Martha Helen Stewart is an American retail businesswoman, writer, and television personality. As founder of Martha Stewart Living Omnimedia, she gained success through a variety of business ventures, encompassing publishing, broadcasting, merchandising and e-commerce. She has written numerous bestselling books, is the publisher of Martha Stewart Living magazine and hosted two syndicated television programs: Martha Stewart Living, which ran from 1993 to 2004, and Martha, which ran from 2005 to 2012..

Martha Helen Stewart is an American retail businesswoman, writer, and television personality. As founder of Martha Stewart Living Omnimedia, she gained success through a variety of business ventures, encompassing publishing, broadcasting, merchandising and e-commerce. She has written numerous bestselling books, is the publisher of Martha Stewart Living magazine and hosted two syndicated television programs: Martha Stewart Living, which ran from 1993 to 2004, and Martha, which ran from 2005 to 2012..

In 2004, Stewart was convicted of charges related to the ImClone stock trading case; she served five months in federal prison and was released in March 2005. There was speculation that the incident would effectively end her media empire,but in 2005 Stewart began a comeback campaign[5] and her company returned to profitability in 2006. Continue reading “Businesswoman: Martha Stewart”

William Henry Donaldson (born June 2, 1931) was the 27th Chairman of the U.S. Securities and Exchange Commission (SEC), serving from February 2003 to June 2005. He served as Under Secretary of State for International Security Affairs in the Nixon Administration, as a special adviser to Vice President Nelson Rockefeller, Chairman and CEO of the New York Stock Exchange, and Chairman, President and CEO of Aetna.[1] Donaldson founded Donaldson, Lufkin & Jenrette..

William Henry Donaldson (born June 2, 1931) was the 27th Chairman of the U.S. Securities and Exchange Commission (SEC), serving from February 2003 to June 2005. He served as Under Secretary of State for International Security Affairs in the Nixon Administration, as a special adviser to Vice President Nelson Rockefeller, Chairman and CEO of the New York Stock Exchange, and Chairman, President and CEO of Aetna.[1] Donaldson founded Donaldson, Lufkin & Jenrette.. Donald John Trump (born June 14, 1946) is an American media personality, businessman, and politician who served as the 45th president of the United States from 2017 to 2021..

Donald John Trump (born June 14, 1946) is an American media personality, businessman, and politician who served as the 45th president of the United States from 2017 to 2021.. Institutional investors suing some of the world’s largest banks for manipulating the foreign exchange market will have to prove their losses were not passed on to others after a London court ruled on Thursday that the issue has to be determined at trial.

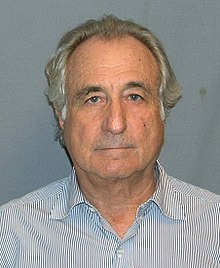

Institutional investors suing some of the world’s largest banks for manipulating the foreign exchange market will have to prove their losses were not passed on to others after a London court ruled on Thursday that the issue has to be determined at trial. Bernard Lawrence Madoff (

Bernard Lawrence Madoff ( At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling.

At the House Financial Services Committee hearing last week on the GameStop debacle, there was an elephant in the room: naked short selling. ROBERT STEELE: This article is such crap. As if DTCC had not willfully covered up $100 trillion in naked short counterfeit sales these past 15-20 years. Until DTCC is given a porcupine enema and we sent DOJ, FBI, and US Southern District Attorneys to jail for life for treason — enabling foreign collusion and domestic crime against the US economy — for life, this will not change.

ROBERT STEELE: This article is such crap. As if DTCC had not willfully covered up $100 trillion in naked short counterfeit sales these past 15-20 years. Until DTCC is given a porcupine enema and we sent DOJ, FBI, and US Southern District Attorneys to jail for life for treason — enabling foreign collusion and domestic crime against the US economy — for life, this will not change. Gary J. Aguirre is an American

Gary J. Aguirre is an American