U.S. Futures Gain, Bond Rally Pauses as Fed Eyed: Markets Wrap

Cecile Gutscher and Joanna Ossinger, 14 June 2021

U.S. equity futures and stocks posted modest gains Monday as investors prepared for a key Federal Reserve meeting later in the week. The rally in bond markets lost steam.

U.S. equity futures and stocks posted modest gains Monday as investors prepared for a key Federal Reserve meeting later in the week. The rally in bond markets lost steam.

S&P 500 futures signaled the gauge was poised to add to Friday’s fresh record. An advance in European equities was led by shares in energy firms. The Treasury 10-year yield rose to 1.46% after hitting three-month lows on Thursday amid the biggest weekly slide since December. French and German government bond peers also reversed course with yields turning higher. Continue reading “Article: U.S. Futures Gain, Bond Rally Pauses as Fed Eyed: Markets Wrap”

Wall Street banks must speed up their efforts to stop using Libor, regulators said Friday, issuing one of their sternest warnings yet about abandoning the scandal-plagued benchmark.

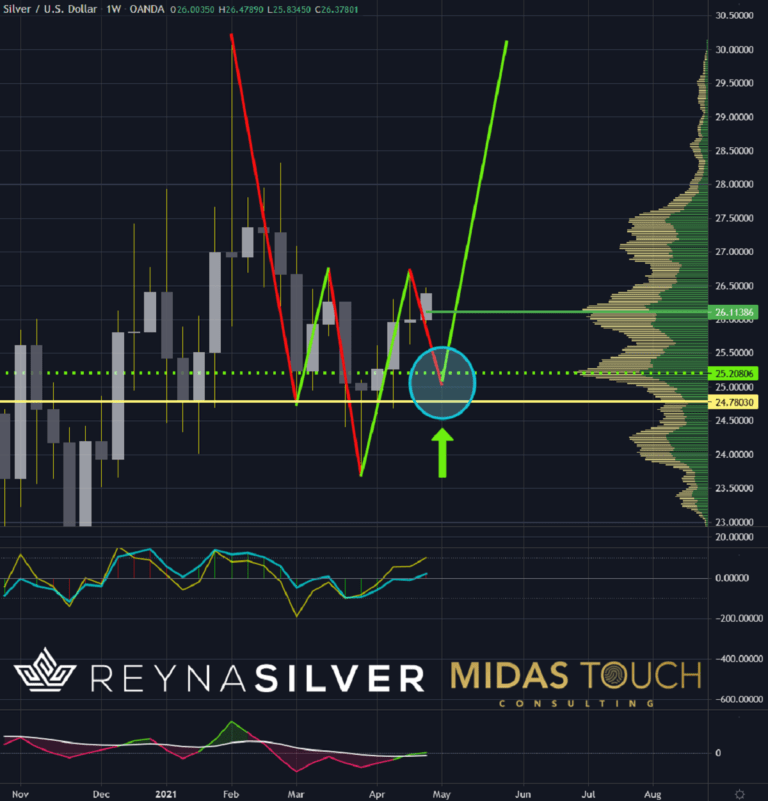

Wall Street banks must speed up their efforts to stop using Libor, regulators said Friday, issuing one of their sternest warnings yet about abandoning the scandal-plagued benchmark. Gaining certainty about a clear picture of the future is getting more complex by the minute. Data arrives of never-seen occurrences that make it seemingly impossible to know how everything will pan out. President Biden demands higher taxation of the rich and a minimum wage of US$15. News about Silver market manipulation introduces fear into this market sector. Janet Yellen spoke of inflation. Many are talking about a possible hyperinflation. Others however are pointing towards the “Japanization” of America. On top, a recent New York Times headline reads: “Reaching herd immunity is unlikely in the U.S.”. All this noise is creating more confusion and pressure instead of clarity. The good news is: You do not need to know how the future unfolds to preserve your wealth. And Silver eats doubt for breakfast.

Gaining certainty about a clear picture of the future is getting more complex by the minute. Data arrives of never-seen occurrences that make it seemingly impossible to know how everything will pan out. President Biden demands higher taxation of the rich and a minimum wage of US$15. News about Silver market manipulation introduces fear into this market sector. Janet Yellen spoke of inflation. Many are talking about a possible hyperinflation. Others however are pointing towards the “Japanization” of America. On top, a recent New York Times headline reads: “Reaching herd immunity is unlikely in the U.S.”. All this noise is creating more confusion and pressure instead of clarity. The good news is: You do not need to know how the future unfolds to preserve your wealth. And Silver eats doubt for breakfast.  It is not often noted that the U.S. Treasury too injects the economy with cash flow, on top of various stimulus packages. With a precarious economic balance such as it is, excess liquidity may yet be another trigger to make inflation worse.

It is not often noted that the U.S. Treasury too injects the economy with cash flow, on top of various stimulus packages. With a precarious economic balance such as it is, excess liquidity may yet be another trigger to make inflation worse. Treasury Secretary Janet Yellen will decline to name China as a currency manipulator in her first semiannual foreign-exchange report, according to people familiar with the matter, a move that allows the U.S. to sidestep a fresh clash with Beijing.

Treasury Secretary Janet Yellen will decline to name China as a currency manipulator in her first semiannual foreign-exchange report, according to people familiar with the matter, a move that allows the U.S. to sidestep a fresh clash with Beijing. Bitcoin Shows Us That Not All Volatilities Are Created Equal

Bitcoin Shows Us That Not All Volatilities Are Created Equal Bitcoin, other cryptocurrencies, and essentially all digital assets have surged in price recently amid surging interest by the public, investors of all types, and the financial industry. Despite a steadily growing acceptance and anticipation of a crypto-friendly regulatory environment under the new administration in Washington, the future regulatory framework for digital assets is complex and uncertain.

Bitcoin, other cryptocurrencies, and essentially all digital assets have surged in price recently amid surging interest by the public, investors of all types, and the financial industry. Despite a steadily growing acceptance and anticipation of a crypto-friendly regulatory environment under the new administration in Washington, the future regulatory framework for digital assets is complex and uncertain.  Five ways Biden could crack down on dirty money and financial secrecy

Five ways Biden could crack down on dirty money and financial secrecy