Man Group Dials Up Short Bets as Turkey Stirs Fragile Five Fears

Ben Bartenstein, 03 April 2021

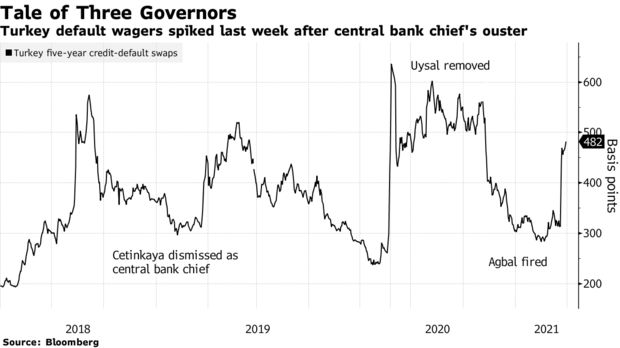

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

Doomsayers including Man Group Plc, the world’s biggest publicly listed hedge-fund firm, and the Institute of International Finance’s chief economist Robin Brooks warn that the turmoil battering Turkish securities could ripple across emerging markets in a repeat of the 2013 taper tantrum. Yet that gloomy scenario isn’t the dominant narrative in the hallways of Pacific Investment Management Co., BlackRock Inc. and Ashmore Group Plc, which have some of the largest exposures to the nations that might be next in the crosshairs. Continue reading “Article: Man Group Dials Up Short Bets as Turkey Stirs Fragile Five Fears”