Want to Make $1 Million? Market Manipulation Is Back! (Thanks to Social Media)

Thomas Yeung, 16 July 2021

When Keith “Roaring Kitty” Gill announced he was buying GameStop (NYSE:GME) shares and options on Reddit’s r/WallStreetBets, regulators might have considered his outrageous claims as parody — speech protected by First Amendment rights. Who could take $20 calls on GME seriously when the stock was trading at $5?

When Keith “Roaring Kitty” Gill announced he was buying GameStop (NYSE:GME) shares and options on Reddit’s r/WallStreetBets, regulators might have considered his outrageous claims as parody — speech protected by First Amendment rights. Who could take $20 calls on GME seriously when the stock was trading at $5?

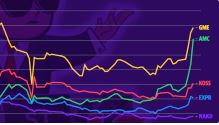

Since then, other social media forums have blurred the lines between satire and intentional deception. This week, shares in SCWorks (NASDAQ:WORX) doubled after traders on Discord and Twitter banded together to push prices higher. MINM, DTSS and an alphabet soup of other small-cap stocks have followed the same path Continue reading “Article: Want to Make $1 Million? Market Manipulation Is Back! (Thanks to Social Media)”

In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing.

In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing. Keith Patrick Gill (born June 8, 1986) is an American financial analyst and investor known for his posts on the subreddit r/wallstreetbets

Keith Patrick Gill (born June 8, 1986) is an American financial analyst and investor known for his posts on the subreddit r/wallstreetbets At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling. One of the most outspoken retail traders on Reddit’s WallStreetBets discussion board has been targeted in a proposed class-action lawsuit alleging the 34-year-old securities broker behind the widely followed “Roaring Kitty” persona committed securities fraud for misrepresenting himself as an amateur trader online while pumping up GameStop stock prices.

One of the most outspoken retail traders on Reddit’s WallStreetBets discussion board has been targeted in a proposed class-action lawsuit alleging the 34-year-old securities broker behind the widely followed “Roaring Kitty” persona committed securities fraud for misrepresenting himself as an amateur trader online while pumping up GameStop stock prices. Lawsuits related to the Gamestop Corporation GME 0.1% short squeeze have been stacking up following the volatile trading in the stock in January.

Lawsuits related to the Gamestop Corporation GME 0.1% short squeeze have been stacking up following the volatile trading in the stock in January.