The Reddit revolt: GameStop and the impact of social media on institutional investors

Annabel Smith, 13 April 2021

The Reddit revolution in the US has drawn attention to the potential power that a growing force of retail investors can wield in stock markets when equipped by social media.

The Reddit revolution in the US has drawn attention to the potential power that a growing force of retail investors can wield in stock markets when equipped by social media.

Amateur investors have increasingly engaged with retail platforms in the last year, partly due to the pandemic leaving them idol at home, but also due to the newfound onslaught of information through social media and access to the market through retail brokerages and platforms such as Robinhood. Continue reading “Article: The Reddit revolt: GameStop and the impact of social media on institutional investors”

Even had she not raised more money than her rivals, Tali Farhadian Weinstein would be a formidable candidate in the nine-way race to become the Manhattan district attorney, perhaps the most high-profile local prosecutor’s office in the country.

Even had she not raised more money than her rivals, Tali Farhadian Weinstein would be a formidable candidate in the nine-way race to become the Manhattan district attorney, perhaps the most high-profile local prosecutor’s office in the country. GameStop plans to elect activist investor Cohen as chairman

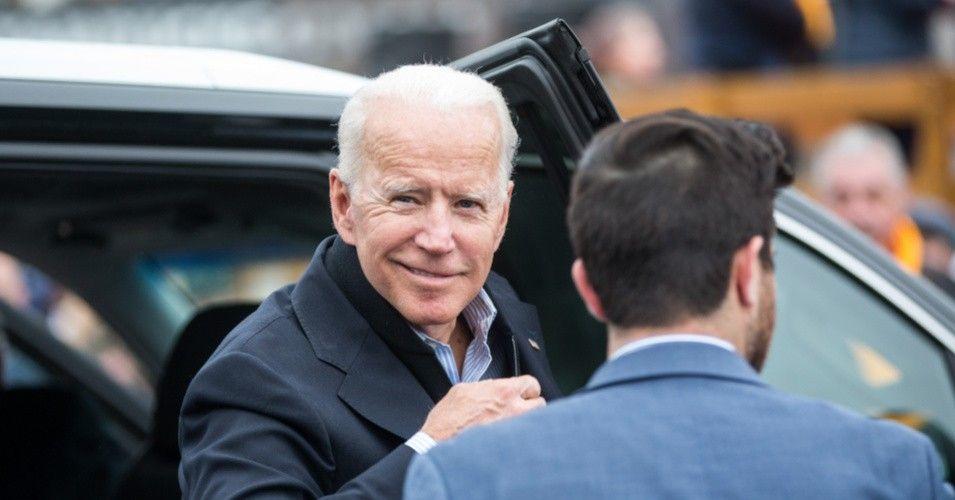

GameStop plans to elect activist investor Cohen as chairman President Biden has come under fire by House Republicans for ‘hypocritically’ using an IRS loophole to avoid paying taxes on $13 million in income for tax years 2017 and 2018, while slamming wealthy Americans for using similar schemes to minimize their tax burden, according to Fox News.

President Biden has come under fire by House Republicans for ‘hypocritically’ using an IRS loophole to avoid paying taxes on $13 million in income for tax years 2017 and 2018, while slamming wealthy Americans for using similar schemes to minimize their tax burden, according to Fox News. Anthony Migchels: “Henry, something big happened last week: the IMF is going to give out loans in SDR. Special Drawing Rights are their currency. By itself, they’re nothing special, but the IMF has always lent in Dollars.

Anthony Migchels: “Henry, something big happened last week: the IMF is going to give out loans in SDR. Special Drawing Rights are their currency. By itself, they’re nothing special, but the IMF has always lent in Dollars. In what some might take to be the latest sign of exhaustion in global equity markets, shares of Deliveroo tumbled 31% in their market debut Wednesday after pricing at the lower end of their range.

In what some might take to be the latest sign of exhaustion in global equity markets, shares of Deliveroo tumbled 31% in their market debut Wednesday after pricing at the lower end of their range. TOPLINE The Securities and Exchange Commission has opened a preliminary investigation into Sung Kook “Bill Hwang,” whose Archegos Capital Management roiled markets by defaulting on risky margin calls last week and prompted $30 billion in losses, Bloomberg reported Wednesday.

TOPLINE The Securities and Exchange Commission has opened a preliminary investigation into Sung Kook “Bill Hwang,” whose Archegos Capital Management roiled markets by defaulting on risky margin calls last week and prompted $30 billion in losses, Bloomberg reported Wednesday. It was a bleak moment for the oil industry. U.S. shale companies were failing by the dozen. Petrostates were on the brink of bankruptcy. Texas roughnecks and Kuwaiti princes alike had watched helplessly for months as the commodity that was their lifeblood tumbled to prices that had until recently seemed unthinkable. Below $50 a barrel, then below $40, then below $30.

It was a bleak moment for the oil industry. U.S. shale companies were failing by the dozen. Petrostates were on the brink of bankruptcy. Texas roughnecks and Kuwaiti princes alike had watched helplessly for months as the commodity that was their lifeblood tumbled to prices that had until recently seemed unthinkable. Below $50 a barrel, then below $40, then below $30. Imagine if Goldman Sachs GS -0.5% lent a billion dollars to RoaringKitty.

Imagine if Goldman Sachs GS -0.5% lent a billion dollars to RoaringKitty.