Why did Interactive Brokers restrict trading in GameStop and other companies?

George Sweeney, 29 January 2021

What is happening to GameStop shares?

GameStop shares have been hitting the news quite a lot recently. At first, it was simply due to their astronomical rise in value. Then people started looking into why the price was rising so much. After all, GameStop is a video game retailer that has been hit hard by the coronavirus pandemic and downloadable games.

Because of all the bad luck surrounding the company, they were one of the most shorted companies in the market. Short selling is when traders buy a company’s shares and then sell them, believing that their price will go down before they buy them back for a profit.

Why are there restrictions?

The reasons for the restrictions vary. Interactive Brokers have said their restrictions were created in order to protect the market and make sure there was enough liquidity.

Another concern they have is that they’ll be left to pick up the bill if their customers end up with big losses. That is why they’re increasing the minimum requirements people must meet in order to borrow money to trade.

If these shares all spiral down at the same time, their fear is that many traders won’t be able to pay back the money they’re borrowing for trading.

Other platforms have said they are using restrictions to:

Stop their service becoming overloaded. Provide some breathing room to maintain everything and look after other customers. Prevent investors losing lots of money during unusual volatility. Make sure they meet any regulatory requirements in their country.

However, some argue that limiting people’s ability to trade shares like GameStop freely is effectively market manipulation because: Many traders accept the volatility risk. Brokers are potentially limiting trading because of their own liquidity issues. Investors are not being allowed full control over their investments

Read Full Article

What happened

What happened

About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game.

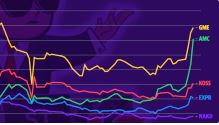

About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game. In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing.

In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing.