and sold without their seal of investment-grade approval. In fact, investors relied on their ratings, often blindly.

After the collapse of Lehman Brothers Holdings Inc., the Big Three rating companies were blamed for their enabling roles in the subprime mortgage crisis. Troubled securitized products would not have been marketed and sold without their seal of investment-grade approval. In fact, investors relied on their ratings, often blindly. What would you do if you were confident you could get away with it? Perhaps you’d rob a bank, or have a wild affair. Or maybe you’d subsist on nothing but candy floss for the rest of your life.

What would you do if you were confident you could get away with it? Perhaps you’d rob a bank, or have a wild affair. Or maybe you’d subsist on nothing but candy floss for the rest of your life. Deutsche Bank AG reported its strongest quarter in seven years thanks to activity at its investment bank, while the lender escaped the implosion of Archegos Capital Management that badly hit some rivals.

Deutsche Bank AG reported its strongest quarter in seven years thanks to activity at its investment bank, while the lender escaped the implosion of Archegos Capital Management that badly hit some rivals. Dutch authorities have hit the third largest bank in the Netherlands with a penalty of more than a half a billion dollars for longstanding failings in nearly every area of its fincrime compliance program, including lax customer risk scoring, shoddy alert investigations and missed reports of potential suspicious activity.

Dutch authorities have hit the third largest bank in the Netherlands with a penalty of more than a half a billion dollars for longstanding failings in nearly every area of its fincrime compliance program, including lax customer risk scoring, shoddy alert investigations and missed reports of potential suspicious activity. Although appellate court judges threw out some claims against the bank, they said that market manipulation allegations were “plausible.”

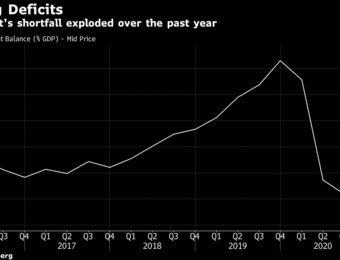

Although appellate court judges threw out some claims against the bank, they said that market manipulation allegations were “plausible.” The Argentine central bank’s fight against inflation is upending the local bond market and squeezing government finances as the country struggles to regain traction while the pandemic rages on.

The Argentine central bank’s fight against inflation is upending the local bond market and squeezing government finances as the country struggles to regain traction while the pandemic rages on. In March 2014, a few days after Vladimir Putin’s forces invaded Crimea, a British official arriving for a meeting of the UK’s National Security Council failed to shield his notes from the Downing Street photographers. Any response to the Kremlin’s aggression should not, the notes read, “close London’s financial centre to Russians”. The government subsequently explained that it “wanted to target action against Moscow and not damage British interests”.

In March 2014, a few days after Vladimir Putin’s forces invaded Crimea, a British official arriving for a meeting of the UK’s National Security Council failed to shield his notes from the Downing Street photographers. Any response to the Kremlin’s aggression should not, the notes read, “close London’s financial centre to Russians”. The government subsequently explained that it “wanted to target action against Moscow and not damage British interests”. It was only when John made a final phone call to confirm the transfer of about €10m to his family trust that he realised he was about to fall victim to a highly sophisticated financial scam.

It was only when John made a final phone call to confirm the transfer of about €10m to his family trust that he realised he was about to fall victim to a highly sophisticated financial scam.