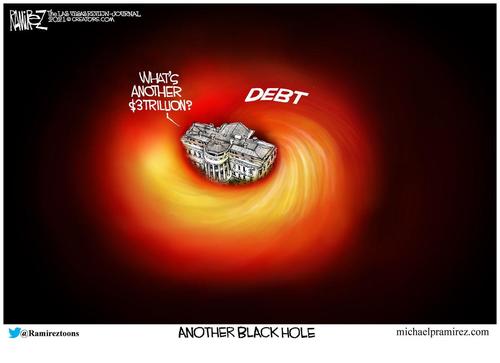

Can the US Economy Withstand a $3 Trillion Cash Injection?

Tim Fries, 12 April 2021

It is not often noted that the U.S. Treasury too injects the economy with cash flow, on top of various stimulus packages. With a precarious economic balance such as it is, excess liquidity may yet be another trigger to make inflation worse.

It is not often noted that the U.S. Treasury too injects the economy with cash flow, on top of various stimulus packages. With a precarious economic balance such as it is, excess liquidity may yet be another trigger to make inflation worse.

Controlled Demolition of the Economy

At this point, it’s safe to say this decade began with a string of anomalies colossal in scope. Novel, harsh lockdowns were introduced for a fast-spreading, largely unknown virus. This led to historic wealth transfer from workers to corporate conglomerates close to $4 trillion, not to be confused with the other historic wealth transfer from boomers to millennials. Continue reading “Article: Can the US Economy Withstand a $3 Trillion Cash Injection?”

As cases of fraud and money laundering rose during the pandemic last year, banks in the UK faced unforeseen challenges. In a new study by global analytics software provider FICO and independent research firm OMDIA, 79 per cent of respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention.

As cases of fraud and money laundering rose during the pandemic last year, banks in the UK faced unforeseen challenges. In a new study by global analytics software provider FICO and independent research firm OMDIA, 79 per cent of respondents from UK banks said that working from home had a high or major impact on the effectiveness of their financial crime prevention. Being “tough on China” is politically popular in Washington these days, and Biden has come out of the gate swinging against Beijing. But “being tough” isn’t a policy and reflexively applying it to China doesn’t serve U.S. interests. A logical and realistic approach to Beijing, however, can.

Being “tough on China” is politically popular in Washington these days, and Biden has come out of the gate swinging against Beijing. But “being tough” isn’t a policy and reflexively applying it to China doesn’t serve U.S. interests. A logical and realistic approach to Beijing, however, can. “We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

“We are now speeding down the road of wasteful spending and debt, and unless we can escape we will be smashed in inflation.”- Herbert Hoover

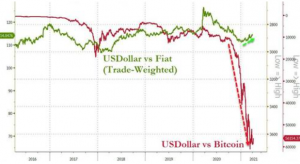

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US”

‘Pro-Crypto’ Peter Thiel Warns Bitcoin “Could Be A Chinese Financial Weapon Against The US” The GameStop saga stopped the stock market in its tracks earlier this year, with wealthy hedge funds losing millions of pounds. The move was orchestrated on a subreddit thread, with vast numbers of average investors joining forces to push up the share price.

The GameStop saga stopped the stock market in its tracks earlier this year, with wealthy hedge funds losing millions of pounds. The move was orchestrated on a subreddit thread, with vast numbers of average investors joining forces to push up the share price. XRP, the currency that runs on the digital payment platform RippleNet, hit $1 on Tuesday morning EDT, becoming the fourth highest-valued cryptocurrency with a $45.5 billion market cap despite being sued by the U.S. agency that works against market manipulation.

XRP, the currency that runs on the digital payment platform RippleNet, hit $1 on Tuesday morning EDT, becoming the fourth highest-valued cryptocurrency with a $45.5 billion market cap despite being sued by the U.S. agency that works against market manipulation.