EU to name and shame banks that fail to fight money laundering

Jon Ihle, 08 May 2021

The European Banking Authority (EBA) is setting up a centralised database to name and shame financial institutions in the EU that have weak anti-money laundering (AML) controls.

The European Banking Authority (EBA) is setting up a centralised database to name and shame financial institutions in the EU that have weak anti-money laundering (AML) controls.

The EBA, which is responsible for creating a single rulebook for bank regulation in the EU, said the new database would be a “key tool” for coordinating the fight against money laundering and terrorist financing. Continue reading “Article: EU to name and shame banks that fail to fight money laundering”

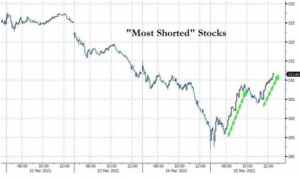

Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain

Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain