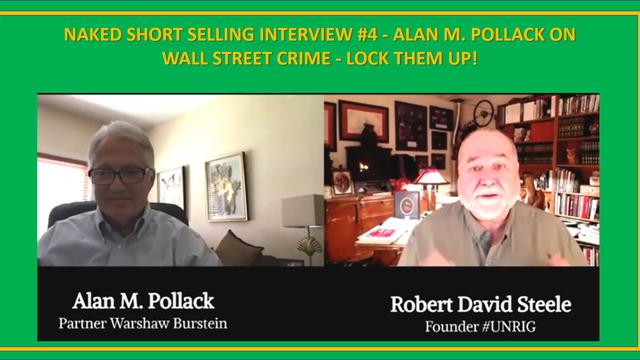

Lawyer: Alan M. Pollack

Lawyer Alan M. Pollack

Alan M. Pollack

Partner, Washaw Burnstein

Among multiple areas of interest:

Represented defrauded investors in naked-short selling and stock manipulation cases brought against major investment banks under RICO and the federal securities laws.

Paper: Market Manipulation and Directors Fiduciary Duty of Care

PaperMarket Manipulation and Directors Fiduciary Duty of Care

Market manipulation of emerging or small cap companies is pervaasive on Wall Street and according to the SEC has increased over 37% in the last decade. The nature and scope of market manipulation schemes is limited only by the creativity and audacity of their perpetrators. While the substance and mechanics of market manipulation schemes may differ, the objective is the same – to inject false information into the marketplace that artificially affects the price of the target companies securities by “interfering with the natural interplay of the forces of supply and demand.” The proliferation of market manipulation scshemes has created challenging risk-management and best practice issues for the directors of targeted companies, which require directors to continuously assess the nature and scope of their fiduciary duty of care.

Continue reading “Paper: Market Manipulation and Directors Fiduciary Duty of Care”

Article: The ‘Phantom Shares’ Menace

Article - MediaThe ‘Phantom Shares’ Menace

John W. Welborn

Securities & Exchange, 24 April 2008

In 1985, the National Association of Securities Dealers (nasd) commissioned Irving M. Pollack, a securities law expert and former Securities and Exchange commissioner, to conduct a comprehensive review of short selling in nasdaq securities. The nasd sought to determine what, if any, additional short selling regulation was needed for the nasdaq market. The result was the now-famous “Pollack Study,” which described the short selling landscape of the day and made important recommendations regarding the disclosure, reporting, and settlement of short sales.

PDF (10 pages): The ‘Phantom Shares’ Menace