JP Morgan Chase, Bernie Madoff’s $64.8 Billion Ponzi Scheme and Crime on Wall Street

Dennis M. Kelleher, 06 December 2017

As the headlines have made clear for years, JP Morgan Chase has a long rap sheet of illegal conduct and, although overlooked, it includes enabling Bernie Madoff’s $64.8 billion Ponzi scheme, the largest in history, which caused net losses of more than $17 billion and untold human wreckage.

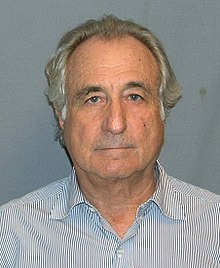

Six years ago on December 11, 2008, federal agents arrested Madoff, the ringleader of the Ponzi scheme — as a coda to an age of regulator and prosecutorial incompetence and neglect, Madoff was not caught; he was arrested after turning himself in. This happened in the middle of the largest financial crash since 1929, when the country’s economy was collapsing and when a second Great Depression was a very real possibility. Although not responsible for the crash and collapse, Madoff in handcuffs was in some ways the face of Wall Street greed and criminality.

However, that is a false and misleading picture of crime on Wall Street.

After all, how could this one guy possibly pull off such a crime and at that scale and for so long? He couldn’t have and didn’t. Like most substantial illegal and criminal financial activities, Madoff had a very close relationship with a big Wall Street bank: JP Morgan Chase, the country’s largest bank. Given the focus on the crash and economic calamity in 2008 and JP Morgan Chase’s years-long efforts to prevent any information from being publicly disclosed, JP Morgan’s role in enabling this massive crime wasn’t publicly known for years.

That veil of secrecy ended when a compliant was filed by a court appointed trustee to recover funds for the thousands of injured investors, as summarized in this article: “Trustee: JP Morgan Abetted Madoff.“ In the complaint, the trustees alleged that JP Morgan Chase “was at the very center of the fraud, and thoroughly complicit in it.” JP Morgan Chase, the complaint stated, “turned a blind eye to” Madoff’s fraud.”

Madoff’s decades long fraudulent scheme resulted in the loss of “$64.8 billion in paper wealth and at least $17.5 billion in cash losses.“ The second, third and fourth largest Ponzi scheme losses in history collectively only amounted to 60% of what Madoff stole. While this was happening, JP Morgan made hundreds of millions of dollars from “servicing” Madoff’s accounts and saved itself another $276 million invested with Madoff by remarkably well-timed withdrawals, conveniently just before the scheme was revealed. All of this is documented in the complaint.

Moreover, there is clear information that JP Morgan Chase, including senior officials in compliance and elsewhere, knew about the Ponzi scheme long before Madoff decided to turn himself in. In fact, it appears that JP Morgan Chase “ignored red flags for about 15 years“ that Madoff used JP Morgan Chase accounts to run his fraudulent scheme. Just one egregious example: the complaint quotes (p. 31+) from a June 15, 2007 email from John Hogan, Chief Risk Officer, Investment Bank, JP Morgan Chase to Matt Zames, a senior executive and head of several business lines, stating:

“For whatever its worth, I am sitting at lunch with Matt Zames who just told me that there is a well-known cloud over the head of Madoff and that his returns are speculated to be part of a [P]onzi scheme….”

Read Full Article

CEOs from the six largest banks on Wall Street testified under oath yesterday before the House Financial Services Committee. But only one CEO, Jamie Dimon, had an ear-piercing electronic sound emanate from his microphone, which blocked out the sound of his voice, when he was asked key questions by two separate members of Congress.

CEOs from the six largest banks on Wall Street testified under oath yesterday before the House Financial Services Committee. But only one CEO, Jamie Dimon, had an ear-piercing electronic sound emanate from his microphone, which blocked out the sound of his voice, when he was asked key questions by two separate members of Congress.

A Cayman Islands investment fund urged the highest court for overseas British territories on Tuesday to revive its breach of contract claim against Bank of Bermuda and an HSBC subsidiary for $2 billion in damages as the result of losses from Bernie Madoff’s massive Ponzi scheme.

A Cayman Islands investment fund urged the highest court for overseas British territories on Tuesday to revive its breach of contract claim against Bank of Bermuda and an HSBC subsidiary for $2 billion in damages as the result of losses from Bernie Madoff’s massive Ponzi scheme. When Bernard Madoff’s Ponzi scheme collapsed in December 2008, $65bn vanished overnight, devastating tens of thousands of small investors, charities and religious groups who continue to struggle to this day.

When Bernard Madoff’s Ponzi scheme collapsed in December 2008, $65bn vanished overnight, devastating tens of thousands of small investors, charities and religious groups who continue to struggle to this day. Bernard Lawrence Madoff (

Bernard Lawrence Madoff (