BoJo Launches Investigation Into Cameron’s Lobbying On Behalf Of Greensill

TYLER DURDEN, 13 April 2021

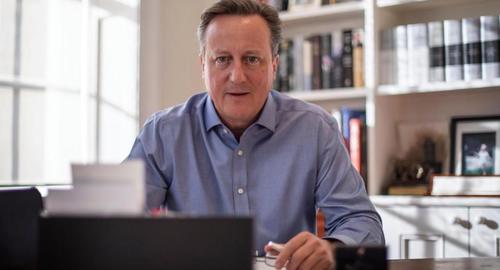

For British PM Boris Johnson, the fallout from the collapse of Greensill has been akin to being gifted a golden saucer filled with excrement. At the time, BoJo apparently didn’t see anything wrong with facilitating the lobbying objectives of one of his predecessors, former PM David Cameron. But now that the British tabloid press has sicced the hounds on the PM, he has apparently realized it’s time for some damage control.

For British PM Boris Johnson, the fallout from the collapse of Greensill has been akin to being gifted a golden saucer filled with excrement. At the time, BoJo apparently didn’t see anything wrong with facilitating the lobbying objectives of one of his predecessors, former PM David Cameron. But now that the British tabloid press has sicced the hounds on the PM, he has apparently realized it’s time for some damage control.

To wit, the FT reports that Downing Street and the Cabinet Office have launched a wide-ranging investigation after acknowledging that there was “significant interest in this matter.” Continue reading “Article: BoJo Launches Investigation Into Cameron’s Lobbying On Behalf Of Greensill”

No 10 is to a launch an independent investigation into former prime minister David Cameron’s lobbying for the now-collapsed Greensill and the role of the scandal-hit financier Lex Greensill in government.

No 10 is to a launch an independent investigation into former prime minister David Cameron’s lobbying for the now-collapsed Greensill and the role of the scandal-hit financier Lex Greensill in government. By now, the British media has been inundated with reports about the special access afforded Greensill Capital, the trade-finance firm that collapsed and filed for administration three weeks ago after its main insurer declined to renew policies on some of Greensill’s assets, setting off a chain reaction that ensnared some of Europe’s biggest banks (including the embattled Credit Suisse, which is simultaneously fighting off another scandal in the Archegos Capital blowup).

By now, the British media has been inundated with reports about the special access afforded Greensill Capital, the trade-finance firm that collapsed and filed for administration three weeks ago after its main insurer declined to renew policies on some of Greensill’s assets, setting off a chain reaction that ensnared some of Europe’s biggest banks (including the embattled Credit Suisse, which is simultaneously fighting off another scandal in the Archegos Capital blowup).