Article: Rule of Law Collapsed in USA – Martin Armstrong

Article - Media, Publications Rule of Law Collapsed in USA – Martin Armstrong

Rule of Law Collapsed in USA – Martin Armstrong

Greg Hunter, 26 February 2021

Legendary financial and geopolitical cycle analyst Martin Armstrong says now that the stolen election is over, get ready for lawlessness to reign. We start with the Supreme Court that refused to hear the Trump case on Pennsylvania voting fraud. There are three more 2020 Election voter fraud cases pending at the nation’s highest court. Armstrong says, “I don’t think they are going to take any of them. Look, the rule of law has absolutely collapsed in the United States. It’s just a joke at this point. . . . You swear an oath to uphold the Constitution. It’s not whenever you feel like it. . . . This is not only a denial of due process but the civil rights of everybody in the country. They effectively said Pennsylvania changed the rules against the (state) legislature in the middle of an election, and we are not going to hear the case. So, they are effectively saying politicians can change the rules of an election at any time, and it doesn’t have to be constitutional. Refusing to take this case is a disaster because next election they can choose to do the same thing at any time.” Continue reading “Article: Rule of Law Collapsed in USA – Martin Armstrong”

Article: The GameStop Mess Exposes the Naked Short Selling Scam

Article - Media, PublicationsThe GameStop Mess Exposes the Naked Short Selling Scam

LUCY KOMISAR, 25 February 2021

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

Short selling, effectively betting that a stock will go down, involves a trader selling shares he does not own, hoping to buy them back at a lower price to make money on the spread. The trader is supposed to locate (or have a “reasonable belief” he can locate) or borrow the shares in brokerage accounts, and then transfer them to the buyer within two days. This accounts for as much as 50 percent of daily trading. Continue reading “Article: The GameStop Mess Exposes the Naked Short Selling Scam”

Article: ‘Global Trade’ Super Bowl XX: U.S. Can’t Manufacture A Win Over China

Article - Media, Publications‘Global Trade’ Super Bowl XX: U.S. Can’t Manufacture A Win Over China

Ken Roberts, 05 February 2021

Let’s think about President Biden’s strategy on China this way.

It’s early Sunday evening. Tampa Bay quarterback Tom Brady is standing over his center, preparing to take his first snap at the start of Super Bowl LV.

As he barks his signals and glances left to right, right to left, into his vision comes a sea of more than 40 Kansas City Chief defenders scattered across the line of scrimmage rather than the customary 11. Continue reading “Article: ‘Global Trade’ Super Bowl XX: U.S. Can’t Manufacture A Win Over China”

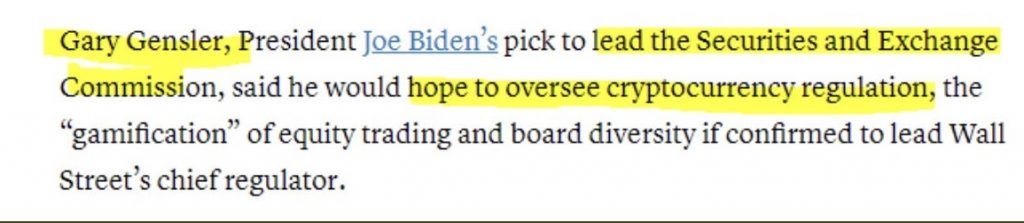

Article: The Securities And Exchange Commission May Look Into Possible Market Manipulation Made By Reddit Day Traders Instead Of The Short-Selling Hedge Funds

Article - Media, PublicationsJack Kelly, 29 January 2021

It’s telling that regulators aren’t asking why high-end hedge funds were allowed to target vulnerable corporations, such as GameStop, in an alleged short-selling scheme to drive their victims into bankruptcy. As the stock price of their prey goes to nearly zero, the hedge fund honchos could earn multimillions—or billions of dollars–in profits off of the companies closing their doors and laying off thousands of employees into the worst job market in modern history.

It’s telling that regulators aren’t asking why high-end hedge funds were allowed to target vulnerable corporations, such as GameStop, in an alleged short-selling scheme to drive their victims into bankruptcy. As the stock price of their prey goes to nearly zero, the hedge fund honchos could earn multimillions—or billions of dollars–in profits off of the companies closing their doors and laying off thousands of employees into the worst job market in modern history.

Instead, according to the Wall Street Journal, the Securities and Exchange Commission (SEC) is looking into the young, goofy, fun-loving, scrappy and foul-mouthed novice investors on the r/wallstreetbets subreddit of Reddit. There is the feel of an institutional knee-jerk reaction to accept activities from established Wall Street professionals (no matter how odious it seems), while shining a harsh light on new—mostly naive—entrants into the financial community. Continue reading “Article: The Securities And Exchange Commission May Look Into Possible Market Manipulation Made By Reddit Day Traders Instead Of The Short-Selling Hedge Funds”

Article: US Chides Vietnam Over Currency, But Makes No Tariff Threat

Article - Media, PublicationsUS Chides Vietnam Over Currency, But Makes No Tariff Threat

Alex Lawson, 15 January 2021

The Office of the U.S. Trade Representative found that Vietnam’s currency manipulation is unfairly hindering U.S. businesses but held off on teeing up new tariffs against Hanoi on Friday, leaving a final decision in the case up to the incoming Biden administration.

After a three-month investigation, the USTR found that Vietnam’s persistent undervaluation of its currency, paired with its more recent intervention in foreign exchange markets, artificially lowered the prices of Vietnamese exports to the U.S., leaving U.S. producers at a disadvantage. Continue reading “Article: US Chides Vietnam Over Currency, But Makes No Tariff Threat”

Article: PATRICK BYRNE GIVE REAL HOPE IN ELECTION FRAUD INVESTIGATION

Article - Media, PublicationsPATRICK BYRNE GIVE REAL HOPE IN ELECTION FRAUD INVESTIGATION

Cooter, 05 January 2021

We’ve learned some new and very important information thanks to former Overstock CEO Patrick Byrne this week. They’ve now been able to confirm and corroborate the testimony and sworn affidavit of the USPS worker who said that he drove ballots from New York to Pennsylvania. Continue reading “Article: PATRICK BYRNE GIVE REAL HOPE IN ELECTION FRAUD INVESTIGATION”

Article: Swiss central bank chief rejects ‘currency manipulator’ label from the U.S.

Article - Media, PublicationsSwiss central bank chief rejects ‘currency manipulator’ label from the U.S.

Elliot Smith, 17 December 2020

LONDON — Swiss National Bank President Thomas Jordan has rejected a U.S. decision to label Switzerland a “currency manipulator.”

The U.S. Treasury on Wednesday added Switzerland to a list of nations it suspects of deliberately devaluing their currencies against the dollar.

Jordan told CNBC on Thursday that neither the SNB nor Switzerland itself has artificially manipulated the value of the Swiss franc.

“Our monetary policy is necessary, it is legitimate, and we have a very low inflation rate — it is even negative at this moment — so we have to fight this deflation, and the Swiss franc is very strong, so it appreciated in nominal terms over the last 12 years enormously, both vis-a-vis the euro and vis-a-vis the U.S. dollar,” he said. Continue reading “Article: Swiss central bank chief rejects ‘currency manipulator’ label from the U.S.”

Article: The Vitol Enforcement Action: Part 1 – Market Manipulation Through Corruption

Article - Media, PublicationsThe Vitol Enforcement Action: Part 1 – Market Manipulation Through Corruption

Thomas Fox, 07 December 2020

Last week the Department of Justice (DOJ) settled a multi-part enforcement action, partly involving the Foreign Corrupt Practices Act (FCPA), with Vitol Inc. (Vitol), the US subsidiary of Vitol Holding II SA. Vitol agreed to pay a combined $135 million to resolve matters.

Interestingly, also included in the overall settlement was a disgorgement of more than $12.7 million to the Commodity Futures Trading Commission (CFTC) in a related matter and a penalty payment to the CFTC of $16 million related to trading activity. The FCPA component was settled via a Deferred Prosecution Agreement (DPA) and Criminal Information (Information). Continue reading “Article: The Vitol Enforcement Action: Part 1 – Market Manipulation Through Corruption”