In-Depth: Citadel Connect and Dark Pools Uncovered

MTim Fries, 20 July 2021

Before dark pools, institutional investors had to trade in blocks of shares outside trading hours to avoid upsetting the market. Now, the utility found within dark pools is so high that some market makers have embedded them within their operations. There are certainly some benefits here in terms of increased liquidity, but there’s another side of the coin as well.

Before dark pools, institutional investors had to trade in blocks of shares outside trading hours to avoid upsetting the market. Now, the utility found within dark pools is so high that some market makers have embedded them within their operations. There are certainly some benefits here in terms of increased liquidity, but there’s another side of the coin as well.

Throughout 2021, retail traders have uncovered significant short positions held by hedge funds in a number of stocks. Naked short selling is suspected by many retail traders to be involved. At this point, hedge funds have collectively lost $12 billion—so far. Continue reading “Article: In-Depth: Citadel Connect and Dark Pools Uncovered”

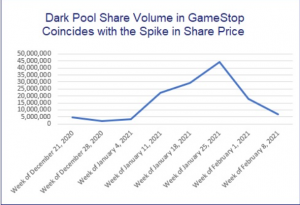

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price

A Massive Increase in Trading in GameStop by Dark Pools Owned by the Mega Wall Street Banks Coincided with the Spike in its Share Price