S&P Settles SEC’s Stale

Valuation Charges

Credit Suisse

Alicia McElhaney, 17 May 2021

S&P Dow Jones Indices has settled with the SEC over charges that it published stale valuations of a volatility-related index.

S&P Dow Jones Indices has settled with the SEC over charges that it published stale valuations of a volatility-related index.

The Securities and Exchange Commission announced Monday that S&P had agreed to pay a $9 million fine without admitting or denying the SEC’s findings.

The regulator’s charges had centered on the S&P 500 VIX Short Term Futures Index ER, a volatility-tracking product that S&P licensed to certain issuers, including Credit Suisse, which used the S&P product for an exchange-traded note that tracked the index. Continue reading “Article: S&P Settles SEC’s Stale Valuation Charges”

Anthony Migchels: “Henry, something big happened last week: the IMF is going to give out loans in SDR. Special Drawing Rights are their currency. By itself, they’re nothing special, but the IMF has always lent in Dollars.

Anthony Migchels: “Henry, something big happened last week: the IMF is going to give out loans in SDR. Special Drawing Rights are their currency. By itself, they’re nothing special, but the IMF has always lent in Dollars. Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain

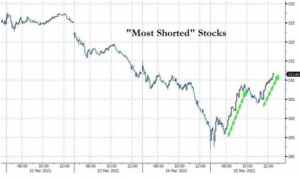

Stocks Dump’n’Pump; Dollar Gains Amid Bitcoin, Bond Pain