Pam Martens and Russ Martens, 23 July 2021

The unthinkable is happening with alarming regularity at the Frankenbank JPMorgan Chase. Over the last seven years, with Chairman and CEO Jamie Dimon at the helm, JPMorgan Chase has managed to do what no other federally-insured American bank has managed to do in the history of banking in the United States. The bank has admitted to five separate felony countsbrought by the U.S. Department of Justice, while regulators took no action to remove the Board of Directors or Jamie Dimon.

The unthinkable is happening with alarming regularity at the Frankenbank JPMorgan Chase. Over the last seven years, with Chairman and CEO Jamie Dimon at the helm, JPMorgan Chase has managed to do what no other federally-insured American bank has managed to do in the history of banking in the United States. The bank has admitted to five separate felony countsbrought by the U.S. Department of Justice, while regulators took no action to remove the Board of Directors or Jamie Dimon.

Now, once again, the outrageous hubris of this Board is on display. Just last fall the bank forked over $920 million of shareholders moneyto settle its fourth and fifth felony counts brought by the Department of Justice, this time for rigging the precious metals and U.S. Treasury market. Now, in the dog days of summer, rarely a time for bonuses on Wall Street, the Jrgan Chase board announced on July 20 that it is giving Dimon 1.5 million stock options which, according to a specialist cited at Bloomberg News, have a total value of $50 million on paper.

The United States District Court for the Northern District of California this week unsealed an indictment returned by a federal grand jury in San Francisco charging Rancho Santa Fe resident Racho Jordanov with conspiracy to commit trade secret theft and wire fraud, international money laundering, and related charges including obstruction of justice.

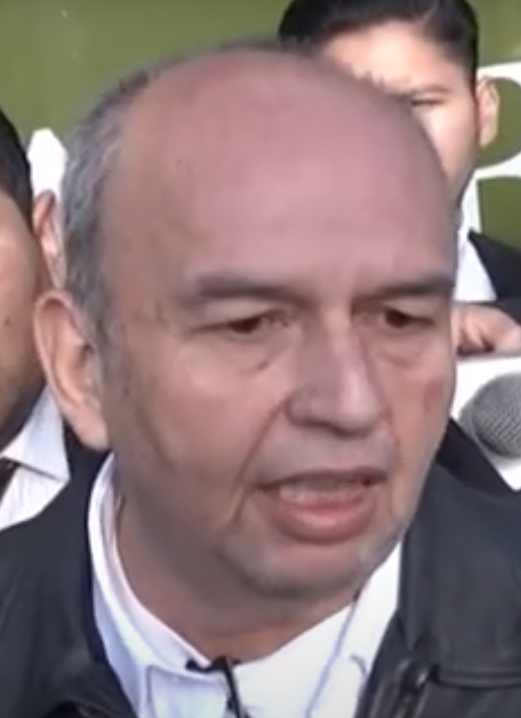

The United States District Court for the Northern District of California this week unsealed an indictment returned by a federal grand jury in San Francisco charging Rancho Santa Fe resident Racho Jordanov with conspiracy to commit trade secret theft and wire fraud, international money laundering, and related charges including obstruction of justice. Bolivia arrested its former interior minister earlier this week over an alleged bribery and money laundering scheme that enabled a U.S.-based company to secure a government contract, the U.S. Department of Justice announced on Wednesday.

Bolivia arrested its former interior minister earlier this week over an alleged bribery and money laundering scheme that enabled a U.S.-based company to secure a government contract, the U.S. Department of Justice announced on Wednesday. Senators Mike Rounds of South Dakota and Tina Smith of Minnesota are asking Attorney General Merrick Garland to examine whether the control large meatpackers have over the beef processing market violates U.S. antitrust laws and principles of fair competition. They wrote a letter to the AG this week and are inviting all members of Congress to join them. This isn’t the first investigation on this issue, but Rounds says both producers and consumers are at the center of this examination.

Senators Mike Rounds of South Dakota and Tina Smith of Minnesota are asking Attorney General Merrick Garland to examine whether the control large meatpackers have over the beef processing market violates U.S. antitrust laws and principles of fair competition. They wrote a letter to the AG this week and are inviting all members of Congress to join them. This isn’t the first investigation on this issue, but Rounds says both producers and consumers are at the center of this examination. It was tax season 1999. I was a federal economic-crimes prosecutor in Miami, and this was the time of year my colleagues and I brought cases to deter would-be tax cheats. My target was a tax-return preparer operating out of Liberty City’s “Pork & Beans” projects, made famous in the movie Moonlight. This tax preparer had been manufacturing false W-2s and Social Security numbers so that her clients would receive an earned-income tax credit to which they weren’t entitled—amounting to more than $100,000 in bogus refunds. She eventually pleaded guilty and spent nearly three years in prison, which at the time I considered a broadly just result. She had committed a real crime against the United States.

It was tax season 1999. I was a federal economic-crimes prosecutor in Miami, and this was the time of year my colleagues and I brought cases to deter would-be tax cheats. My target was a tax-return preparer operating out of Liberty City’s “Pork & Beans” projects, made famous in the movie Moonlight. This tax preparer had been manufacturing false W-2s and Social Security numbers so that her clients would receive an earned-income tax credit to which they weren’t entitled—amounting to more than $100,000 in bogus refunds. She eventually pleaded guilty and spent nearly three years in prison, which at the time I considered a broadly just result. She had committed a real crime against the United States.  BOSTON – A New York man pleaded guilty today in federal court in Boston to heroin and fentanyl possession and distribution charges.

BOSTON – A New York man pleaded guilty today in federal court in Boston to heroin and fentanyl possession and distribution charges. (CNN) — A Utah man promised investors his business could turn dirt into gold and swindled millions of dollars from them over several years, according to federal officials. Now, he has been sentenced to prison for his role in an $8 million telemarketing fraud scheme.

(CNN) — A Utah man promised investors his business could turn dirt into gold and swindled millions of dollars from them over several years, according to federal officials. Now, he has been sentenced to prison for his role in an $8 million telemarketing fraud scheme. JPMorgan Chase treated indicted employees better than an executive who cooperated with federal investigators, according to a lawsuit.

JPMorgan Chase treated indicted employees better than an executive who cooperated with federal investigators, according to a lawsuit. EL PASO, Texas (KTSM) — It might look like the women from Bravo’s “Real Housewives” franchises have it all, but a recent arrest of one star is shedding light on criminal schemes across the country.

EL PASO, Texas (KTSM) — It might look like the women from Bravo’s “Real Housewives” franchises have it all, but a recent arrest of one star is shedding light on criminal schemes across the country.  Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money laundering procedures at its Singapore casino, which has already been the target of probes by U.S. officials and local police.

Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money laundering procedures at its Singapore casino, which has already been the target of probes by U.S. officials and local police. Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money-laundering procedures at its Singapore casino, which has already been the target of probes by US officials and local police.

Las Vegas Sands Corp. set up a special committee to look into potential breaches of anti-money-laundering procedures at its Singapore casino, which has already been the target of probes by US officials and local police.