Are Oil Prices Headed toward $100 a Barrel?

nasdaq, 12 June 2021

On June 1, 2021, Jeremy Schwartz, Global Head of Research a

On June 1, 2021, Jeremy Schwartz, Global Head of Research a

t WisdomTree and regular host of the Behind the Markets podcast, was joined by Mobeen Tahir, Associate Director of Research at WisdomTree, to host Erik Gilje, professor of finance at the University of Pennsylvania’s Wharton School of Business. The topic was oil, and the focus was on Erik’s bullish view on the commodity stemming from structural supply issues in the U.S. amid an improving demand outlook.

Professor Gilje outlined that over the last decade, almost all new supply of oil has come from North America—i.e., either Canada or the U.S.—while the Organization of the Petroleum Exporting Countries and its partners (OPEC+) have lost market share. The group was forced by the COVID-19 pandemic to reduce 9.7 million barrels of supply in what can be characterized as a dramatic and unprecedented policy coordination. Continue reading “Article: Are Oil Prices Headed toward $100 a Barrel?”

Shell companies sure make strange bedfellows.

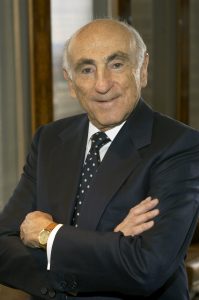

Shell companies sure make strange bedfellows. Bernard Leon Schwartz Schwartz was born in Brooklyn, New York and grew up in the Bensonhurst neighborhood of Brooklyn. Schwartz graduated from Townsend Harris High School in NYC. He holds a B.S. in finance and an honorary doctorate of science from City University of New York.[1] He is a World War II veteran, having served in the US Army Air Corps.

Bernard Leon Schwartz Schwartz was born in Brooklyn, New York and grew up in the Bensonhurst neighborhood of Brooklyn. Schwartz graduated from Townsend Harris High School in NYC. He holds a B.S. in finance and an honorary doctorate of science from City University of New York.[1] He is a World War II veteran, having served in the US Army Air Corps.