Cannabis Banking Is Happening Despite No Official Legislation In Place

J. Samuel, 19 July 2021

There has been an increase of banks and credits unions that have spoken on working with cannabis businesses. In recent times reports have come out about how these financial institutes have remained stable over the last quarter. This updated info has come from published federal data.

There has been an increase of banks and credits unions that have spoken on working with cannabis businesses. In recent times reports have come out about how these financial institutes have remained stable over the last quarter. This updated info has come from published federal data.

Going back from the last 3 quarters of 2020 those states have been falling consistently. This is partially happening because of overhauled reporting requirements from the Financial Crimes Enforcement Network. As well this is also due to the coronavirus pandemic. Yet things seem to have been sustainable over the most recent two quarters. Continue reading “Article: Cannabis Banking Is Happening Despite No Official Legislation In Place”

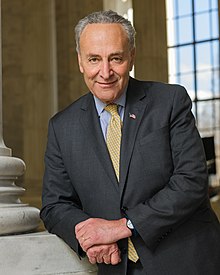

Charles Ellis Schumer ((/ˈʃuːmər/ SHOO-mər; born November 23, 1950) is an American politician serving as Senate Majority Leader since January 20, 2021.

Charles Ellis Schumer ((/ˈʃuːmər/ SHOO-mər; born November 23, 1950) is an American politician serving as Senate Majority Leader since January 20, 2021.