The Firm Behind The $30 Billion Firesale Shaking Financial Markets Disclosed Almost Nothing

Antoine Gara, 28 March 2021

Up until recently, the website of Archegos Capital Management, the firm behind a reported $30 billion financial firesale that is battering stocks worldwide, contained a giant image of Central Park. The vista displayed on Archegos’ webpage was a fitting homage to the views of its offices atop a Manhattan skyscraper on 57th street, until the site was taken down as the firm gets liquidated.

Archegos was a giant in U.S. financial markets, apparently holding tens of billions of dollars in securities, including massive exposures to companies like ViacomCBS, Discovery Communications and Baidu. It traded with Wall Street’s largest brokerages, and was headquartered at an expensive address housing many powerhouse investment firms. But when it came to routine financial disclosures, Archegos was virtually non-existent.

Forbes searched for a trace of Archegos on the Securities and Exchange Commission’s repository for securities filings, called EDGAR, short for Electronic Data Gathering, Analysis, and Retrieval. Amazingly, almost nothing came up. Continue reading “Article: The Firm Behind The $30 Billion Firesale Shaking Financial Markets Disclosed Almost Nothing”

The Supreme Court is set to hear arguments from Goldman Sachs in a long-running case that could have major implications for shareholders seeking to bring securities-fraud lawsuits.

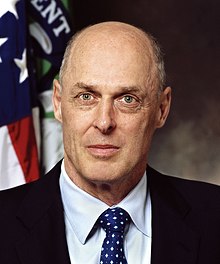

The Supreme Court is set to hear arguments from Goldman Sachs in a long-running case that could have major implications for shareholders seeking to bring securities-fraud lawsuits. Henry Merritt “Hank” Paulson Jr. (born March 28, 1946) is an American banker who served as the 74th United States Secretary of the Treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson was the chairman and chief executive officer (CEO) of Goldman Sachs..

Henry Merritt “Hank” Paulson Jr. (born March 28, 1946) is an American banker who served as the 74th United States Secretary of the Treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson was the chairman and chief executive officer (CEO) of Goldman Sachs..