Indian-Origin Husband Of Ex-Amazon Employee Jailed For Securities Fraud In US

Press Trust of India, 14 June 2021

Washington: The Indian-origin husband of a former Amazon employee has been sentenced to 26 months in prison by a US court for securities fraud and illegally making a profit of USD 1.4 million by using inside trading information from his wife.

Washington: The Indian-origin husband of a former Amazon employee has been sentenced to 26 months in prison by a US court for securities fraud and illegally making a profit of USD 1.4 million by using inside trading information from his wife.

Viky Bohra, 37, from Bothell, Washington state, pleaded guilty in November 2020, admitting that between 2016 and 2018, he used Amazon inside information he obtained from his wife, an Amazon finance employee, to place trades in Amazon stock-making a profit of $1.4 million, acting US Attorney Tessa M Gorman said. Continue reading “Article: Indian-Origin Husband Of Ex-Amazon Employee Jailed For Securities Fraud In US”

Money managers intimate a growing confidence that oil prices have room to run higher this year, thanks to expectations of a robust economic rebound and rising global demand for crude.

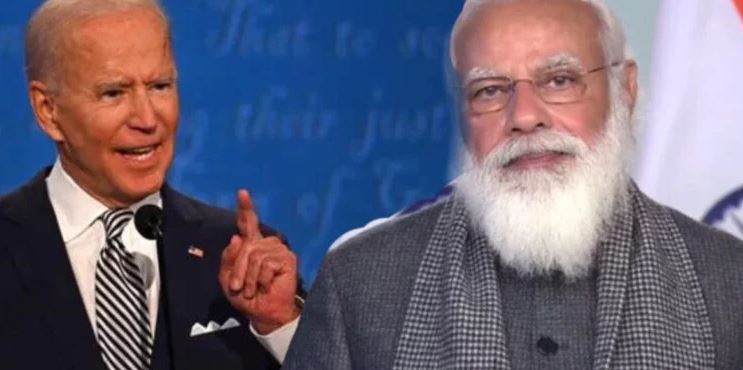

Money managers intimate a growing confidence that oil prices have room to run higher this year, thanks to expectations of a robust economic rebound and rising global demand for crude.  Colombo, May 1: India and the US have designated themselves as “strategic partners” with political, economic and military dimensions to the relationship. But the partnership has kept coming under strain.

Colombo, May 1: India and the US have designated themselves as “strategic partners” with political, economic and military dimensions to the relationship. But the partnership has kept coming under strain. The Reserve Bank of India restricted American Express Banking Corp. and Diners Club International Ltd. from adding new local customers, citing non-compliance with data-storage rules.

The Reserve Bank of India restricted American Express Banking Corp. and Diners Club International Ltd. from adding new local customers, citing non-compliance with data-storage rules. America’s decision to place India on its currency manipulator’s watchlist is ludicrous. The US Fed’s policy of keeping interest rates ultra-low, along with America’s allies in Europe and Japan, is responsible for both the dollar’s plunge and surging flows of capital to emerging markets, like India, in search of reasonable returns. These capital inflows make the rupee appreciate out of line with real economy concerns. Seen from India’s perspective, the US should be pointing fingers at itself when it comes to currency manipulation.

America’s decision to place India on its currency manipulator’s watchlist is ludicrous. The US Fed’s policy of keeping interest rates ultra-low, along with America’s allies in Europe and Japan, is responsible for both the dollar’s plunge and surging flows of capital to emerging markets, like India, in search of reasonable returns. These capital inflows make the rupee appreciate out of line with real economy concerns. Seen from India’s perspective, the US should be pointing fingers at itself when it comes to currency manipulation. India does not see any logic in the United States putting it on a monitoring list of currency manipulators, a trade ministry official said on Tuesday.

India does not see any logic in the United States putting it on a monitoring list of currency manipulators, a trade ministry official said on Tuesday.