Crown stuffs $630m under the bed, betting on rainy days ahead

Elizabeth Knight, 24 May 2021

At first glance there doesn’t appear to be an obvious nexus between alleged fresh money laundering claims against Crown Resorts revealed during Monday’s Victorian royal commission and the company’s decision not to redeem $630 million of subordinated notes.

At first glance there doesn’t appear to be an obvious nexus between alleged fresh money laundering claims against Crown Resorts revealed during Monday’s Victorian royal commission and the company’s decision not to redeem $630 million of subordinated notes.

For that matter, most wouldn’t join the dots between Crown’s decision to not pay out its noteholders and claims by the Victorian gaming regulator last week that it was misled by Crown about the arrests of 19 of its China staff back in 2016.

Crown paints a portrait of itself as a now conservative company that wants to maintain its liquidity in the face of the COVID-induced sporadic closures of its venues or changes to their operating conditions. Continue reading “Article: Crown stuffs $630m under the bed, betting on rainy days ahead”

HONG KONG — Suncity Group, the Macao-based gambling company, has pulled out of the running for rights to run a casino resort in Japan.

HONG KONG — Suncity Group, the Macao-based gambling company, has pulled out of the running for rights to run a casino resort in Japan. For an outsider to understand China’s A-share stock markets, which are dominated by retail investors and thus known for high levels of market turnover and volatility, learning about harvesting chives and stir-frying methods in Chinese cookery would help a great deal. By official counts, there are more than 180 million mostly small investors who, driven by rumours, trade in and out of positions very frequently, contributing to wild fluctuations. The trading pattern is known as chao, the Chinese term for a method of stir-frying meat or vegetables rapidly in a wok at high heat.

For an outsider to understand China’s A-share stock markets, which are dominated by retail investors and thus known for high levels of market turnover and volatility, learning about harvesting chives and stir-frying methods in Chinese cookery would help a great deal. By official counts, there are more than 180 million mostly small investors who, driven by rumours, trade in and out of positions very frequently, contributing to wild fluctuations. The trading pattern is known as chao, the Chinese term for a method of stir-frying meat or vegetables rapidly in a wok at high heat. One of the world’s largest credit rating agencies believes that central bank digital currencies (CBDCs) could disrupt the current financial systems. In its latest report, Fitch Ratings looked into how CBDCs could impact the global financial system, including giving governments a new way to track financial data and new financial policy options.

One of the world’s largest credit rating agencies believes that central bank digital currencies (CBDCs) could disrupt the current financial systems. In its latest report, Fitch Ratings looked into how CBDCs could impact the global financial system, including giving governments a new way to track financial data and new financial policy options. Stocks in mainland China retreated from a three-day advance as commodity prices eased and lingering concerns about global inflation soured appetite for risks. Financial markets in Hong Kong were closed for a public holiday.

Stocks in mainland China retreated from a three-day advance as commodity prices eased and lingering concerns about global inflation soured appetite for risks. Financial markets in Hong Kong were closed for a public holiday. Zoy Home Furnishing, an exporter of sofas and furniture in Zhejiang province spurned by most securities analysts, has become the public face of China’s crackdown on financial malfeasance, offering the nation’s 186 million investors a peek into the underbelly of Asia’s largest capital market. The 1.4 billion yuan (US$218 million) company, based in Anji county, was named on May 16 by the China Securities Regulatory Commission (CSRC) as the subject of an investigation into pump-and-dump price manipulation based on a whistle-blower’s report.

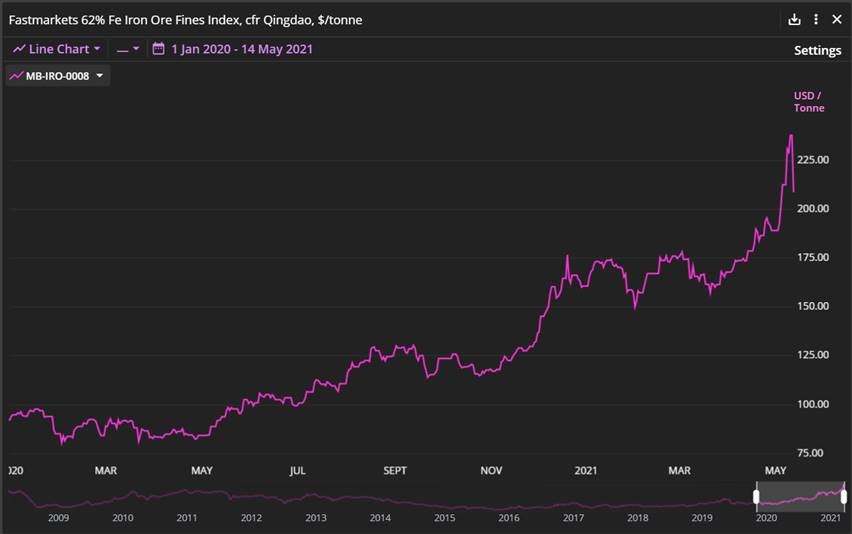

Zoy Home Furnishing, an exporter of sofas and furniture in Zhejiang province spurned by most securities analysts, has become the public face of China’s crackdown on financial malfeasance, offering the nation’s 186 million investors a peek into the underbelly of Asia’s largest capital market. The 1.4 billion yuan (US$218 million) company, based in Anji county, was named on May 16 by the China Securities Regulatory Commission (CSRC) as the subject of an investigation into pump-and-dump price manipulation based on a whistle-blower’s report. How did we get here? Of course, steel demand and iron ore supply do not change by multiple percentages over these daily timeframes. Mature markets trade as much on expectation as on current fundamentals, and changes in sentiment triggered by news and gossip can drive jarring session-to-session swings. However, panning out to a noise-reducing resolution, the explanations for iron ore’s current high price levels are very apparent.

How did we get here? Of course, steel demand and iron ore supply do not change by multiple percentages over these daily timeframes. Mature markets trade as much on expectation as on current fundamentals, and changes in sentiment triggered by news and gossip can drive jarring session-to-session swings. However, panning out to a noise-reducing resolution, the explanations for iron ore’s current high price levels are very apparent. Crown Resorts management “lied” and used delay tactics to stymie an investigation into the 2016 arrests of 19 China-based staff, the Victorian gambling regulator told the Crown Resorts royal commission on Monday.

Crown Resorts management “lied” and used delay tactics to stymie an investigation into the 2016 arrests of 19 China-based staff, the Victorian gambling regulator told the Crown Resorts royal commission on Monday. China’s stock market regulator has started an investigation into alleged price manipulation, vowing to crack down on illegal activities to protect the nation’s 180 million mainly retail investors.

China’s stock market regulator has started an investigation into alleged price manipulation, vowing to crack down on illegal activities to protect the nation’s 180 million mainly retail investors. After taking oath as the 22nd Prime Minister of Pakistan on August 18, 2018, Imran Khan has visited China three times (2018-2020, once every year) during his 33 months in power. After the first visit to Saudi Arabia, which is customary for all new entrants, the Prime Minister showed the importance Pakistan attaches to its most trusted friend, China, by visiting it next.

After taking oath as the 22nd Prime Minister of Pakistan on August 18, 2018, Imran Khan has visited China three times (2018-2020, once every year) during his 33 months in power. After the first visit to Saudi Arabia, which is customary for all new entrants, the Prime Minister showed the importance Pakistan attaches to its most trusted friend, China, by visiting it next. Professor Eswar Prasad at Cornell University believes that the US Treasury report this time includes more intensive analysis and shows a less overtly political approach than previous reports during the Trump Administration. However, to avoid being labeled as a currency manipulator again in the future, Vietnam needs to do much more concerning trade and currency issues, rather than just tackling short term problems.

Professor Eswar Prasad at Cornell University believes that the US Treasury report this time includes more intensive analysis and shows a less overtly political approach than previous reports during the Trump Administration. However, to avoid being labeled as a currency manipulator again in the future, Vietnam needs to do much more concerning trade and currency issues, rather than just tackling short term problems. Chris Hedges: Don’t Be Fooled By Joe Biden

Chris Hedges: Don’t Be Fooled By Joe Biden