South Korea’s retail investor army declares war on short-sellers

Song Jung-a, 25 April 2021

Jung Eui-Jung, a former South Korean bank employee, recalls his bitter experience as a novice stock trader more than a decade ago, when he lost Won25m ($22,000) after the small metal group he invested in was delisted.

Jung Eui-Jung, a former South Korean bank employee, recalls his bitter experience as a novice stock trader more than a decade ago, when he lost Won25m ($22,000) after the small metal group he invested in was delisted.

“It is the past that I want to forget. Back then, I didn’t have much access to information. I was bound to lose in an environment tilted against amateur traders,” said the 62-year-old head of the Korean Stockholders’ Alliance, an advocacy group that represents about 44,000 retail investors.

But the tables have turned over the past year as retail investors have emerged as the dominant force in South Korea’s $2tn stock market, accounting for almost 60 per cent of daily turnover. With that heft, amateur traders have become a political force, seeking to even the odds against professional investors.

Mom-and-pop investors bought a net Won63.9tn of Korean shares last year, compared with a net sale of Won5.5tn in 2019. That helped propel the benchmark Kospi index up 118 per cent following a coronavirus-driven sell-off last March, making it one of the best-performing markets globally.

Almost one-fifth of Korea’s population of 52m dabbles in stocks, and data showed local brokerages have amassed Won76tn in cash deposits.

“The market dynamic is changing fast with individual investors becoming a powerful force that even hedge funds should be afraid of,” said Albert Yong, managing director at Petra Capital Management, a Seoul-based investment firm.

Read Full Article

On Monday February 27th, 2012, WikiLeaks began publishing The Global Intelligence Files, over five million e-mails from the Texas headquartered “global intelligence” company Stratfor. The e-mails date between July 2004 and late December 2011. They reveal the inner workings of a company that fronts as an intelligence publisher, but provides confidential intelligence services to large corporations, such as Bhopal’s Dow Chemical Co., Lockheed Martin, Northrop Grumman, Raytheon and government agencies, including the US Department of Homeland Security, the US Marines and the US Defence Intelligence Agency. The emails show Stratfor’s web of informers, pay-off structure, payment laundering techniques and psychological methods.

On Monday February 27th, 2012, WikiLeaks began publishing The Global Intelligence Files, over five million e-mails from the Texas headquartered “global intelligence” company Stratfor. The e-mails date between July 2004 and late December 2011. They reveal the inner workings of a company that fronts as an intelligence publisher, but provides confidential intelligence services to large corporations, such as Bhopal’s Dow Chemical Co., Lockheed Martin, Northrop Grumman, Raytheon and government agencies, including the US Department of Homeland Security, the US Marines and the US Defence Intelligence Agency. The emails show Stratfor’s web of informers, pay-off structure, payment laundering techniques and psychological methods.

The American father-son duo charged with helping former Nissan Motor Co. Chairman Carlos Ghosn flee trial in Japan a year and a half ago pleaded guilty in a Tokyo court Monday.

The American father-son duo charged with helping former Nissan Motor Co. Chairman Carlos Ghosn flee trial in Japan a year and a half ago pleaded guilty in a Tokyo court Monday. Two Americans charged with helping former Nissan Motor Co. Chairman Carlos Ghosn flee trial in Japan a year-and-a-half ago are now set to appear at their own hearing at the Tokyo District Court on Monday.

Two Americans charged with helping former Nissan Motor Co. Chairman Carlos Ghosn flee trial in Japan a year-and-a-half ago are now set to appear at their own hearing at the Tokyo District Court on Monday. Toshiba’s top executives once wrote in an email asking government officials to “defeat” hedge funds. Demand reported in an independent survey of shareholder consignments shows why shareholder activists rarely succeed in Japan.

Toshiba’s top executives once wrote in an email asking government officials to “defeat” hedge funds. Demand reported in an independent survey of shareholder consignments shows why shareholder activists rarely succeed in Japan. However loudly U.S. politicians vow to compete with China, they seem happy to quit the field and let Beijing win in one crucial area: trade. If President Joe Biden hopes to build a coalition in Asia to counterbalance China’s rise, he can’t afford such defeatism.

However loudly U.S. politicians vow to compete with China, they seem happy to quit the field and let Beijing win in one crucial area: trade. If President Joe Biden hopes to build a coalition in Asia to counterbalance China’s rise, he can’t afford such defeatism. HONG KONG — Suncity Group, the Macao-based gambling company, has pulled out of the running for rights to run a casino resort in Japan.

HONG KONG — Suncity Group, the Macao-based gambling company, has pulled out of the running for rights to run a casino resort in Japan. The battering to Wall Street banks from Archegos Capital Management topped $10 billion after UBS Group AG and Nomura Holdings, Inc. reported fresh hits caused by the fund’s collapse.

The battering to Wall Street banks from Archegos Capital Management topped $10 billion after UBS Group AG and Nomura Holdings, Inc. reported fresh hits caused by the fund’s collapse. Jung Eui-Jung, a former South Korean bank employee, recalls his bitter experience as a novice stock trader more than a decade ago, when he lost Won25m ($22,000) after the small metal group he invested in was delisted.

Jung Eui-Jung, a former South Korean bank employee, recalls his bitter experience as a novice stock trader more than a decade ago, when he lost Won25m ($22,000) after the small metal group he invested in was delisted. America’s decision to place India on its currency manipulator’s watchlist is ludicrous. The US Fed’s policy of keeping interest rates ultra-low, along with America’s allies in Europe and Japan, is responsible for both the dollar’s plunge and surging flows of capital to emerging markets, like India, in search of reasonable returns. These capital inflows make the rupee appreciate out of line with real economy concerns. Seen from India’s perspective, the US should be pointing fingers at itself when it comes to currency manipulation.

America’s decision to place India on its currency manipulator’s watchlist is ludicrous. The US Fed’s policy of keeping interest rates ultra-low, along with America’s allies in Europe and Japan, is responsible for both the dollar’s plunge and surging flows of capital to emerging markets, like India, in search of reasonable returns. These capital inflows make the rupee appreciate out of line with real economy concerns. Seen from India’s perspective, the US should be pointing fingers at itself when it comes to currency manipulation. Japan is on the ‘monitor’ list having satisfied 2 of the 3 US criteria, along with other countries. You can find more on the report here:

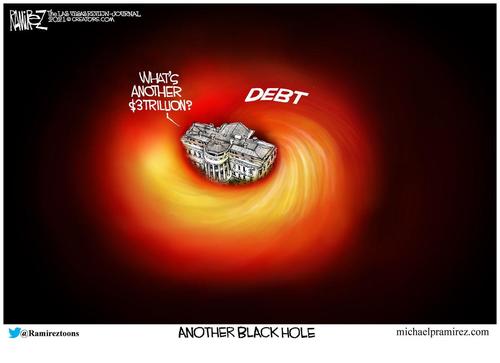

Japan is on the ‘monitor’ list having satisfied 2 of the 3 US criteria, along with other countries. You can find more on the report here: “We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

“We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

SoftBank Group Corp. said today it has invested $2.8 billion to acquire a 40% stake in Norwegian warehouse automation company AutoStore AS.

SoftBank Group Corp. said today it has invested $2.8 billion to acquire a 40% stake in Norwegian warehouse automation company AutoStore AS.