In-Depth: Citadel Connect and Dark Pools Uncovered

MTim Fries, 20 July 2021

Before dark pools, institutional investors had to trade in blocks of shares outside trading hours to avoid upsetting the market. Now, the utility found within dark pools is so high that some market makers have embedded them within their operations. There are certainly some benefits here in terms of increased liquidity, but there’s another side of the coin as well.

Before dark pools, institutional investors had to trade in blocks of shares outside trading hours to avoid upsetting the market. Now, the utility found within dark pools is so high that some market makers have embedded them within their operations. There are certainly some benefits here in terms of increased liquidity, but there’s another side of the coin as well.

Throughout 2021, retail traders have uncovered significant short positions held by hedge funds in a number of stocks. Naked short selling is suspected by many retail traders to be involved. At this point, hedge funds have collectively lost $12 billion—so far. Continue reading “Article: In-Depth: Citadel Connect and Dark Pools Uncovered”

When Keith “Roaring Kitty” Gill announced he was buying GameStop (NYSE:GME) shares and options on Reddit’s r/WallStreetBets, regulators might have considered his outrageous claims as parody — speech protected by First Amendment rights. Who could take $20 calls on GME seriously when the stock was trading at $5?

When Keith “Roaring Kitty” Gill announced he was buying GameStop (NYSE:GME) shares and options on Reddit’s r/WallStreetBets, regulators might have considered his outrageous claims as parody — speech protected by First Amendment rights. Who could take $20 calls on GME seriously when the stock was trading at $5? If you want to become a day trader, I don’t blame you. People who consistently earn several percentage points per day can become wealthy beyond belief. Crypto arbitrageur Sam Bankman-Fried recently became a minor celebrity after revealing he was a billionaire by age 29.

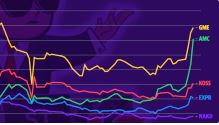

If you want to become a day trader, I don’t blame you. People who consistently earn several percentage points per day can become wealthy beyond belief. Crypto arbitrageur Sam Bankman-Fried recently became a minor celebrity after revealing he was a billionaire by age 29. As trading platforms like Robinhood create a rise in retail investor market participation and spark a renewed interest in shares of companies dubbed “meme stocks” like GameStop (GME), BlackBerry (BB), and AMC (AMC), the world of finance is seeing an intersection with the social media sphere.

As trading platforms like Robinhood create a rise in retail investor market participation and spark a renewed interest in shares of companies dubbed “meme stocks” like GameStop (GME), BlackBerry (BB), and AMC (AMC), the world of finance is seeing an intersection with the social media sphere. You’ve got to hand it to r/WallStreetBets: They’ve gotten very robust in their stock selection process as compared to the GameStop (NYSE:GME) era. The message board, which has grown significantly in the first half of the year, is picking mortgage REITs and private prisons as some of the latest meme stocks. It should not be a surprise then that the retail investor group is looking to follow whales to new frontiers, like they are doing today with Itaú Unibanco Holdings (NYSE:ITUB) stock.

You’ve got to hand it to r/WallStreetBets: They’ve gotten very robust in their stock selection process as compared to the GameStop (NYSE:GME) era. The message board, which has grown significantly in the first half of the year, is picking mortgage REITs and private prisons as some of the latest meme stocks. It should not be a surprise then that the retail investor group is looking to follow whales to new frontiers, like they are doing today with Itaú Unibanco Holdings (NYSE:ITUB) stock.  Staring at a meme stock craze that shows few signs of abating, Wall Street is still wrestling with how to trade it.

Staring at a meme stock craze that shows few signs of abating, Wall Street is still wrestling with how to trade it. vThe Covid-19 crisis came at the end of more than two decades that witnessed a significant transformation of financial markets with main catalysts such as financial innovation, technology adoption, and financial regulations. The 2020 stock market’s roller coaster (record price levels and volatility) exposed the financial system’s fragility. This year, the increased volatility in so-called ‘meme’ stocks – i.e., stocks whose trading volume increases not because of the company’s good performance, but because of hype on social media –, has highlighted several problems in financial markets. Although seemingly unimportant, the risk that these events could pose to the entire financial system opens the door for discussions on the implementation of new regulations (or the improvement of older ones).

vThe Covid-19 crisis came at the end of more than two decades that witnessed a significant transformation of financial markets with main catalysts such as financial innovation, technology adoption, and financial regulations. The 2020 stock market’s roller coaster (record price levels and volatility) exposed the financial system’s fragility. This year, the increased volatility in so-called ‘meme’ stocks – i.e., stocks whose trading volume increases not because of the company’s good performance, but because of hype on social media –, has highlighted several problems in financial markets. Although seemingly unimportant, the risk that these events could pose to the entire financial system opens the door for discussions on the implementation of new regulations (or the improvement of older ones).  AMC Entertainment, the meme stock that amazed Wall Street recently, rallied double digits on Monday as speculative trading activity in the struggling movie theater gained steam.

AMC Entertainment, the meme stock that amazed Wall Street recently, rallied double digits on Monday as speculative trading activity in the struggling movie theater gained steam.

The rise of the “meme stocks” has been a fascinating adventure with the combination of ubiquitous technology and the ability to drive trading by retail investors in a way that has never been experienced before. While a certain amount of manipulation of markets has always existed, the recent advent of trading forums, like Wallstreetbets on Reddit, and other digital communication methods, has shifted some of the influence away from big money to smaller investors pooling resources.

The rise of the “meme stocks” has been a fascinating adventure with the combination of ubiquitous technology and the ability to drive trading by retail investors in a way that has never been experienced before. While a certain amount of manipulation of markets has always existed, the recent advent of trading forums, like Wallstreetbets on Reddit, and other digital communication methods, has shifted some of the influence away from big money to smaller investors pooling resources. About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game.

About three months ago, the investing world was left reeling after retail investors proved they can beat Wall Street at its own game. In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing.

In January 2021, the rise of retail investing and the subreddit r/WallStreetBets sparked a broader speculative movement in a few stocks that ended up disrupting trading at brokerages and culminating in a Congressional hearing.