S.Africa’s ex-president Zuma pleads not guilty to corruption charges

Reuters, 26 May 2021

South Africa’s former leader Jacob Zuma pleaded not guilty on Wednesday to corruption, fraud, racketeering and money laundering charges relating to a $2 billion arms deal when he was deputy president.

South Africa’s former leader Jacob Zuma pleaded not guilty on Wednesday to corruption, fraud, racketeering and money laundering charges relating to a $2 billion arms deal when he was deputy president.

Zuma, who was president between 2009-2018, faces 18 charges relating to the 1999 deal. He has rejected the charges and says he is the victim of a politically motivated witch hunt by a rival faction of the ruling African National Congress.

Zuma, who also faces a separate inquiry into corruption during his time as president, is accused of accepting 500,000 rand ($34,000) annually from French arms company Thales, in exchange for protecting the company from an investigation into the deal. Continue reading “Article: S.Africa’s ex-president Zuma pleads not guilty to corruption charges”

Blockchain evaluation agency, Chainalysis’ newest crime report has named Mirror Buying and selling Worldwide (MTI) as the largest cryptocurrency rip-off of 2020. Chainalysis arrived at this conclusion after an investigation discovered that MTI had taken in $589 million from greater than 471,000 deposits. In line with the report, MTI’s haul is considerably greater than that of Forsage and J-enco, the following greatest scams. Each scams raked in lower than $350 million every.

Blockchain evaluation agency, Chainalysis’ newest crime report has named Mirror Buying and selling Worldwide (MTI) as the largest cryptocurrency rip-off of 2020. Chainalysis arrived at this conclusion after an investigation discovered that MTI had taken in $589 million from greater than 471,000 deposits. In line with the report, MTI’s haul is considerably greater than that of Forsage and J-enco, the following greatest scams. Each scams raked in lower than $350 million every.  The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.

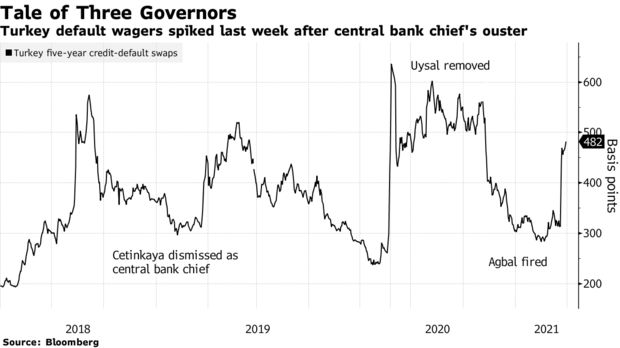

The market meltdown following Turkey’s central-bank shakeup is reviving a longtime debate among the world’s largest money managers and Ivy League economists over the vulnerability of developing nations.