Brazil exporters demand $3.8 billion from banks for currency manipulation

Carolina Mandl, 16 June 2021

Continue reading “Article: Brazil exporters demand $3.8 billion from banks for currency manipulation”

Continue reading “Article: Brazil exporters demand $3.8 billion from banks for currency manipulation”

Brazil exporters demand $3.8 billion from banks for currency manipulation

Carolina Mandl, 16 June 2021

Continue reading “Article: Brazil exporters demand $3.8 billion from banks for currency manipulation”

Continue reading “Article: Brazil exporters demand $3.8 billion from banks for currency manipulation”

JBS Paid Hackers $11 Million After Hack Crippled Meat Plants

Fabiana Batista and Michael Hirtzer, 10 June 2021

JBS USA said it paid $11 million in ransom to criminals responsible for the cyberattack that disrupted meat processing across North America and Australia, the latest high profile example of large corporations falling prey to extortion.

JBS USA said it paid $11 million in ransom to criminals responsible for the cyberattack that disrupted meat processing across North America and Australia, the latest high profile example of large corporations falling prey to extortion.

“This was a very difficult decision to make for our company and for me personally,” JBS USA Chief Executive Officer Andre Nogueira said in a statement. “However, we felt this decision had to be made to prevent any potential risk for our customers.”

The ransom payment was made in Bitcoin, according to a spokesperson for JBS Brazil. Continue reading “Article: JBS Paid Hackers $11 Million After Hack Crippled Meat Plants”

US Attorney General Warns Ransomware ‘Getting Worse and Worse’/strong>

Masood Farivar, 09 June 2021

U.S. Attorney General Merrick Garland warned Wednesday that ransom-motivated cyberattacks are “getting worse and worse,” echoing other top Biden administration officials who have sounded the alarm about the problem in recent weeks.

U.S. Attorney General Merrick Garland warned Wednesday that ransom-motivated cyberattacks are “getting worse and worse,” echoing other top Biden administration officials who have sounded the alarm about the problem in recent weeks.

“We have to do everything we possibly can here,” Garland told lawmakers. “This is a very, very serious threat.” Continue reading “Article: US Attorney General Warns Ransomware ‘Getting Worse and Worse’”

The Wheels Are Coming Off Tesla

JIM COLLINS, 04 June 2021

After today’s brutal miss on the jobs number — 559,000 actual vs. a 671,000 estimate was a 16.7% miss — the normal feedback loop commenced. Economy not that hot = interest rates down (the yield on the 10-year UST has ticked down today to 1.58%) = Nasdaq up. This has been the state of affairs in 2021. Is what it is. I don’t fight it, I just use these mindless bounces to reset my short positions.

Without entering into a long-winded diatribe about Elon Musk, Bitcoin, self-driving, etc., let me just note one key point that has become increasingly apparent to those of us who actually analyze fundamentals this week: the wheels are coming off Tesla (TSLA) . That is true both literally – Tesla has announced two separate recalls this week, the first covering 5,974 Models 3/Y in the U.S. and 734 in China over potentially loose brake caliper bolts and the second covering 7,696 3/Ys in the U.S. owing to potentially loose seatbelt fastener connections – and figuratively. Continue reading “Article: The Wheels Are Coming Off Tesla”

Head of volleyball body targeted by Brazilian fraud probe

MAURICIO SAVARESE, 20 May 2021

SAO PAULO (AP) — The president of the International Volleyball Federation is being investigated in his native Brazil as part of a wider fraud probe launched on Thursday. Rio de Janeiro police and state prosecutors said in a statement that Ary Graça, who has headed FIVB since 2012, and nine other people are suspected of tax fraud, money laundering and identity fraud.

Investigators say Graça used money from a sponsorship deal between Banco do Brasil and the Brazilian Volleyball Confederation to pay for contracts with suspected shell companies in the city of Saquarema, outside Rio de Janeiro. Graça was head of the Brazilian body until 2014. A former mayor of the city was also charged. Continue reading “Article: Head of volleyball body targeted by Brazilian fraud probe”

Will ‘Global Britain’ clamp down on money laundering?

Tom Burgis, 28 April 2021

In March 2014, a few days after Vladimir Putin’s forces invaded Crimea, a British official arriving for a meeting of the UK’s National Security Council failed to shield his notes from the Downing Street photographers. Any response to the Kremlin’s aggression should not, the notes read, “close London’s financial centre to Russians”. The government subsequently explained that it “wanted to target action against Moscow and not damage British interests”.

In March 2014, a few days after Vladimir Putin’s forces invaded Crimea, a British official arriving for a meeting of the UK’s National Security Council failed to shield his notes from the Downing Street photographers. Any response to the Kremlin’s aggression should not, the notes read, “close London’s financial centre to Russians”. The government subsequently explained that it “wanted to target action against Moscow and not damage British interests”.

Seven years on, the assessment is very different. Last year’s report on Russia by parliament’s Intelligence and Security Committee — eventually published after a contentious delay — found that the warm British welcome for Russian money “offered ideal mechanisms by which illicit finance could be recycled through what has been referred to as the London ‘laundromat’”. Continue reading “Article: Will ‘Global Britain’ clamp down on money laundering?”

BHP, Vale-Owned Mineral Co. Files Ch. 15 For $9B Debt Reorg

Rick Archer, 20 April 2021

A Brazilian mining joint venture between Vale SA and the BHP Group involved in a 2015 dam disaster Tuesday asked a New York bankruptcy court for Chapter 15 bankruptcy recognition as it attempts to reorganize $8.8 billion in debt in the Brazilian courts.

A Brazilian mining joint venture between Vale SA and the BHP Group involved in a 2015 dam disaster Tuesday asked a New York bankruptcy court for Chapter 15 bankruptcy recognition as it attempts to reorganize $8.8 billion in debt in the Brazilian courts.

n its petition late Monday, Samarco Mineração SA asked for the U.S. court’s recognition of the restructuring proceedings it began in the Brazilian courts last week.

Vale and BHP announced April 9 that Samarco Mineração had filed for judicial reorganization in the Brazilian courts as a “last ditch” response to legal actions filed by creditors in the U.S. and Brazil seeking payments on $2.5 billion in debt, and pledged Samarco would continue operating and paying for remediation efforts stemming from the Fundão Dam collapse. Continue reading “Article: BHP, Vale-Owned Mineral Co. Files Ch. 15 For $9B Debt Reorg”

EXCLUSIVE Brazil’s IG4 bids $916 mln to become a top shareholder in Chilean miner SQM -sources

Dave Sherwood, Tatiana Bautzer, 17 April 2021

Brazilian private equity firm IG4 Capital has delivered a $916 million bid to buy into holding companies that have large stakes in Chilean lithium miner Sociedad Quimica y Minera de Chile, known as SQM, two sources with knowledge of the matter said.

Brazilian private equity firm IG4 Capital has delivered a $916 million bid to buy into holding companies that have large stakes in Chilean lithium miner Sociedad Quimica y Minera de Chile, known as SQM, two sources with knowledge of the matter said.

If SQM’s shareholder Julio Ponce agrees to the proposed deal, IG4 would become one of the largest shareholders of the world’s second largest lithium producer. The group intends to appoint up to four board members, according to the proposal described by the sources. Continue reading “Article: EXCLUSIVE Brazil’s IG4 bids $916 mln to become a top shareholder in Chilean miner SQM -sources”

FICO Survey Finds UK Banks Struggled With Covid-19 Financial Crime Surge

Polly Jean Harrison, 10 April 2021

As cases of fraud and money laundering rose during the pandemic last year, banks in the UK faced unforeseen challenges. In a new study by global analytics software provider FICO and independent research firm OMDIA, 79 per cent of respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention.

As cases of fraud and money laundering rose during the pandemic last year, banks in the UK faced unforeseen challenges. In a new study by global analytics software provider FICO and independent research firm OMDIA, 79 per cent of respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention.

“Just as the pandemic put huge stresses on the health care system, it put huge stresses on fraud and financial crime management teams,” explained Toby Carlin, senior director for fraud consulting at FICO. “Teams that collaborate in person and work with large software systems that have restricted access found that working from home hurt their productivity. This was compounded as the volume of fraud attacks rose.” Continue reading “Article: FICO Survey Finds UK Banks Struggled With Covid-19 Financial Crime Surge”

Man Group Dials Up Short Bets as Turkey Stirs Fragile Five Fears

Ben Bartenstein, 03 April 2021

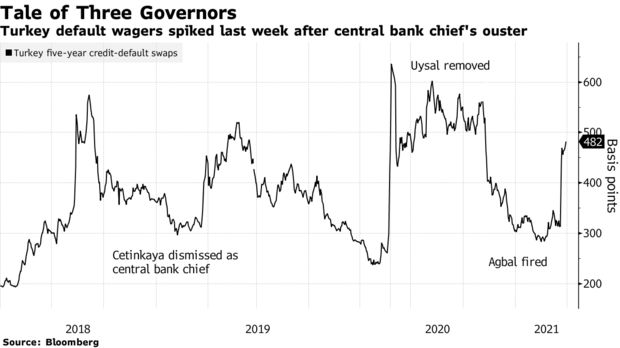

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

Doomsayers including Man Group Plc, the world’s biggest publicly listed hedge-fund firm, and the Institute of International Finance’s chief economist Robin Brooks warn that the turmoil battering Turkish securities could ripple across emerging markets in a repeat of the 2013 taper tantrum. Yet that gloomy scenario isn’t the dominant narrative in the hallways of Pacific Investment Management Co., BlackRock Inc. and Ashmore Group Plc, which have some of the largest exposures to the nations that might be next in the crosshairs. Continue reading “Article: Man Group Dials Up Short Bets as Turkey Stirs Fragile Five Fears”

Ex-Glencore Trader Pleads Guilty to Manipulating Oil Prices

Joel Rosenblatt, Malathi Nayak and Javier Blas, 25 March 2021

(Bloomberg) — A former Glencore Plc trader pleaded guilty to manipulating an oil price benchmark, allowing the world’s largest commodities trader to profit from the price swings and enriching himself.Emilio Heredia appeared by video conference on Wednesday in federal court in San Francisco and admitted to a conspiracy in which he directed buy and sell orders that pushed fuel oil prices up and down.

Heredia, 49, faces a maximum sentence of five years in prison and a $250,000 fine. Justice Department lawyer Matthew Sullivan told the judge that Heredia, who became a naturalized citizen in 2016, could lose his immigration status and be removed from the U.S. But Sullivan also said Heredia had agreed to cooperate with the government as it investigates further.

Glencore has said it is cooperating with authorities. Continue reading “Article: Ex-Glencore Trader Pleads Guilty to Manipulating Oil Prices”

The Vitol Enforcement Action: Part 1 – Market Manipulation Through Corruption

Thomas Fox, 07 December 2020

Last week the Department of Justice (DOJ) settled a multi-part enforcement action, partly involving the Foreign Corrupt Practices Act (FCPA), with Vitol Inc. (Vitol), the US subsidiary of Vitol Holding II SA. Vitol agreed to pay a combined $135 million to resolve matters.

Interestingly, also included in the overall settlement was a disgorgement of more than $12.7 million to the Commodity Futures Trading Commission (CFTC) in a related matter and a penalty payment to the CFTC of $16 million related to trading activity. The FCPA component was settled via a Deferred Prosecution Agreement (DPA) and Criminal Information (Information). Continue reading “Article: The Vitol Enforcement Action: Part 1 – Market Manipulation Through Corruption”

Vitol to pay $95.7 million to settle fraud, market manipulation charges

Reuters Staff, 04 December 2020

WASHINGTON (Reuters) – Energy and commodities trading firm Vitol Inc has agreed to pay $95.7 million to settle charges of corruption-based fraud and attempted market manipulation, the U.S. Commodity Futures Trading Commission on Thursday.

Houston-based Vitol did not admit or deny the charges, but agreed to pay the civil penalties related to making bribes and offering kickbacks to employees of certain state-owned entities in Brazil, Ecuador and Mexico in exchange for “preferential treatment and access to trades,” the regulator said.

Currency wars and the emerging-market countries

Richard Portes, 04 November 2010

The headlines shout “currency wars”. The US believes China engages in “currency manipulation”. The authorities hesitate to declare this to the US Congress, and the Secretary of the Treasury says “competitive non-appreciation” instead. China accuses the US of excessively loose monetary policy, flooding the world with liquidity. There is some truth in both charges, but some exaggeration.

This is one of the key issues facing the G20. Exchange-rate pressures, global imbalances and rebalancing, spillovers and the desirability of policy coordination – these are at the centre of the economic interdependence between the developed and emerging market countries. All this is in the context of weak US and European recoveries from the Great Recession, the risk of deflation, and the likelihood of more quantitative easing (QE) by major central banks. Domestic issues and inability to get direct action on exchange rates has led the US to propose internationally agreed targets for current-account imbalances. The wheel goes round – these proposals bear some resemblance to those of Keynes at Bretton Woods, which the US then opposed.