Iron ore’s most volatile week: How we got here and what comes next

Peter Hannah, 18 May 2021

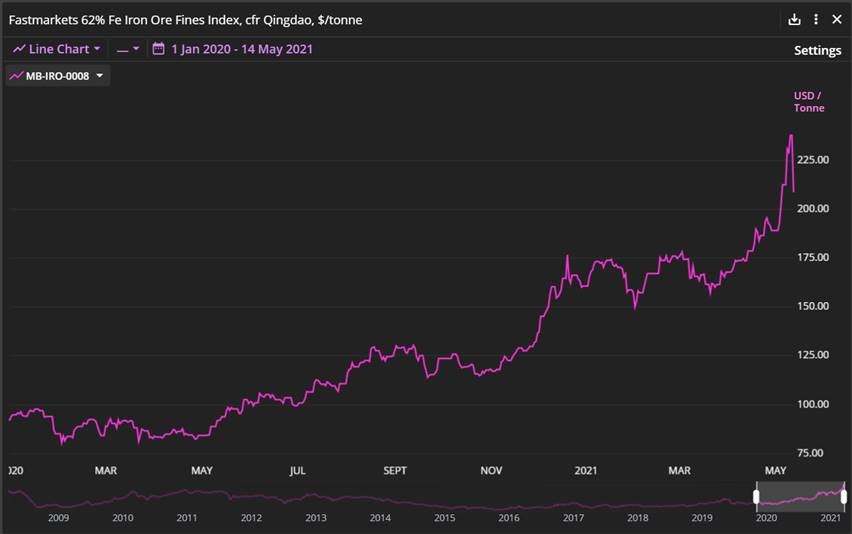

How did we get here? Of course, steel demand and iron ore supply do not change by multiple percentages over these daily timeframes. Mature markets trade as much on expectation as on current fundamentals, and changes in sentiment triggered by news and gossip can drive jarring session-to-session swings. However, panning out to a noise-reducing resolution, the explanations for iron ore’s current high price levels are very apparent.

How did we get here? Of course, steel demand and iron ore supply do not change by multiple percentages over these daily timeframes. Mature markets trade as much on expectation as on current fundamentals, and changes in sentiment triggered by news and gossip can drive jarring session-to-session swings. However, panning out to a noise-reducing resolution, the explanations for iron ore’s current high price levels are very apparent.

Regular attendees to industry conferences in recent years will have repeatedly heard the major iron ore producers laying out supply plans based on anticipations of Chinese crude steel production reaching the mythical 1-billion-tonne-per-year mark by 2025 at the earliest. Not only was that level exceeded a full five years sooner in 2020, but various production issues meant that iron ore supply also undershot projections. Continue reading “Article: Iron ore’s most volatile week: How we got here and what comes next”