14 Critical Lessons Investors Can Learn From The GameStop Story

Forbes Finance Council, 20 April 2021

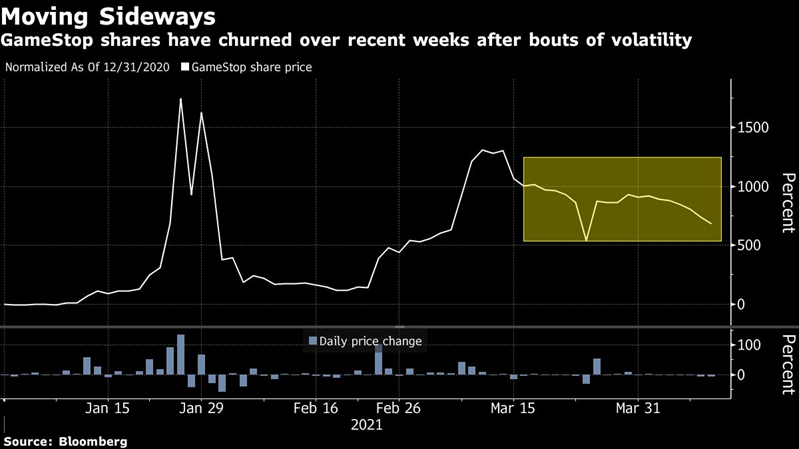

Investing in the stock market comes with risks, especially in the age of social media. Valuable information that every investor should be aware of—including the occasional volatility of the stock market as well as investment nuances such as short selling—came into the spotlight recently when Redditors banded together to inflate the prices of retailer GameStop’s (GME) stock.

As well as serving as a refresher on stock market basics, the GameStop situation is also a signpost pointing to emerging trends in investment and fintech. Current and would-be stock market investors can take away some important lessons from this story. Below, 14 members of Forbes Finance Council share what every investor should learn from the GameStop stock saga.

The elite investor David Einhorn blasted market regulators, accused Elon Musk and Chamath Palihapitiya of juicing assets, and praised the GameStop champion Keith Gill in a letter to Greenlight Capital investors this week.

The elite investor David Einhorn blasted market regulators, accused Elon Musk and Chamath Palihapitiya of juicing assets, and praised the GameStop champion Keith Gill in a letter to Greenlight Capital investors this week. (The Senate is expected to confirm Gary Gensler as the new chairman of the Securities and Exchange Commission on Wednesday, and crypto assets — including bitcoin — are likely high on his agenda.

(The Senate is expected to confirm Gary Gensler as the new chairman of the Securities and Exchange Commission on Wednesday, and crypto assets — including bitcoin — are likely high on his agenda. The Reddit revolution in the US has drawn attention to the potential power that a growing force of retail investors can wield in stock markets when equipped by social media.

The Reddit revolution in the US has drawn attention to the potential power that a growing force of retail investors can wield in stock markets when equipped by social media. (Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst.

(Bloomberg) — GameStop Corp.’s Reddit-fueled trading surge is likely going to fade as threats from digital game downloads sink in, according to one skeptical Wall Street analyst. The GameStop saga stopped the stock market in its tracks earlier this year, with wealthy hedge funds losing millions of pounds. The move was orchestrated on a subreddit thread, with vast numbers of average investors joining forces to push up the share price.

The GameStop saga stopped the stock market in its tracks earlier this year, with wealthy hedge funds losing millions of pounds. The move was orchestrated on a subreddit thread, with vast numbers of average investors joining forces to push up the share price. Shares in GameStop fell on Monday after the video-game retailer said it may sell up to $1bn (£720m) worth of stock as it tries to make the best of the 900% surge in its shares from a Reddit-driven rally this year.

Shares in GameStop fell on Monday after the video-game retailer said it may sell up to $1bn (£720m) worth of stock as it tries to make the best of the 900% surge in its shares from a Reddit-driven rally this year. More than 2 months have passed since Robinhood shut off trading in Gamestop while the firm’s shares soared past the $400 mark, marking a historic confrontation between an army of GME-hodling “apes” and hedge funds like Melvin Capital, not to mention the mighty hedge fund-market maker Citadel, that would cement GME’s status as a favorite of the “Wall Street Bets” retail-trading army.

More than 2 months have passed since Robinhood shut off trading in Gamestop while the firm’s shares soared past the $400 mark, marking a historic confrontation between an army of GME-hodling “apes” and hedge funds like Melvin Capital, not to mention the mighty hedge fund-market maker Citadel, that would cement GME’s status as a favorite of the “Wall Street Bets” retail-trading army.