Morgan Stanley backs Bitcoin for 12 mutual funds

EXPLICA .CO, 02 April 2021

US investment bank Morgan Stanley has filed an update to its prospectus related to bitcoin (BTC) with the Securities and Exchange Commission (SEC). The institution applied for 12 of its funds to have exposure with the first cryptocurrency.

US investment bank Morgan Stanley has filed an update to its prospectus related to bitcoin (BTC) with the Securities and Exchange Commission (SEC). The institution applied for 12 of its funds to have exposure with the first cryptocurrency.

According to the bank, the funds would have indirect exposure to bitcoin in two ways: through cash-settled futures and through the Grayscale Bitcoin Trust (GBTC), one of the world’s largest trusts focused on digital assets.

On the type of futures that funds can invest in, Morgan Stanley noted: “The only bitcoin futures that a fund can invest in are cash-settled bitcoin futures that are traded on listed futures exchanges. CFTC ‘.

In the document, the bank explains that the Selected funds will be able to invest up to 25% of their assets in bitcoin. The institution also stressed that this type of operation implies a risk of illiquidity since bitcoin futures are not traded so “intensely” because they are relatively new. Continue reading “Article: Morgan Stanley backs Bitcoin for 12 mutual funds”

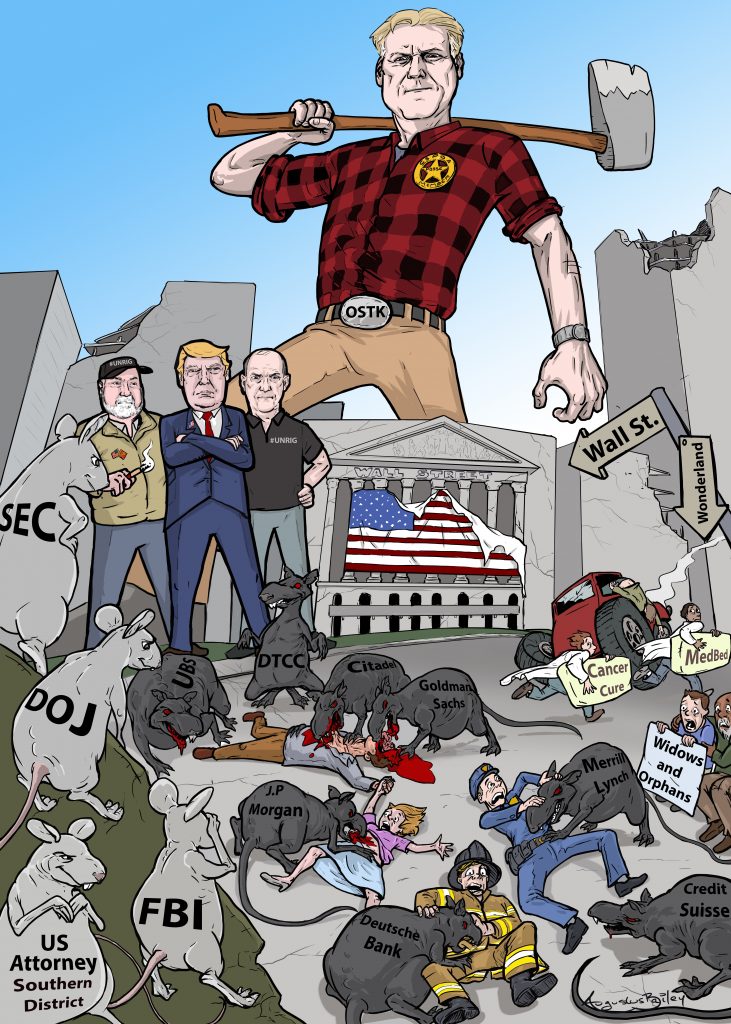

As more details from the now infamous debacle surrounding Tiger cub Archegos, whose massive derivative-based exposures spilled out into the open and transformed into the biggest and most painful rolling margin call to hit Wall Street since Lehman, we now know that at least six Prime Brokers scrambled to unwind the biggest hedge fund blowup since LTCM without hammering the overall market.

As more details from the now infamous debacle surrounding Tiger cub Archegos, whose massive derivative-based exposures spilled out into the open and transformed into the biggest and most painful rolling margin call to hit Wall Street since Lehman, we now know that at least six Prime Brokers scrambled to unwind the biggest hedge fund blowup since LTCM without hammering the overall market. The Supreme Court is set to hear arguments from Goldman Sachs in a long-running case that could have major implications for shareholders seeking to bring securities-fraud lawsuits.

The Supreme Court is set to hear arguments from Goldman Sachs in a long-running case that could have major implications for shareholders seeking to bring securities-fraud lawsuits.