Bill Ackman Sent a Text to the CEO of Mastercard. What Happened Next Is a Parable for ESG.

Michelle Celarier, 16 June 2021

On a Saturday morning last December, Bill Ackman was scrolling through Twitter when an article in The New York Times caught his eye. “The Children of Pornhub,” by Nicholas Kristof, told how unauthorized sex — and rape and torture — videos were being spread across the internet on a website called Pornhub, one of the most popular in the world.

On a Saturday morning last December, Bill Ackman was scrolling through Twitter when an article in The New York Times caught his eye. “The Children of Pornhub,” by Nicholas Kristof, told how unauthorized sex — and rape and torture — videos were being spread across the internet on a website called Pornhub, one of the most popular in the world.

Ackman, who has four daughters, was outraged when he read how one teenager ended up a Pornhub victim after sending a naked video of herself to a boy she had a crush on. Harassed and humiliated, the young girl attempted suicide. Continue reading “Article: Bill Ackman Sent a Text to the CEO of Mastercard. What Happened Next Is a Parable for ESG.”

From Piggly Wiggly to GameStop, short squeezes have been causing drama on the stock markets for more than a century. Read on to learn about the biggest short squeezes in history and how to take part in the next one.

From Piggly Wiggly to GameStop, short squeezes have been causing drama on the stock markets for more than a century. Read on to learn about the biggest short squeezes in history and how to take part in the next one. Even had she not raised more money than her rivals, Tali Farhadian Weinstein would be a formidable candidate in the nine-way race to become the Manhattan district attorney, perhaps the most high-profile local prosecutor’s office in the country.

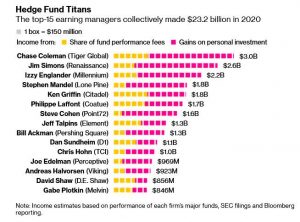

Even had she not raised more money than her rivals, Tali Farhadian Weinstein would be a formidable candidate in the nine-way race to become the Manhattan district attorney, perhaps the most high-profile local prosecutor’s office in the country. William Albert Ackman (born May 11, 1966) is an American investor and hedge fund manager. He is the founder and CEO of Pershing Square Capital Management, a hedge fund management company. Ackman has been considered an engaged activist investor, which is long-term in nature..

William Albert Ackman (born May 11, 1966) is an American investor and hedge fund manager. He is the founder and CEO of Pershing Square Capital Management, a hedge fund management company. Ackman has been considered an engaged activist investor, which is long-term in nature..