Alibaba shares jump after record $2.8bn anti-monopoly fine

Mark Sweney, 12 April 2021

Shares in Alibaba surged on Monday after the e-commerce company said that a record $2.8bn (£2bn) fine handed down by Chinese regulators marked the end of an investigation into anti-competitive practices at the company.

Shares in Alibaba surged on Monday after the e-commerce company said that a record $2.8bn (£2bn) fine handed down by Chinese regulators marked the end of an investigation into anti-competitive practices at the company.

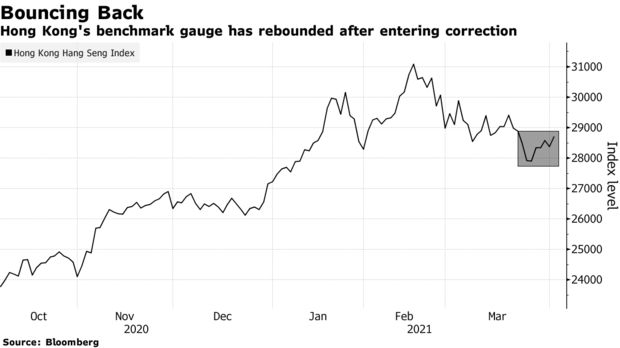

Top executives at the company, founded by the billionaire Jack Ma, told investors that while Chinese regulators continued a wider investigation into the sprawling conglomerates in the country’s tech industry, they believed the multibillion dollar fine announced at the weekend marked the end of the focus on Alibaba. The company is listed in Hong Kong and its shares climbed as much as 9% on the management’s comments. Continue reading “Article: Alibaba shares jump after record $2.8bn anti-monopoly fine”

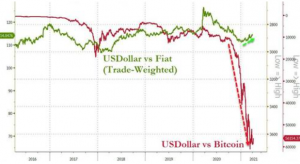

Treasury Secretary Janet Yellen will decline to name China as a currency manipulator in her first semiannual foreign-exchange report, according to people familiar with the matter, a move that allows the U.S. to sidestep a fresh clash with Beijing.

Treasury Secretary Janet Yellen will decline to name China as a currency manipulator in her first semiannual foreign-exchange report, according to people familiar with the matter, a move that allows the U.S. to sidestep a fresh clash with Beijing. Being “tough on China” is politically popular in Washington these days, and Biden has come out of the gate swinging against Beijing. But “being tough” isn’t a policy and reflexively applying it to China doesn’t serve U.S. interests. A logical and realistic approach to Beijing, however, can.

Being “tough on China” is politically popular in Washington these days, and Biden has come out of the gate swinging against Beijing. But “being tough” isn’t a policy and reflexively applying it to China doesn’t serve U.S. interests. A logical and realistic approach to Beijing, however, can. Shanghai, China: Chinese regulators have hit e-commerce giant Alibaba with a massive 18.2 billion yuan ($2.78 billion) fine over practices deemed to be an abuse of the company’s dominant market position, state-run media reported on Saturday.

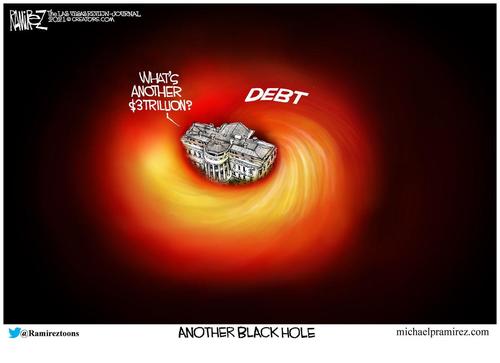

Shanghai, China: Chinese regulators have hit e-commerce giant Alibaba with a massive 18.2 billion yuan ($2.78 billion) fine over practices deemed to be an abuse of the company’s dominant market position, state-run media reported on Saturday. “We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

“We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

Bitcoin Shows Us That Not All Volatilities Are Created Equal

Bitcoin Shows Us That Not All Volatilities Are Created Equal ‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US” Trading in more than 50 Hong Kong-listed companies was suspended on Thursday, after a number of firms failed to report earnings ahead of the March 31 deadline.

Trading in more than 50 Hong Kong-listed companies was suspended on Thursday, after a number of firms failed to report earnings ahead of the March 31 deadline.