Assets recovered from Tom Petters Ponzi scheme reach $722 million

Dana Thiede, 15 June 2021

MINNEAPOLIS — A bankruptcy trustee’s search to recover assets linked to one of the largest financial crimes in Minnesota’s history has netted $722 million.

MINNEAPOLIS — A bankruptcy trustee’s search to recover assets linked to one of the largest financial crimes in Minnesota’s history has netted $722 million.

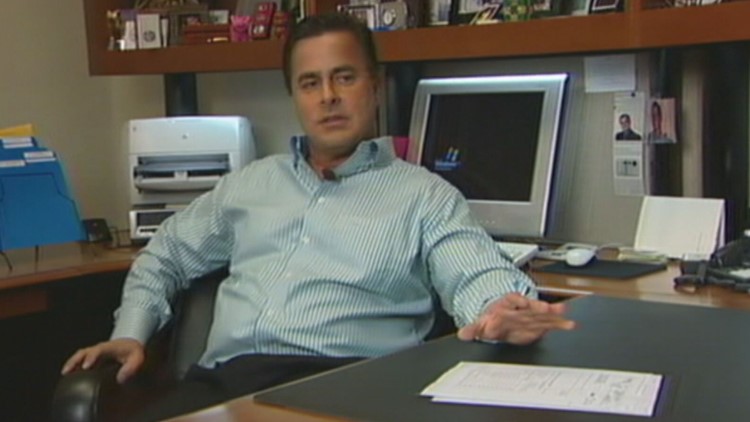

Doug Kelley says his work to collect assets from Tom Petters’ $1.9 billion Ponzi scheme is nearly done, 13 years after the search began.

Petters, now 63, was indicted in 2008 on multiple counts of mail fraud, wire fraud, money laundering and conspiracy for operating a scheme which spanned 26 countries, including the the Cayman Islands, Germany and Switzerland. Continue reading “Article: Assets recovered from Tom Petters Ponzi scheme reach $722 million”

Doug Kelley has been working since 2008 to help organizations and individuals who lost billions in the Twin Cities businessman Tom Petters’ Ponzi scheme, the biggest financial crime in Minnesota history.

Doug Kelley has been working since 2008 to help organizations and individuals who lost billions in the Twin Cities businessman Tom Petters’ Ponzi scheme, the biggest financial crime in Minnesota history.